Bankruptcy Discharge Withheld

Description

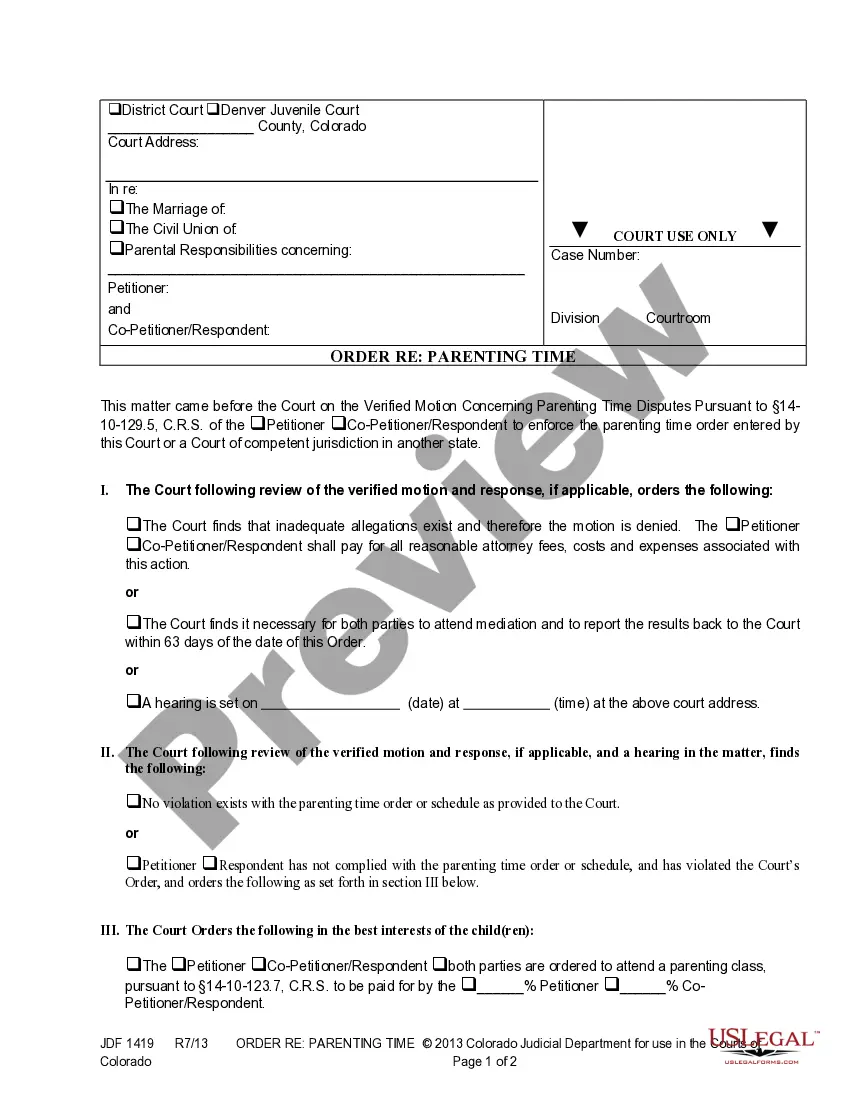

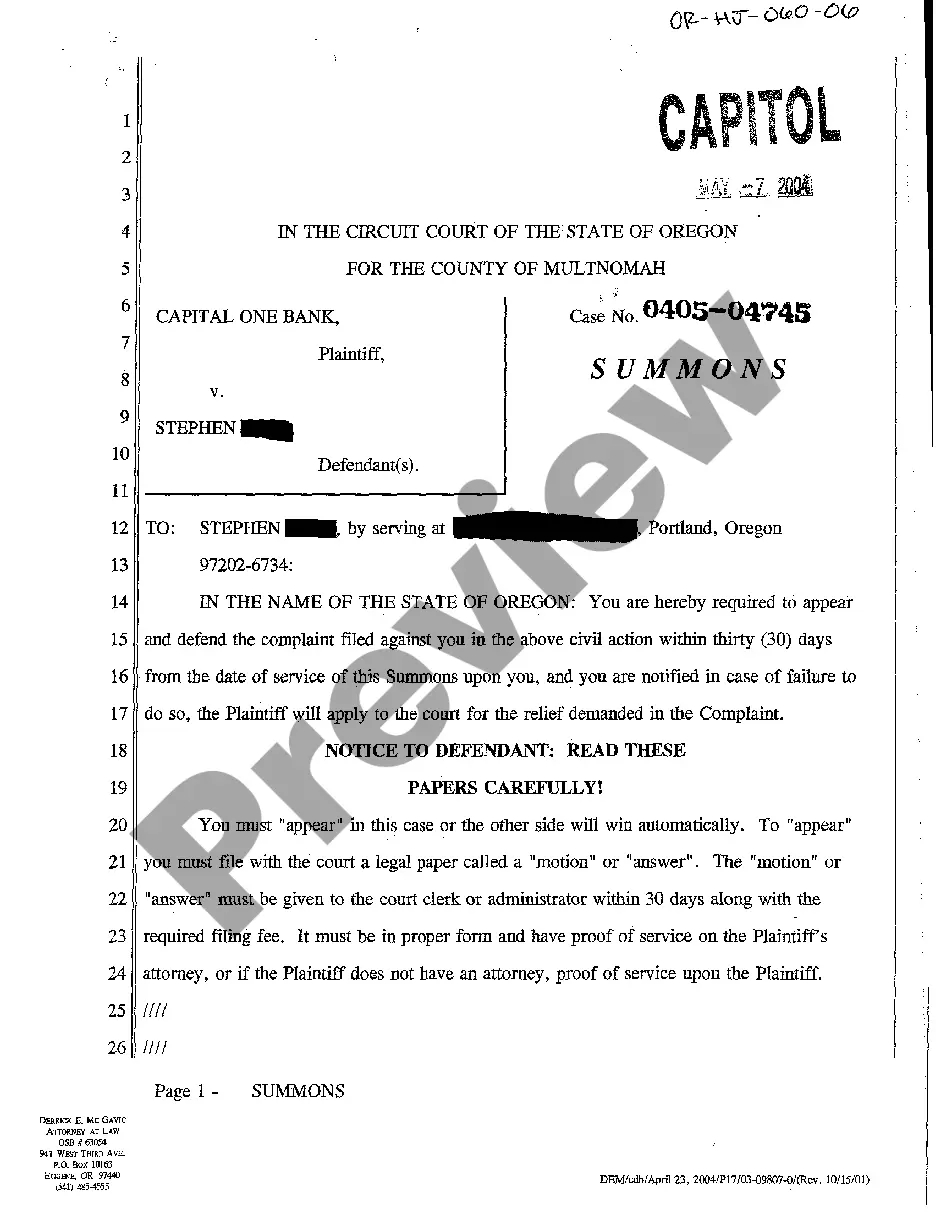

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceedings For Concealment By Debtor And Omitting From Schedules Fraudulently Transferred Property?

What is the most dependable service to obtain the Bankruptcy Discharge Withheld and other current versions of legal documents.

US Legal Forms is the answer! It boasts the most comprehensive collection of legal paperwork for any scenario.

If you still lack an account with us, follow these steps to create one: Form compliance assessment. Before acquiring any template, ensure it meets your use case requirements and aligns with your state or county laws. Review the form description and utilize the Preview if available. Alternative document search. If any discrepancies arise, utilize the search bar at the header of the page to locate another template. Click Buy Now to select the suitable one. Registration and subscription procurement. Choose the most fitting pricing plan, Log In or create an account, and process your payment via PayPal or credit card. Downloading the documents. Choose the preferred format for saving the Bankruptcy Discharge Withheld (PDF or DOCX) and click Download to retrieve it. US Legal Forms is an excellent solution for anyone needing to manage legal documents. Premium users can benefit even more, as they can complete and sign their previously saved documents electronically at any time using the integrated PDF editing tool. Explore it today!

- Each template is correctly drafted and verified for compliance with federal and local laws.

- They are organized by region and state of application, making it simple to find what you need.

- Experienced users of the platform simply need to Log In to the system, verify if their subscription is active, and select the Download button next to the Bankruptcy Discharge Withheld to obtain it.

- Once saved, the template remains accessible for future use within the My documents section of your profile.

Form popularity

FAQ

When a bankruptcy is discharged, your credit report will reflect that your debts are no longer owed. This is a critical step in your financial recovery, providing you with a fresh start. However, if a bankruptcy discharge is withheld, it becomes essential to understand the implications on your credit history. For insights and assistance, uslegalforms can help clarify these terms and offer tools for your financial journey.

Your credit score may experience a boost once your bankruptcy is discharged, but several factors influence this. A discharged bankruptcy means you eliminated considerable debt, which can positively impact your credit utilization rate. Yet, if a bankruptcy discharge is withheld, it could hinder this positive change. Utilizing uslegalforms can guide you towards rebuilding your credit wisely.

