Stay Put Rule

Description

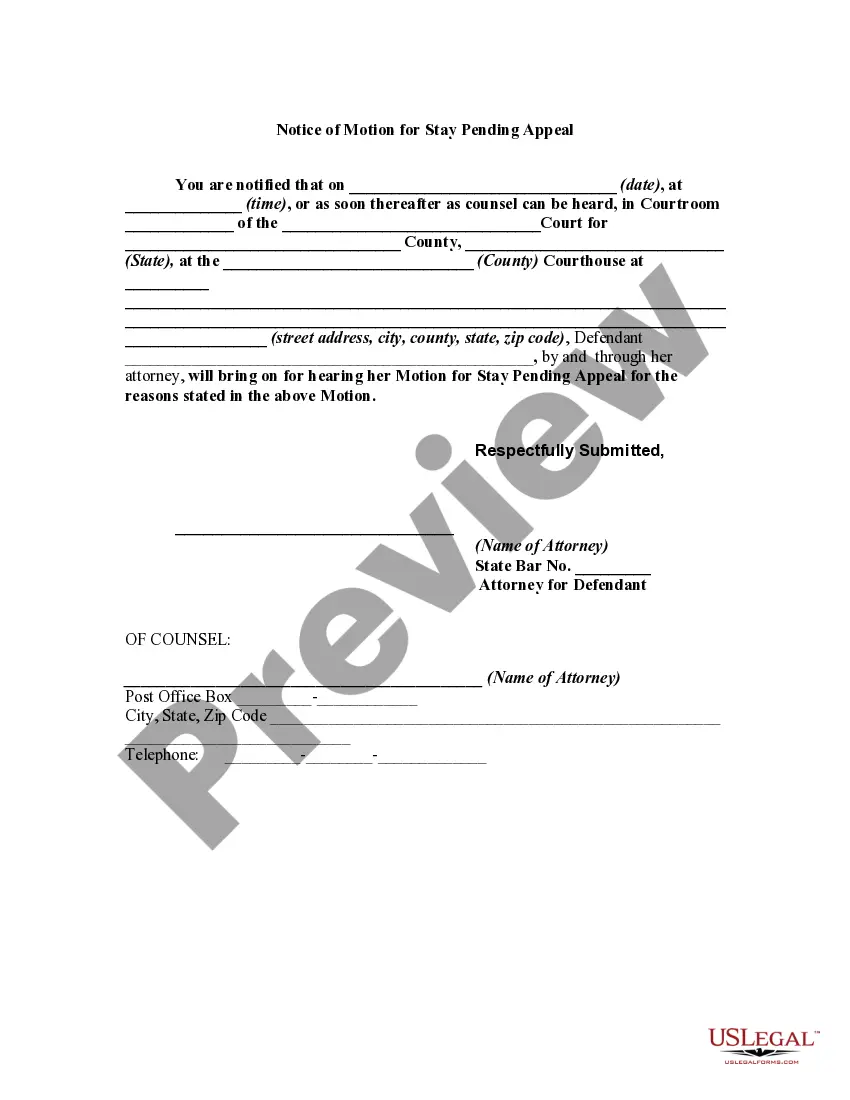

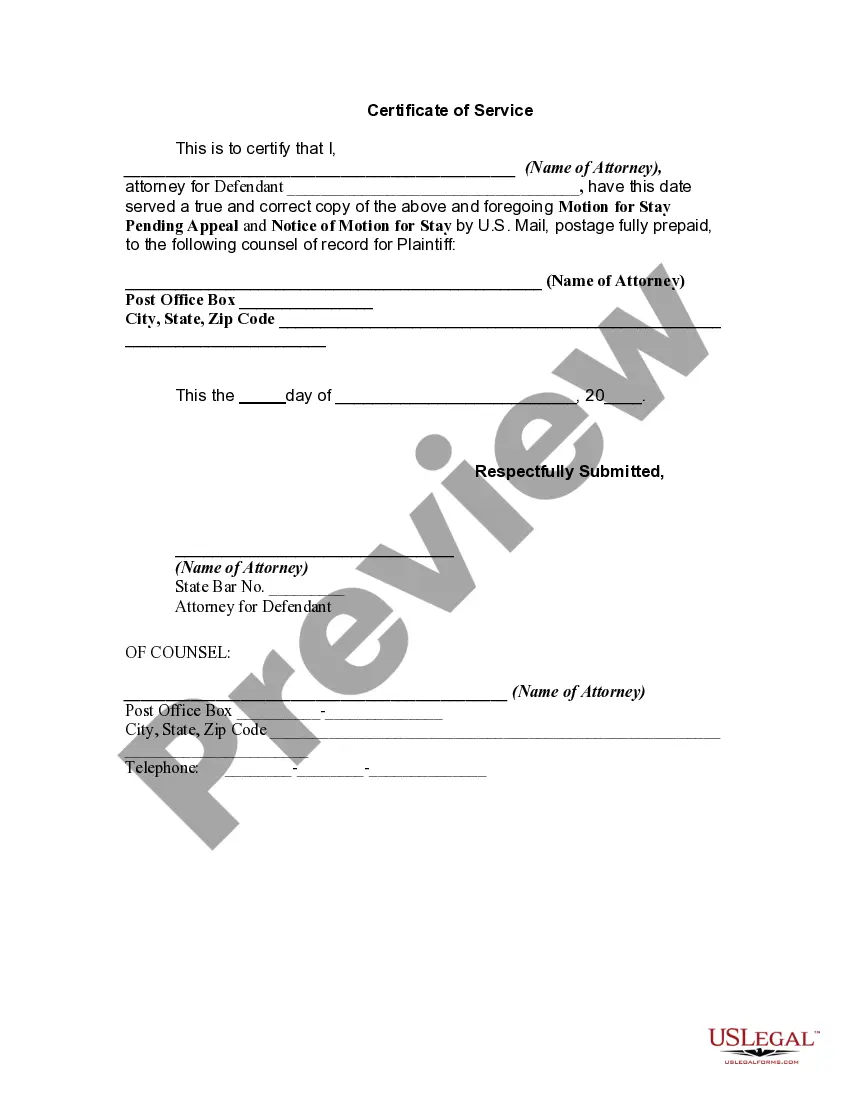

How to fill out Motion For Stay Pending Appeal And Notice Of Motion?

The Stay Put Rule presented on this page is a reusable legal document designed by experienced attorneys in compliance with federal and local statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 validated, state-specific templates for various business and personal circumstances. It is the quickest, simplest, and most dependable method to acquire the documents you require, as the service ensures bank-level data security and anti-malware safeguards.

Re-download your documents as needed. Access the My documents tab in your profile to re-download any previously purchased templates.

- Examine the document you require and verify it.

- Review the sample you searched for and observe it or check the form description to confirm it meets your criteria. If it does not, utilize the search function to discover the right one. Click Buy Now once you have found the template you want.

- Register and sign in. Choose the pricing option that best fits you and create an account. Use PayPal or a credit card to complete a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template. Select the format you desire for your Stay Put Rule (PDF, DOCX, RTF) and save the document on your device.

- Complete and sign the document. Print the template to finish it manually. Alternatively, use an online versatile PDF editor to swiftly and precisely fill out and sign your form with an eSignature.

Form popularity

FAQ

Texas has one form for all domestic for-profit businesses. Fill out and file in duplicate Form 424, Certificate of Amendment. You can file it in person, by mail or online at Texas SOSDirect for $1 log in fee. You also can fax your amendment with form 807 with your credit card information.

