Dynasty Trust Sample Foreign

Description

How to fill out Irrevocable Generation Skipping Or Dynasty Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

Whether for corporate objectives or personal matters, everyone must handle legal issues at some point in their lives.

Finalizing legal documents requires meticulous attention, starting with selecting the correct form template.

With an extensive catalog of US Legal Forms available, you do not need to waste time searching for the suitable sample online. Utilize the library's straightforward navigation to find the correct form for any situation.

- For example, if you select an incorrect version of the Dynasty Trust Sample Foreign, it will be rejected upon submission.

- Therefore, it is crucial to have a trustworthy source for legal documents such as US Legal Forms.

- If you need to acquire a Dynasty Trust Sample Foreign template, follow these straightforward steps.

- Utilize the search bar or catalog navigation to locate the sample you require.

- Review the form's details to ensure it corresponds with your case, state, and area.

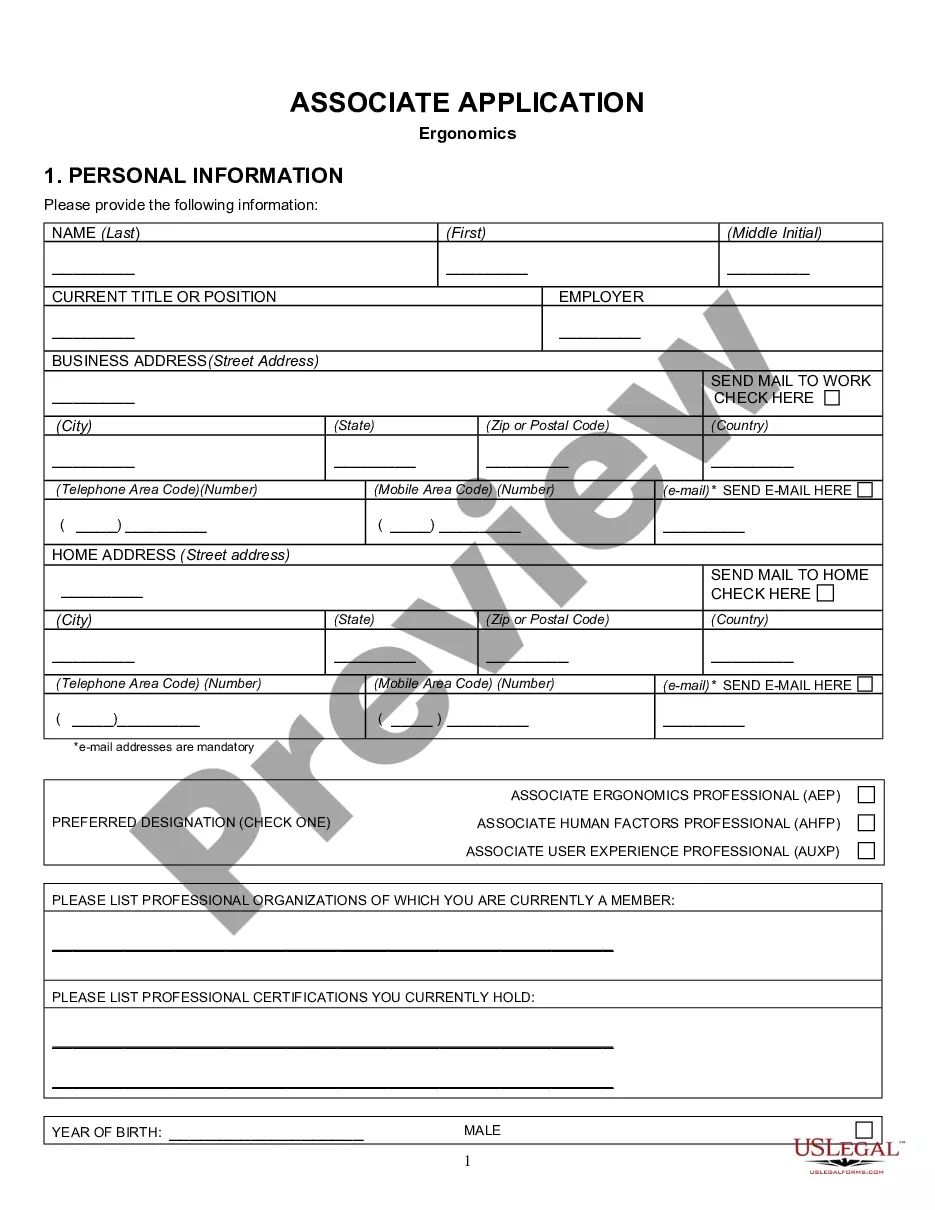

- Select the form's preview to examine it.

- If it is not the correct form, return to the search option to find the Dynasty Trust Sample Foreign template you need.

- Obtain the document if it aligns with your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Choose your payment method: either a credit card or a PayPal account.

- Select the file format you prefer and download the Dynasty Trust Sample Foreign.

- After downloading, you can fill out the form using editing software or print it to complete it manually.

Form popularity

FAQ

The owner of a foreign trust, often referred to as the grantor, is usually the individual who creates the trust and transfers their assets into it. In many cases, this can be a U.S. citizen or resident who aims to achieve specific estate planning goals. However, the trust's terms define who benefits from it, which may include multiple generations. Exploring a dynasty trust sample foreign can offer insights into ownership structures in foreign trusts.

An example of a foreign trust might be a trust set up by a U.S. citizen in a country like the Cayman Islands, with a local trustee managing it. This arrangement can offer tax advantages, but compliance with U.S. tax laws remains essential. Understanding how foreign trusts operate may require professional guidance to navigate intricate regulations. Consulting a dynasty trust sample foreign can provide clarity on that setup.

An example of a dynasty trust could be a trust established by a grandparent that provides for their children, grandchildren, and future generations. This trust is structured to avoid estate taxes over time while still providing financial support for beneficiaries. It typically includes a variety of assets, allowing them to grow without immediate taxation. Reviewing a dynasty trust sample foreign can help visualize its framework and benefits.

