The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Chapter 13 Bankruptcy Discharge Form Template

Description

How to fill out Chapter 13 Bankruptcy Discharge Form Template?

Whether for business purposes or for personal affairs, everyone has to deal with legal situations at some point in their life. Filling out legal documents requires careful attention, starting with choosing the appropriate form sample. For instance, when you pick a wrong version of a Chapter 13 Bankruptcy Discharge Form Template, it will be turned down when you send it. It is therefore important to have a dependable source of legal documents like US Legal Forms.

If you have to get a Chapter 13 Bankruptcy Discharge Form Template sample, follow these simple steps:

- Find the sample you need using the search field or catalog navigation.

- Look through the form’s information to make sure it suits your case, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect form, go back to the search function to locate the Chapter 13 Bankruptcy Discharge Form Template sample you require.

- Download the file when it meets your needs.

- If you have a US Legal Forms account, just click Log in to access previously saved files in My Forms.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Pick the proper pricing option.

- Finish the account registration form.

- Select your transaction method: you can use a bank card or PayPal account.

- Pick the document format you want and download the Chapter 13 Bankruptcy Discharge Form Template.

- When it is downloaded, you are able to complete the form by using editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time looking for the appropriate sample across the web. Make use of the library’s easy navigation to get the correct template for any occasion.

Form popularity

FAQ

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

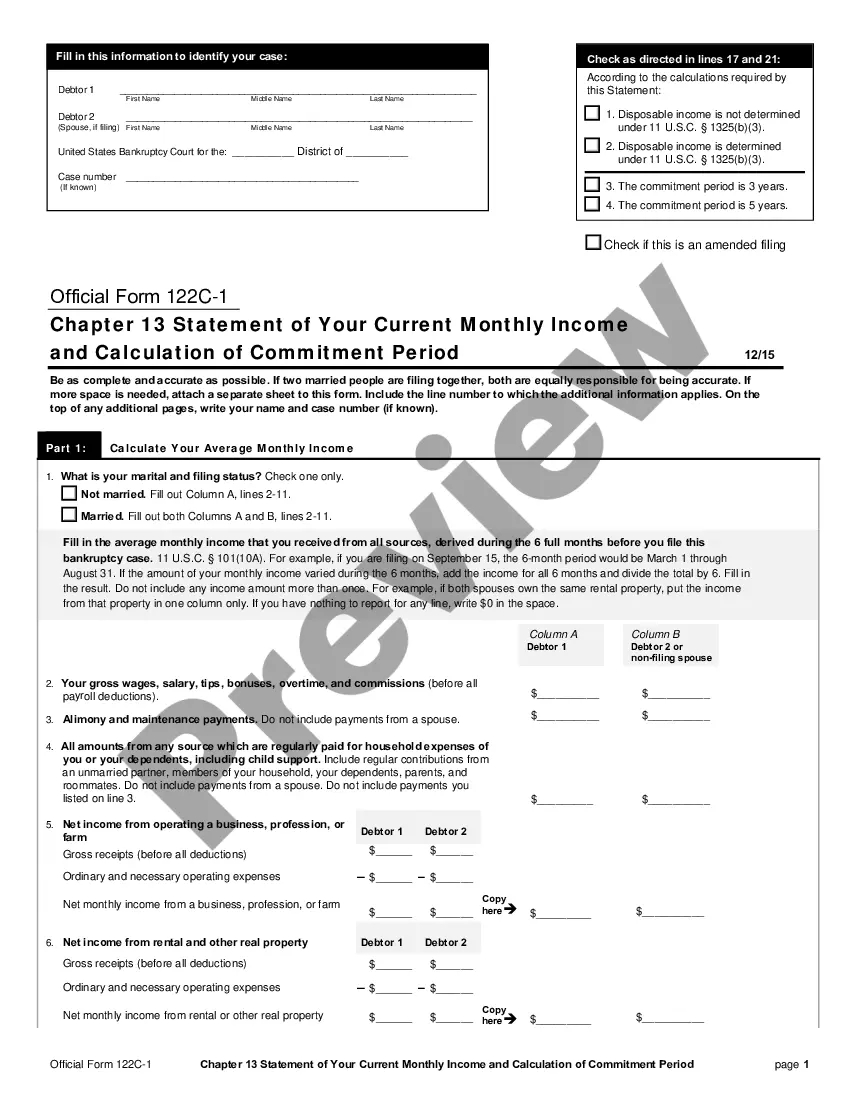

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

What does my Chapter 13 discharge order look like? While every court is slightly different, the Chapter 13 discharge order looks similar. It is signed by a judge and states that ?A discharge under 11 U.S.C. § 1328(a) is granted to: Your Name?.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

Your credit score will lower dramatically due to Chapter 13 being on your credit report. It will be removed after seven years. Credit scores tend to drop between 150 to 200 points after filing for bankruptcy. The average score is around 579.