Collateral Assignment Of Life Insurance Policy Form

Description

How to fill out Partial Assignment Of Life Insurance Policy As Collateral?

There's no longer a necessity to squander hours searching for legal documents to adhere to your local state stipulations.

US Legal Forms has consolidated all of them in a single location and enhanced their accessibility.

Our platform offers over 85k templates for any business and personal legal matters compiled by state and usage area.

Quickly and easily prepare legal documents under federal and state laws and regulations with our platform. Try US Legal Forms today to keep your paperwork organized!

- All forms are suitably drafted and verified for authenticity, ensuring you receive a current Collateral Assignment Of Life Insurance Policy Form.

- If you're acquainted with our platform and already possess an account, you must verify that your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all acquired documents whenever required by accessing the My documents tab in your profile.

- If this is your first time using our platform, the process will require a few additional steps to finish.

- Here’s how new users can locate the Collateral Assignment Of Life Insurance Policy Form in our catalog.

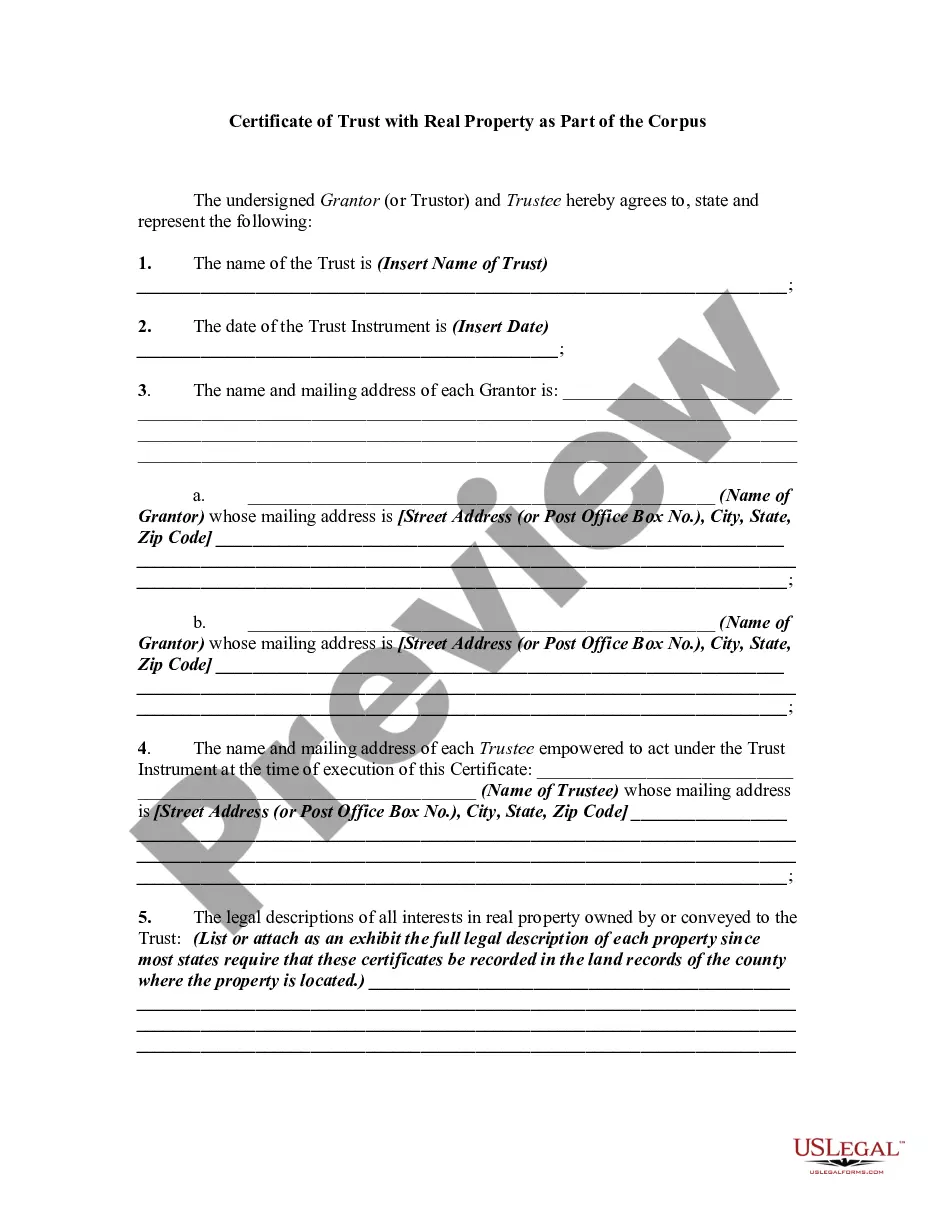

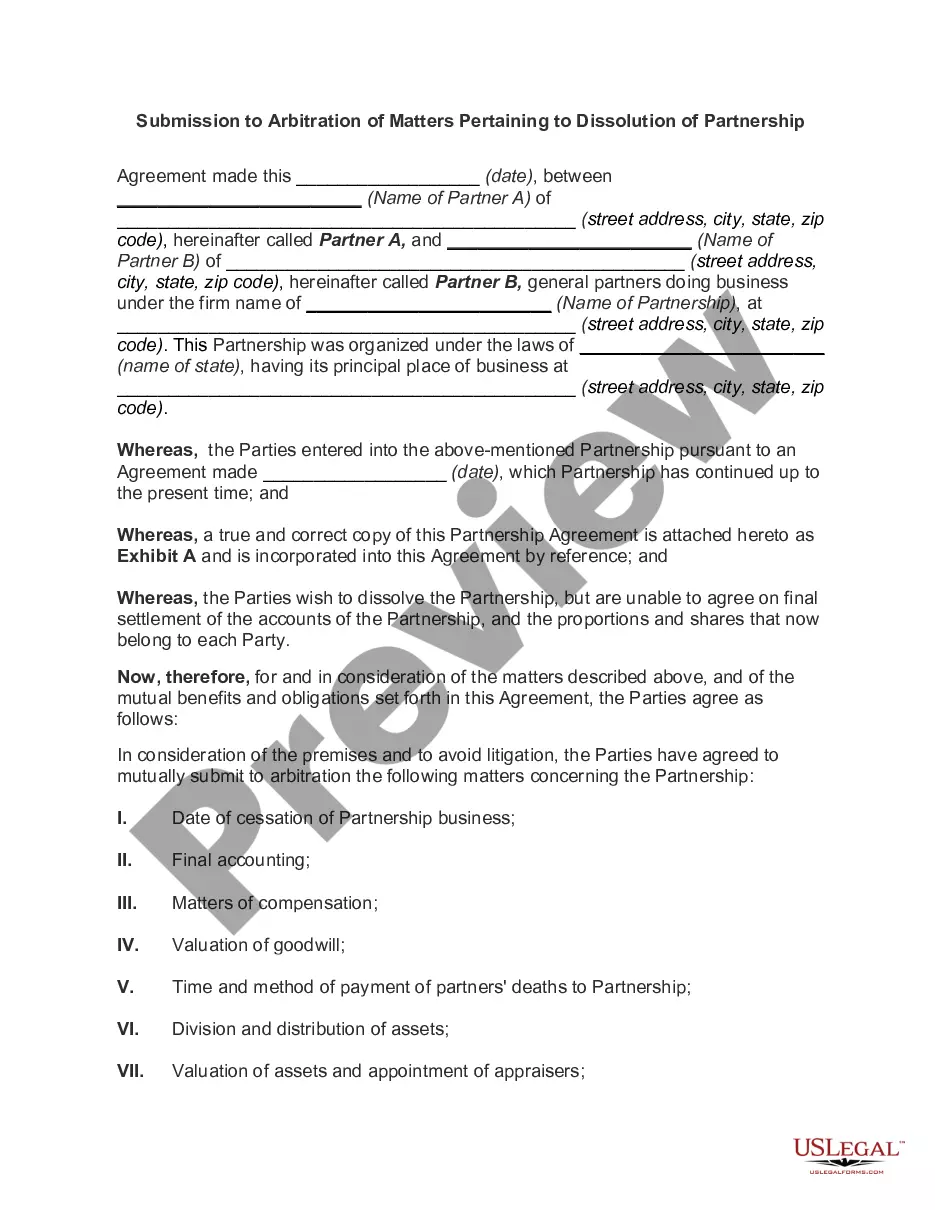

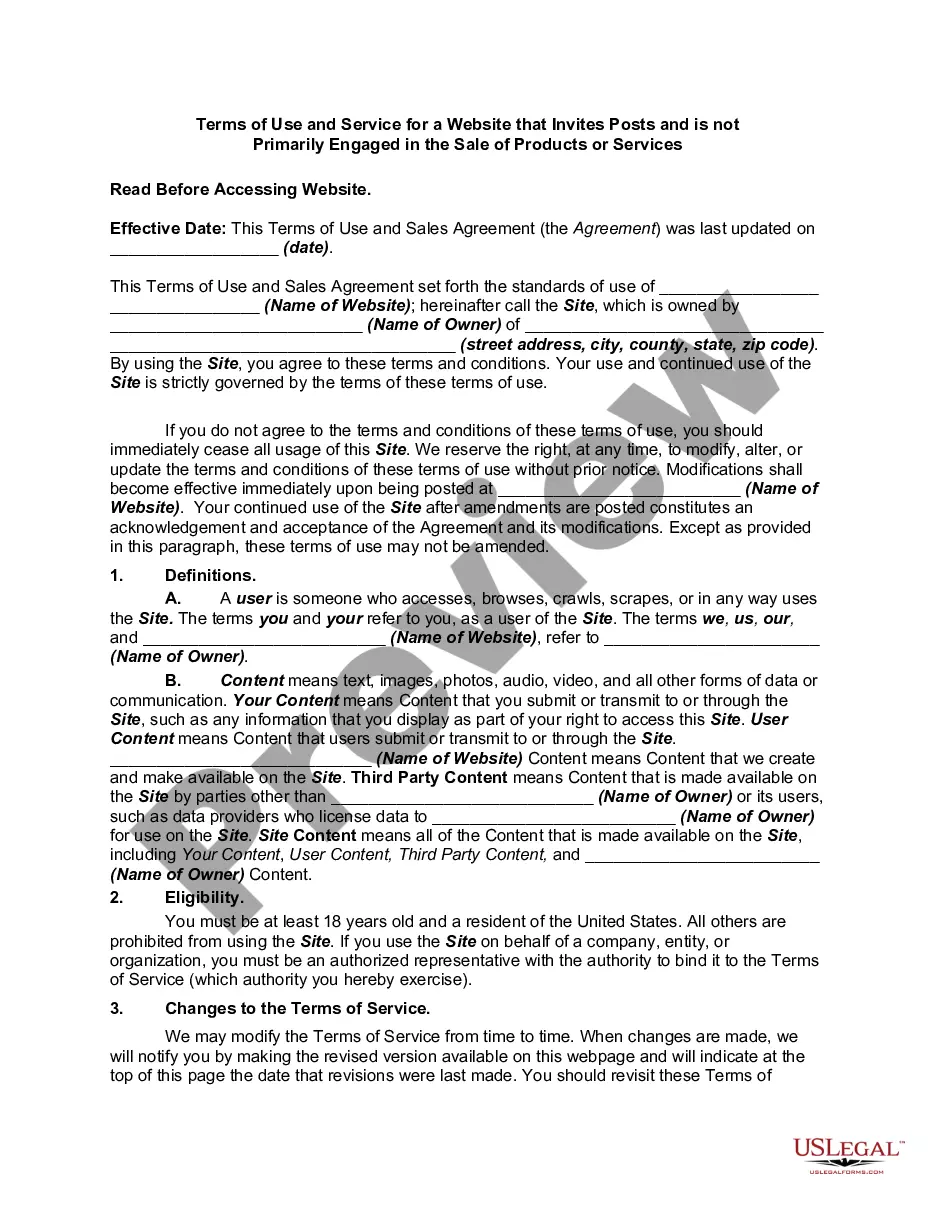

- Examine the page content closely to ensure it contains the sample you need.

- Utilize the form description and preview options, if any.

Form popularity

FAQ

