Affidavit Property Form For Tax

Description

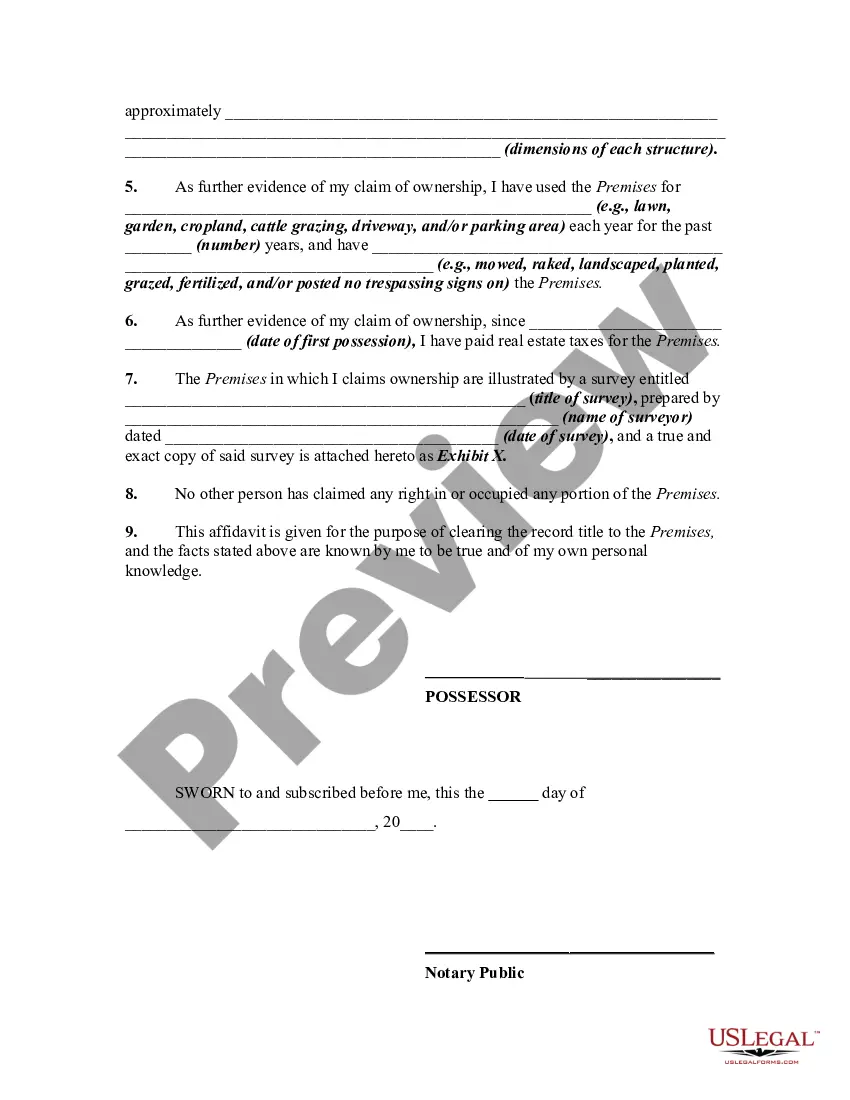

How to fill out Affidavit By Adverse Possessor That Property Held Adversely And Claim Of Title Is Based On Grant Of Ownership From Previous Owner - Squatters Rights?

The Affidavit Property Form For Tax displayed on this page is a reusable legal template crafted by experienced attorneys in accordance with federal and state statutes and guidelines.

For over 25 years, US Legal Forms has supplied individuals, organizations, and lawyers with more than 85,000 authenticated, state-specific documents for any business and personal situation. It’s the fastest, simplest, and most dependable method to acquire the forms you require, as the service ensures the utmost level of data protection and anti-malware security.

Subscribe to US Legal Forms to have authenticated legal templates for all of life’s circumstances readily available.

- Search for the document you require and examine it. Browse through the file you sought and preview it or read the form description to confirm it meets your needs. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now once you have found the template you need.

- Create an account and sign in. Choose the pricing option that fits you and set up an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template. Select the format you prefer for your Affidavit Property Form For Tax (PDF, DOCX, RTF) and save the document on your device.

- Fill out and sign the document. Print the template to complete it by hand. Alternatively, use an online multifunctional PDF editor to rapidly and accurately fill out and endorse your form with a legally-binding electronic signature.

- Re-download your documents as needed. Access the same document again whenever necessary. Open the My documents section in your profile to retrieve any previously downloaded forms.

Form popularity

FAQ

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

Real estate or a debt secured by a lien on real property may be transferred to the successor or successors by affidavit if certain requirements are met. This affidavit must be filed in the county where the decedent was domiciled or, if not domiciled in this state, in the county where the property is located.

This form is used to record the selling price, date of sale and other required information about the sale of property.

Arizona statutes offer an alternative to avoiding probate by using an Affidavit of Succession to Real Property in cases in which the real property value does not exceed a certain value. The estate value must be less than $100,000 minus all the liens and any other encumbrances when the decedent passed away.

State Law requires a Property Transfer Affidavit to be filed whenever real estate is transferred (even if you are not recording a deed).