A revocable trust generally cannot be classified as a foreign trust, especially if the grantor is a U.S. person. However, if it meets certain conditions, it could potentially align with foreign trust rules. It’s important to consult with a legal professional to ensure proper compliance and understanding. Checking a dynasty trust sample foreign can illuminate how these distinctions operate.

A foreign trust is typically defined as a trust that is not governed by U.S. laws and that has a non-U.S. person as the trustee or beneficiaries. Such trusts are subject to specific tax rules, which can complicate estate planning. Understanding the differences between foreign and domestic trusts is essential for effective wealth management. Reviewing a dynasty trust sample foreign can clarify the key components of a foreign trust.

Yes, you can place foreign property into a trust, including a dynasty trust. However, you must understand the laws governing foreign property and trusts in the respective countries. Carefully structuring the trust can help you maximize benefits and mitigate potential taxes. Utilizing a dynasty trust sample foreign can help visualize how foreign assets fit into this strategy.

A dynasty trust can hold various assets like real estate, stocks, bonds, and business interests. By transferring these assets into a dynasty trust, you can ensure their long-term growth and protection from taxes. This strategy helps preserve family wealth across generations, providing financial security for your descendants. Exploring a dynasty trust sample foreign can offer you insights into effective asset management.

To acquire a foreign trust, you need to understand various legal aspects and documentation required. A Dynasty trust sample foreign serves to protect assets while allowing for international considerations. Consulting with professionals or utilizing platforms like US Legal Forms can help you navigate the necessary steps efficiently.

Yes, a trust can include foreign beneficiaries. This setup can provide significant tax and estate planning advantages. When you consider a Dynasty trust sample foreign, it’s important to ensure compliance with both US and international laws. US Legal Forms offers resources that simplify this process for you.

Yes, a foreigner can establish a trust in the US. It’s essential to understand the legal requirements and implications involved. A Dynasty trust sample foreign can be an excellent option for asset protection and estate planning. Utilizing a reliable platform like US Legal Forms can guide you through the process smoothly.