Sample Hoa Lien For The

Description

How to fill out Notice Of Lien To A Condominium Unit Owner For Unpaid Assessment Fees?

- If you are an existing user, log in to your account and download the form template by hitting the Download button. Ensure your subscription is active; renew if necessary.

- For first-time users, start by checking the Preview mode and form description to verify you've selected the correct sample HOA lien that fulfills your local requirements.

- If there are discrepancies, utilize the Search tab to find the correct template.

- Once you find the appropriate form, click on the Buy Now button and select your preferred subscription plan. You will need to register an account for full access.

- Provide your payment information—either through credit card details or PayPal—and complete the purchase.

- Download the form to your device, and you'll have access to it in the My documents section whenever required.

In conclusion, US Legal Forms simplifies the process of acquiring necessary legal documents like a Sample HOA Lien, ensuring you have the right tools at your fingertips. Take advantage of their extensive library and expert assistance to secure the legal forms you need efficiently.

Start your journey towards hassle-free legal documentation today with US Legal Forms!

Form popularity

FAQ

A lien, especially a sample HOA lien for the dues owed, can significantly harm your credit score. This negative mark can stay on your credit report for several years, making it difficult to obtain loans or favorable interest rates. Consistently managing your finances and addressing outstanding debts can mitigate the damage. If you need guidance on resolving liens, USLegalForms offers resources to assist you in this process.

Homeowners Associations (HOAs) may report delinquent accounts to credit bureaus, impacting your credit history. If you receive a sample HOA lien for the unpaid dues, it can lead to negative credit reporting. This means timely payments are crucial to maintain a healthy credit score. If you are facing a lien situation, consider using USLegalForms to help you navigate the process effectively.

An HOA lien is typically a statutory lien, which means it arises from state law provisions that allow HOAs to place liens on properties for unpaid dues. This type of lien takes precedence over many other claims, making it critical to understand its implications. Utilizing a sample HOA lien for the applicable state laws can illuminate how this process works and how to manage any related issues effectively.

An HOA lien can negatively impact your credit score if it leads to further legal action, including foreclosure. Such negative marks stay on your credit report and can hinder future borrowing ability. To avoid credit damage, address the lien promptly, and understand your obligations through a sample HOA lien for the specific requirements involved. This proactive approach helps you maintain a good credit standing.

Yes, an HOA lien can affect your credit. When an HOA files a lien against your property for unpaid dues, it may lead to a negative mark on your credit report if the matter escalates to foreclosure. It is essential to address the lien promptly to avoid potential damage to your credit score. A sample HOA lien for the requirements can help you understand the implications better.

