Continuing Guaranty Agreement Form

Description

How to fill out Continuing And Unconditional Guaranty Of Business Indebtedness Including An Indemnity Agreement?

Individuals often link legal documentation with intricate matters that only an expert can handle.

In some respects, this is accurate, as creating a Continuing Guaranty Agreement Form requires a comprehensive understanding of the relevant criteria, including state and local laws.

However, with US Legal Forms, the process has become simpler: ready-to-use legal templates for any life and business circumstance tailored to state regulations are compiled in a single online catalog and are now accessible to all.

All templates in our catalog are reusable: once obtained, they remain stored in your profile. You can access them whenever needed via the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms categorized by state and intended use, making it easy to search for the Continuing Guaranty Agreement Form or any specific sample in just minutes.

- Existing users with an active subscription must Log In to their account and click Download to access the form.

- Users who are new to the platform must first create an account and subscribe before they can download any files.

- Below is the step-by-step guide to obtaining the Continuing Guaranty Agreement Form.

- Review the page content carefully to ensure it meets your needs.

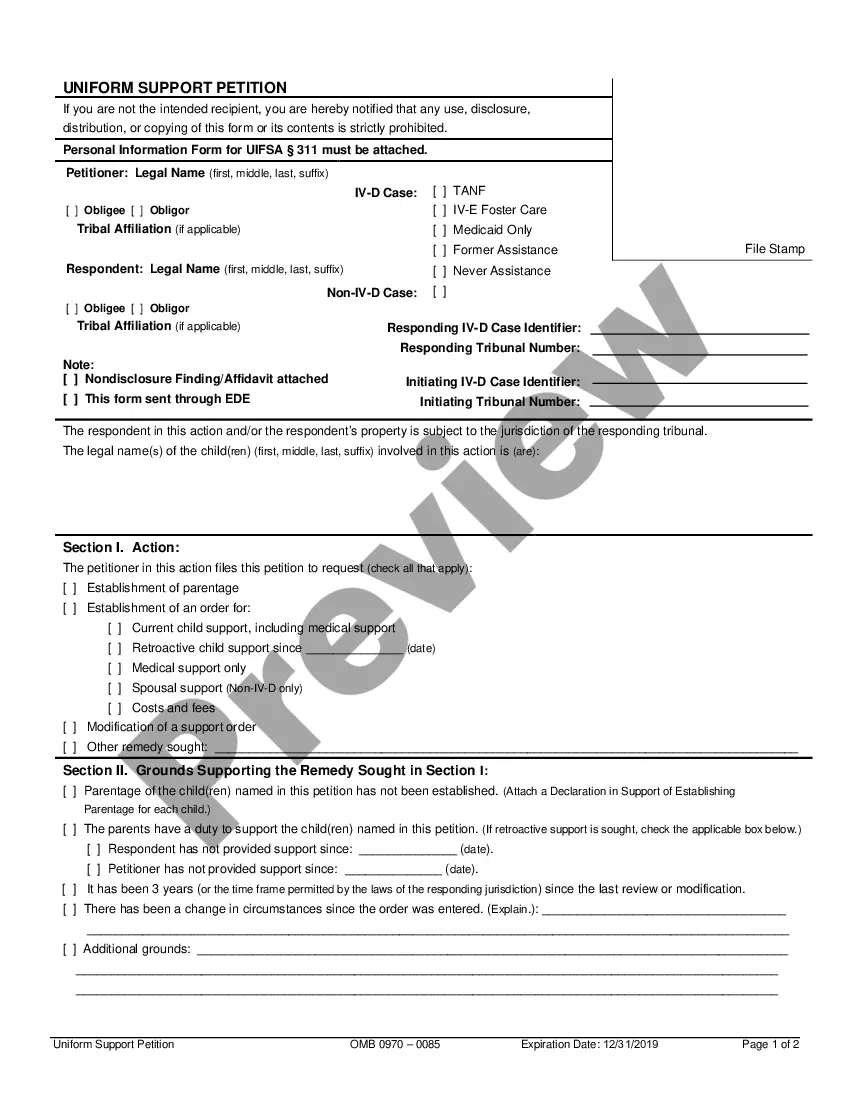

- Read the form description or examine it using the Preview option.

- If the previous sample does not meet your requirements, find another one using the Search bar above.

- When you find the appropriate Continuing Guaranty Agreement Form, click Buy Now.

- Choose a subscription plan that aligns with your necessities and budget.

- Register for an account or Log In to move forward to the payment page.

- Make your payment for the subscription using PayPal or your credit card.

- Choose the format for your document and click Download.

- Print your document or upload it to an online editor for a faster completion.

Form popularity

FAQ

Section 2.2 Irrevocable, Unconditional and Continuing Guaranty. This is an irrevocable, unconditional joint and several and continuing guaranty of the Indebtedness, and the liability of each Guarantor hereunder is absolute.

A continuing guaranty is an agreement by the guarantor to be liable for the obligations of someone else to the lender, even if there are several different obligations that are made, renewed or repaid over time. In contrast, a specific guaranty is limited only to one individual transaction.

129- A guarantee which extends to a series of transactions, is called a "continuing guarantee" Examples: - (a) A, in consideration that B will employ C in collecting the rent of B's zamindari, promises B to be responsible, to the amount of 5,000 rupees, for the due collection and payment by C of those rents.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A guarantee is a legal promise made by a third party (guarantor) to cover a borrower's debt or other types of liability in case of the borrower's default. The time a default happens varies, depending on the terms agreed upon by the creditor and the borrower.