How Much Will It Cost To Reinstate? LLC ? The filing fee for reinstating an administratively dissolved LLC in Texas is $75. Expedited service requires an additional $25. Corporation ? An administratively dissolved corporation in Texas has to pay $75 in order to be reinstated.

Provisions. This form and the information provided are not substitutes for the advice and services of an attorney and tax specialist. To transact business in Texas, a foreign entity must register with the secretary of state under chapter 9 of the Texas Business Organizations Code (BOC).

The Comptroller is required by law to forfeit a company's right to transact business in Texas if the company has not filed a franchise tax report or paid a franchise tax required under Chapter 171.

You can amend your foreign LLC by filing Form 406, Amendment to Registration with the Texas Secretary of State. Your amendment does not need to be notarized, but it will need signing by an authorized person, such as a governing member of your company.

You can revive a business that was involuntarily terminated at any time. If you dissolved your Texas LLC voluntarily, you only have three years to reinstate it. After that, you have to form a new Texas LLC.

An entity forfeited under the Tax Code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all franchise taxes, penalties, and interest, and (3) filing an application for reinstatement (Form 801 Word 178kb, PDF 87kb), ...

Forfeited Existence - An inactive status indicating that the corporation or limited liability company failed to file its franchise tax return or to pay the tax due thereunder. Status is changed by secretary of state when certification of the delinquency is received from the comptroller of public accounts.