A discharged bankruptcy will remain on your credit report for a specific number of years, typically up to ten years. However, if you have a legitimate reason to dispute the entry, it might be possible to have it removed sooner. If you experience issues, the uslegalforms platform can assist you with tools to manage your credit report efficiently. Remember, monitoring your report is vital for your financial health.

A bankruptcy discharge does indicate that your debts have been cleared, but it does not automatically mean the case is closed. The legal process might still require you to fulfill some steps before the case can truly be closed. Keep in mind, if a bankruptcy discharge is withheld, it can impact your ability to move forward. Consider using uslegalforms for guidance through this process.

Yes, a bankruptcy discharge will appear on your credit report for up to 10 years, depending on the type of bankruptcy you filed. While this can affect your credit score, being discharged from debt can provide a fresh start. On platforms like uslegalforms, you can find resources that guide you through rebuilding your credit effectively after bankruptcy.

Yes, filing for bankruptcy can affect your taxes in several ways. While discharged debts generally do not count as income, it may influence your tax returns in other ways. It's wise to consult with a tax professional to navigate any implications, especially regarding your potential tax obligations in the future.

The 3-year rule refers to the time frame in which certain types of debts can potentially be discharged in bankruptcy. For example, if you fail to file your tax return for a previous tax year, the IRS may hold your tax debt for up to three years before it can be discharged. Understanding how this rule works can significantly impact your financial planning.

You usually do not need to claim discharged debt as income, but there are exceptions. The IRS generally views a bankruptcy discharge as a cancellation of debt, which is not taxable. Be sure to keep accurate records and consult with a tax expert to address any specifics regarding your situation.

Discharging taxes in bankruptcy can be tricky, but it is possible under certain conditions. Generally, you must show that the tax debt is old enough, you filed the tax return on time, and the tax was assessed more than 240 days ago. Consulting with an attorney specializing in bankruptcy can help you understand if your specific tax situation qualifies.

There is no specific minimum amount of debt required to file for bankruptcy; rather, it varies based on your financial situation. However, significant debt levels are often catalysts for individuals considering bankruptcy. If you're contemplating filing, evaluate your total debts alongside your income and expenses. This assessment can reveal whether you may face a bankruptcy discharge withheld in your journey through the bankruptcy process.