Motion Stay Sample With Extend Automatic

Description

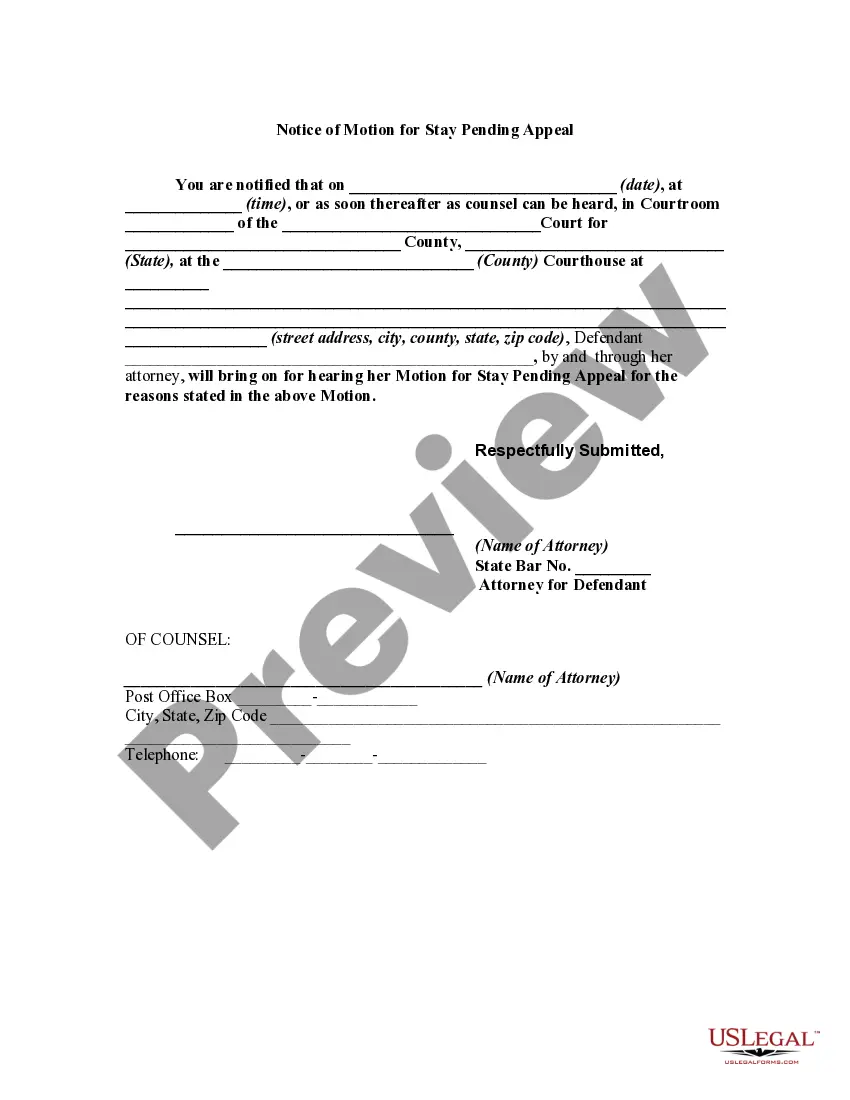

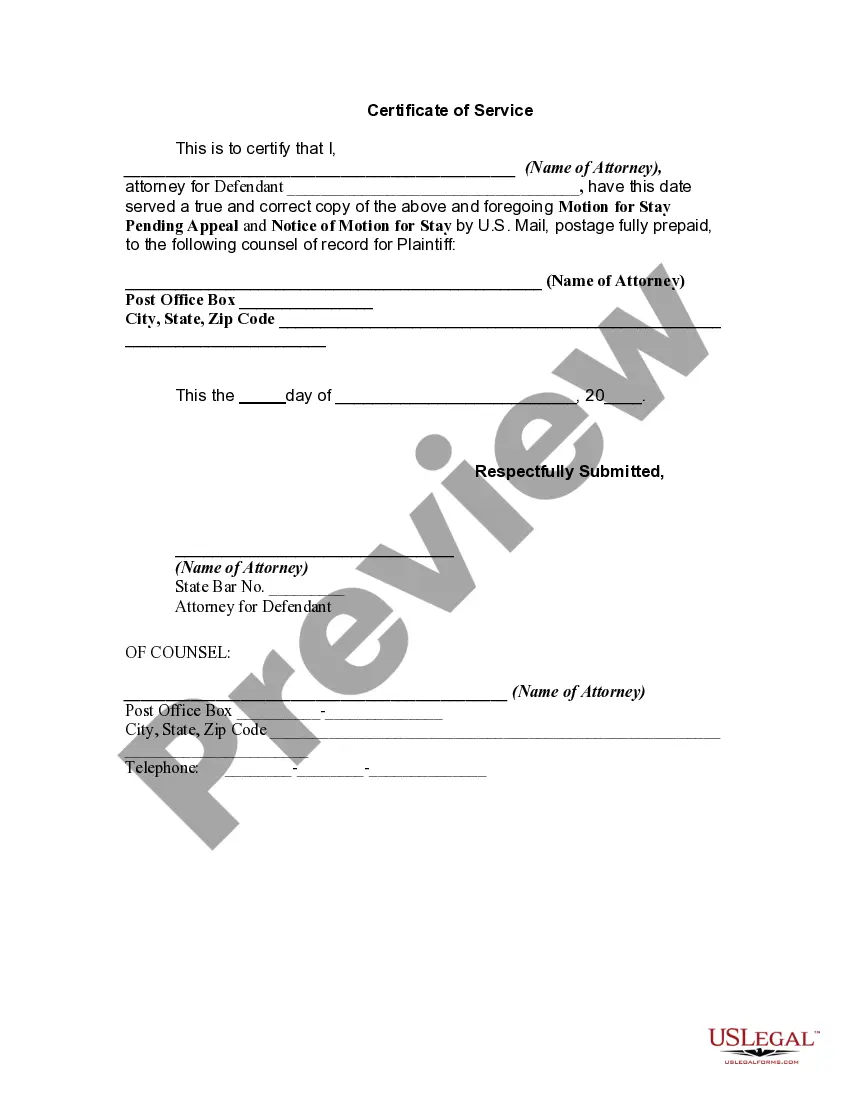

How to fill out Motion For Stay Pending Appeal And Notice Of Motion?

Creating legal documents from the ground up can frequently feel somewhat daunting.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more cost-effective method of generating Motion Stay Sample With Extend Automatic or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online compilation of more than 85,000 current legal documents covers nearly every facet of your financial, legal, and personal matters.

However, before proceeding to download Motion Stay Sample With Extend Automatic, adhere to these guidelines: Review the document preview and details to confirm you’ve found the document you seek. Ensure that the template you select meets the standards of your state and county. Opt for the appropriate subscription plan to acquire the Motion Stay Sample With Extend Automatic. Download the document, then complete, certify, and print it out. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and make form completion an effortless and streamlined experience!

- With just a few clicks, you can rapidly obtain state- and county-specific forms carefully prepared by our legal experts.

- Utilize our platform whenever you require dependable services to easily find and download the Motion Stay Sample With Extend Automatic.

- If you're familiar with our website and have previously set up an account with us, simply Log In to your account, choose the template, and download it or re-download it anytime later in the My documents section.

- Don’t have an account? No problem. Registering takes only a few minutes and allows you to browse the library.

Form popularity

FAQ

Extending the Automatic Stay Prepare a motion explaining why your filing isn't in bad faith. Set the motion hearing date no more than 30 days after your bankruptcy filing date. Timely serve the creditors, the trustee, and the U.S. Trustee with your motion.

Creditors Obtaining Relief From the Automatic Stay -- If a creditor properly files and serves a Motion for Relief from the Automatic Stay, and a bankruptcy judge grants the Motion, the Automatic Stay will either be removed or modified so that the creditor can resume collection efforts against the debtor.

The automatic stay lasts as long as the bankruptcy proceeding continues, and it ceases if the case is dismissed. The length of the stay also depends on whether it applies to collection activity directed toward the debtor personally or toward their property.

Generally, the stay automatically terminates on the earliest of: The case being closed or dismissed. The time a discharge is granted or denied.

The automatic stay generally remains in place until the discharge is entered. Once that happens, you're no longer responsible for the unsecured debts incurred before your Chapter 7 was filed. The permanent protection from creditors provided by the discharge is much stronger than the automatic stay.