Motion Stay File With Time

Description

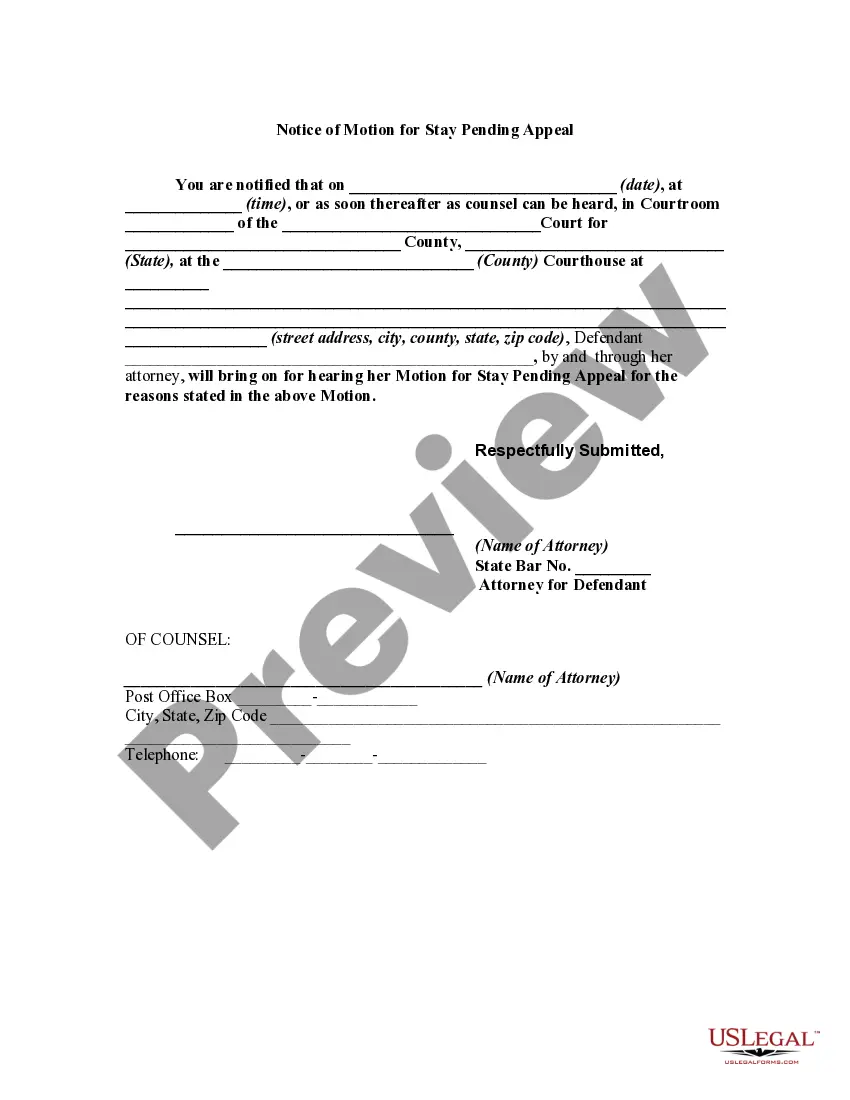

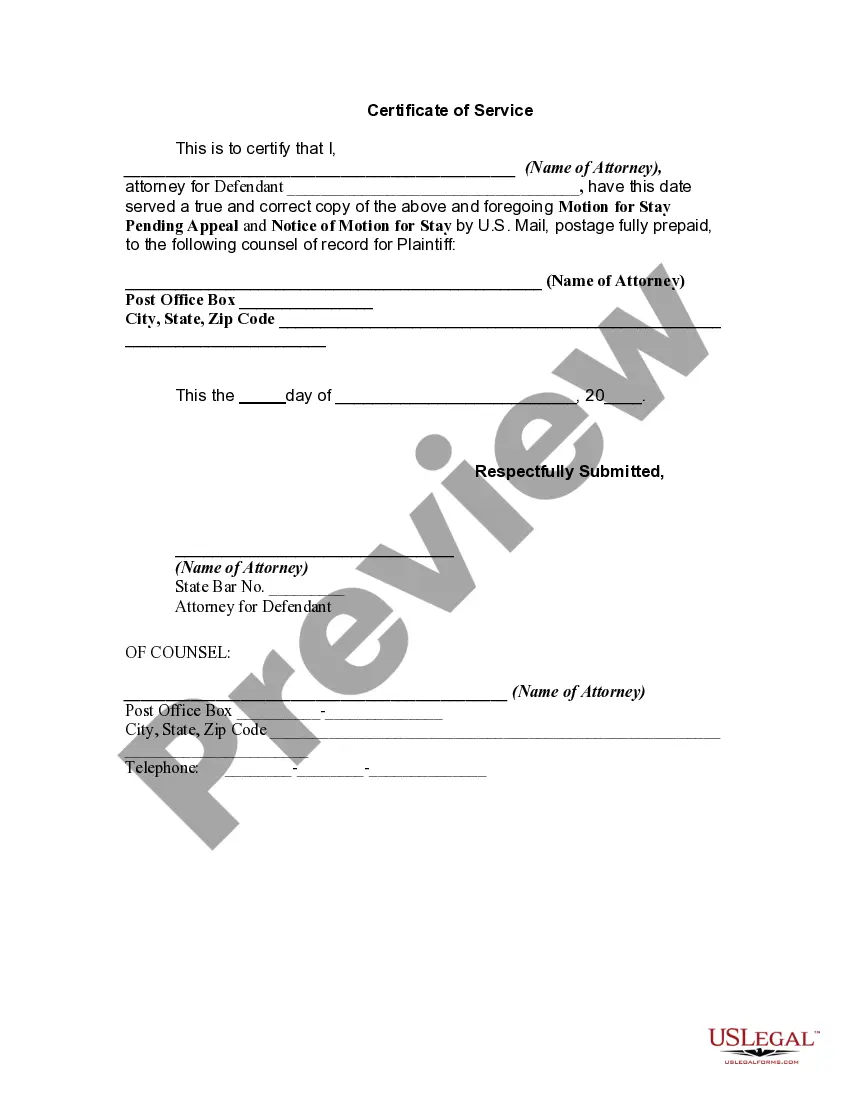

How to fill out Motion For Stay Pending Appeal And Notice Of Motion?

Dealing with legal paperwork can be perplexing, even for the most skilled experts.

When seeking a Motion Stay File With Time and lacking the opportunity to dedicate to finding the correct and current version, the process can be overwhelming.

Obtain state- or county-specific legal and business forms. US Legal Forms addresses any request you may have, from personal to corporate documentation, all in one location.

Utilize sophisticated tools to complete and manage your Motion Stay File With Time.

Upon downloading the required form, follow these steps: Verify its correctness by viewing it and reading its description. Ensure the template is acceptable in your state or county. Click Buy Now when ready. Select a subscription plan. Choose the necessary format, and Download, complete, eSign, print, and dispatch your document. Benefit from the US Legal Forms online library, backed by 25 years of expertise and dependability. Simplify your routine document management into a simple and user-friendly process today.

- Access a database of articles, guides, and manuals relevant to your circumstances and needs.

- Conserve time and energy searching for the documents you require and leverage US Legal Forms' advanced search and Review feature to locate and obtain Motion Stay File With Time.

- If you hold a subscription, Log In to your US Legal Forms account, search for the form, and procure it.

- Check your My documents tab to review the documents you have previously saved and manage your folders as desired.

- If this is your first encounter with US Legal Forms, create an account and gain unrestricted access to all the platform's advantages.

- A robust online form repository can be transformative for anyone looking to navigate these matters effectively.

- US Legal Forms stands as a frontrunner in online legal documents, offering more than 85,000 state-specific legal forms at your fingertips.

- With US Legal Forms, you can.

