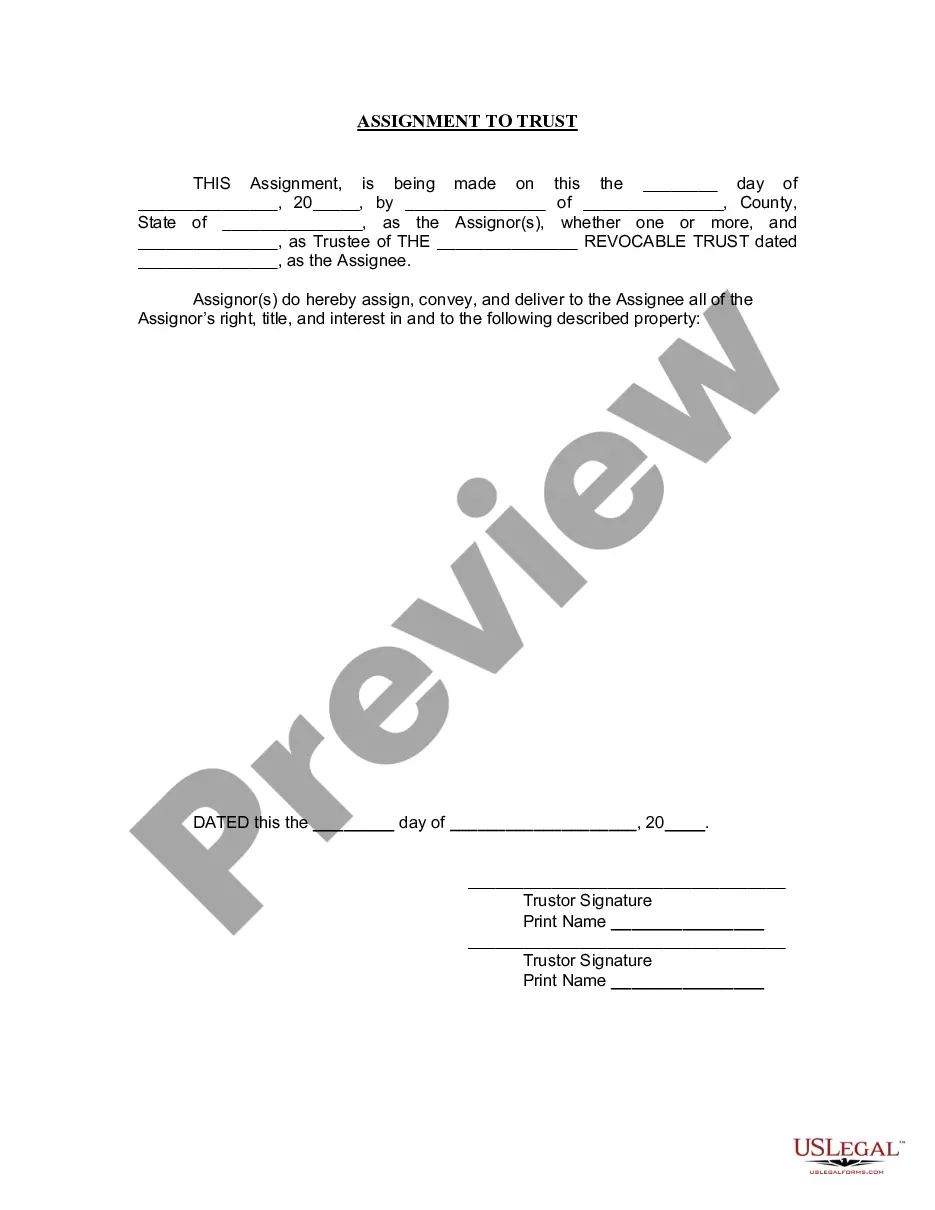

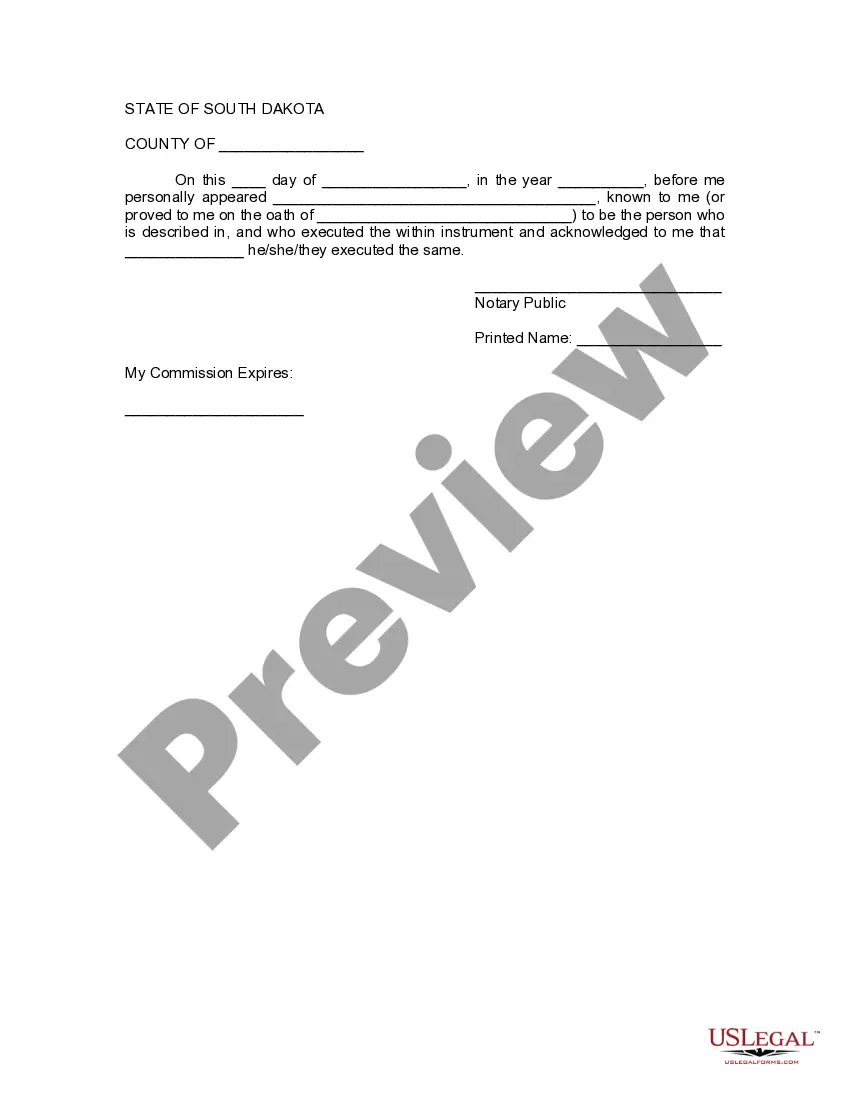

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

South Dakota Assignment to Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Dakota Assignment To Living Trust?

Get access to high quality South Dakota Assignment to Living Trust templates online with US Legal Forms. Steer clear of hours of lost time seeking the internet and dropped money on files that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Find more than 85,000 state-specific authorized and tax templates you can save and fill out in clicks in the Forms library.

To receive the sample, log in to your account and click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Check if the South Dakota Assignment to Living Trust you’re looking at is suitable for your state.

- Look at the form making use of the Preview option and browse its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Select a preferred format to download the file (.pdf or .docx).

You can now open up the South Dakota Assignment to Living Trust example and fill it out online or print it and do it by hand. Consider sending the document to your legal counsel to make certain things are completed properly. If you make a mistake, print and complete sample once again (once you’ve registered an account every document you download is reusable). Create your US Legal Forms account now and get access to more templates.

Form popularity

FAQ

For private trust companies that manage private assets for the benefit of a family or families, the minimum annual fee is $3,750 and the maximum annual fee is $20,000. For public trust companies that offer public accounts, the minimum annual fee is $4,500 and the maximum annual fee is $30,000.

There is a non-refundable application fee of $5,000. A trust must have at least $200,000 of assets to receive a South Dakota charter. The company must file a 12-page application. Once chartered, there is an annual state fee of 7 cents per $10,000 of assets in the trust.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Choose the trust that best suits your financial situation. Take inventory of your property to determine what you'd like to include in the trust. Choose a trustee to manage your trust. Create the trust document. Sign the trust in front of a notary public. Transfer property into the trust to fund it.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

A South Dakotan trust changes all that: it protects assets from claims from ex-spouses, disgruntled business partners, creditors, litigious clients and pretty much anyone else.And it shields your wealth from the government, since South Dakota has no income tax, no inheritance tax and no capital gains tax.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

Unparalleled Tax Efficiency. South Dakota has no state income, capital gains, dividend/interest, or intangible tax. No South Dakota Residency Required. Lowest Insurance Premium Tax. Superior Asset Protection. No Required Termination.