The two types of assignments in life insurance are absolute assignments and collateral assignments. An absolute assignment transfers ownership of the policy completely to another person or entity, while a collateral assignment of life insurance policy form permits temporary use of the policy as collateral. Understanding these distinctions can help you make informed decisions based on your financial goals. Choose the right type depending on your need for flexibility and control.

To complete a collateral assignment form, first, ensure you have the recipient's details, such as their name and address. Next, specify the life insurance policy number and the insurer's information. Finally, clearly outline the terms of the assignment, indicating the amount secured and any conditions. Using a collateral assignment of life insurance policy form from USLegalForms simplifies this process, ensuring compliance with legal standards.

An example of collateral assignment occurs when a business secures a line of credit with its owner's life insurance policy. By assigning the policy as collateral, the business gains access to funds for operational needs. Should the owner default, the lender has rights to the policy's value through the collateral assignment of life insurance policy form. This process safeguards the lender while ensuring access to necessary funds for the business.

The policyholder is authorized to assign a life insurance policy as collateral, as they hold ownership rights. To make this official, the policyholder needs to complete a collateral assignment of life insurance policy form. This form should clearly state the relationship between the policyholder and the assignee, securing the lender’s interest in the death benefit. It is wise to seek guidance from a legal professional to ensure compliance with all regulations.

Typically, only the policyholder can assign a life insurance policy. This means you, as the owner, retain the right to transfer the benefits of the policy to another party through a collateral assignment of life insurance policy form. However, it is essential to verify that you have the authority to assign the policy as outlined in its terms. Consulting with your insurance provider can help clarify this process.

A life insurance policy assignment is usually made by the policyholder, who is the individual that owns the policy. This can involve completing a collateral assignment of life insurance policy form to formally document the assignment. This form conveys the rights and obligations associated with the policy to the assignee, usually a lender or financial institution. It is important to follow proper procedures to ensure the assignment is legally binding.

The insured needs to either endorse the policy document or make a deed of assignment and register the same with the insurer. A form prescribed by the insurers must be filled and signed. In case of conditional assignment, your reason needs to be mentioned as well.

A collateral assignment of life insurance is a conditional assignment appointing a lender as the primary beneficiary of a death benefit to use as collateral for a loan. If the borrower is unable to pay, the lender can cash in the life insurance policy and recover what is owed.

Collateral assignment of life insurance lets you use a life insurance policy as an asset to secure a loan. If you die while the policy is in place and still owe money on the loan, the death benefit goes to pay off the remaining debt. Any money remaining goes to your beneficiaries.