Form popularity

FAQ

Forfeiture is the process that allows the Department to remove inactive entities that have not legally terminated their authority to do business in Maryland or to notify active entities of an existing oversight in meeting legal filing requirements.

What needs to be done to reinstate a company in Maryland? To reinstate your Maryland entity you need to file Articles of Revival (corporations) or Certificate of Reinstatement (LLCs) with Maryland State Department of Assessments and Taxation and pay any fees, missing annual reports and penalties.

In Maryland, the necessary paperwork will depend on the business entity type. LLCs have to file the Articles or Certificate of Reinstatement form, while corporations have to submit Articles of Revival. Additionally, you will have to file all your missing returns and pay the corresponding fees.

If your Maryland corporation was forfeited and you would like to continue to do business, you will need to revive your corporation. File Articles of Revival with the Maryland State Department of Assessments and Taxation (SDAT).

Yes, in Maryland, you can use any name that is not active. However, if a name is inactive because it was not in good standing, then that name cannot be used. If you use a forfeited name or dissolved company name, your new company will be issued a new ID number so there is no confusion with the previous company.

You can download tax forms using the links listed below. Request forms by e-mail. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. Visit our offices.

?Forfeited? means the right of the entity to conduct business in the State of Maryland has been relinquished and it has no right to use its name. For domestic corporations, this also means that the business has no existence under the laws of the State of Maryland.

To revive a Maryland LLC, you'll need to file the Articles or Certificate of Reinstatement with the Maryland State Department of Assessments and Taxation (SDAT). You'll also have to fix the issues that led to your Maryland LLC's dissolution and, in some cases, obtain a Maryland tax clearance certificate.