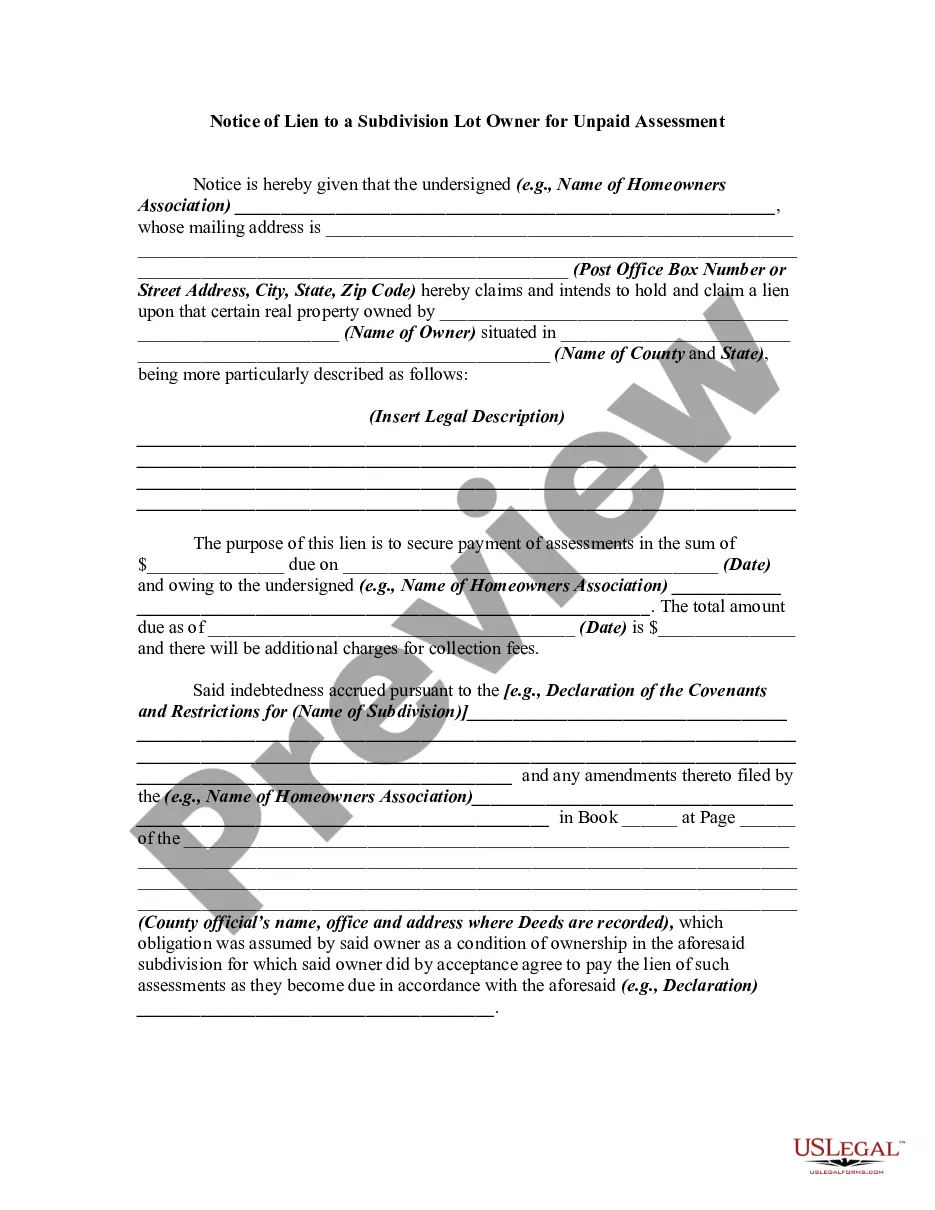

To file an HOA lien, start by gathering all relevant information about your property, including details about the owed fees. Next, prepare the appropriate documentation, which typically includes a sample HOA lien for the specific state requirements. Once you prepare the documents, you will file them with your local county clerk's office. Also, consider using platforms like USLegalForms to obtain templates that guide you through this process.

Writing a letter of intent for a lien entails a clear and straightforward approach. Begin by stating the purpose of the letter, including the debtor's information and the nature of the debt. Clearly outline the lien's intent and the specific property involved. Lastly, express your willingness to discuss the matter further, emphasizing resolution possibilities to avoid escalation.

Yes, it is possible for someone to place a lien on your property without your immediate knowledge. Creditors often file liens as part of debt recovery. Once placed, these liens become part of the public record. Regularly checking property records can help ensure you are aware of any claims against your property.

A lien affidavit is a legal document that declares a lien against a property. This document is used to secure a debt and indicates the creditor's claim against the property. It serves as public notice and can influence the property's title. Understanding how to use a lien affidavit effectively is crucial for homeowners dealing with debts.

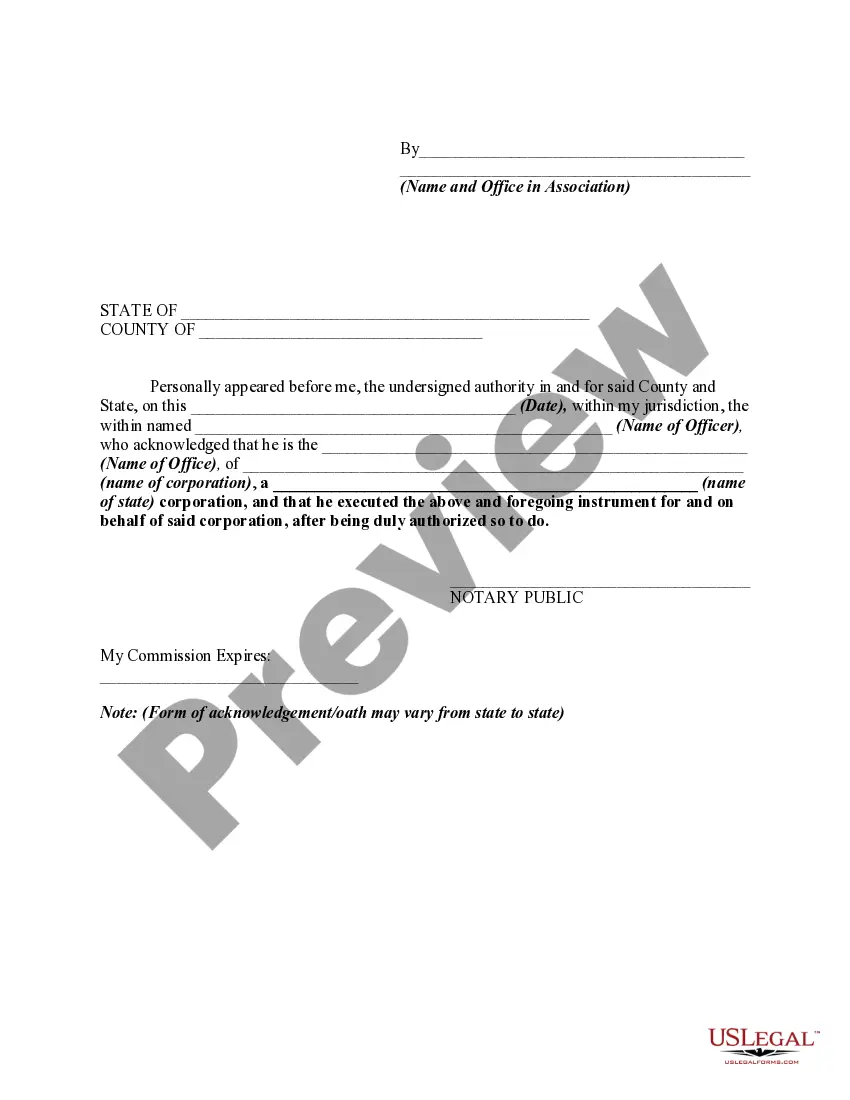

Filling out a lien affidavit requires attention to detail. Start by collecting relevant information, including the property address and the names of involved parties. Follow the provided template carefully to ensure all sections are complete. After finishing, make sure to sign the affidavit in the presence of a notary to make it legally binding.