Letter To Remove Member From Llc

Description

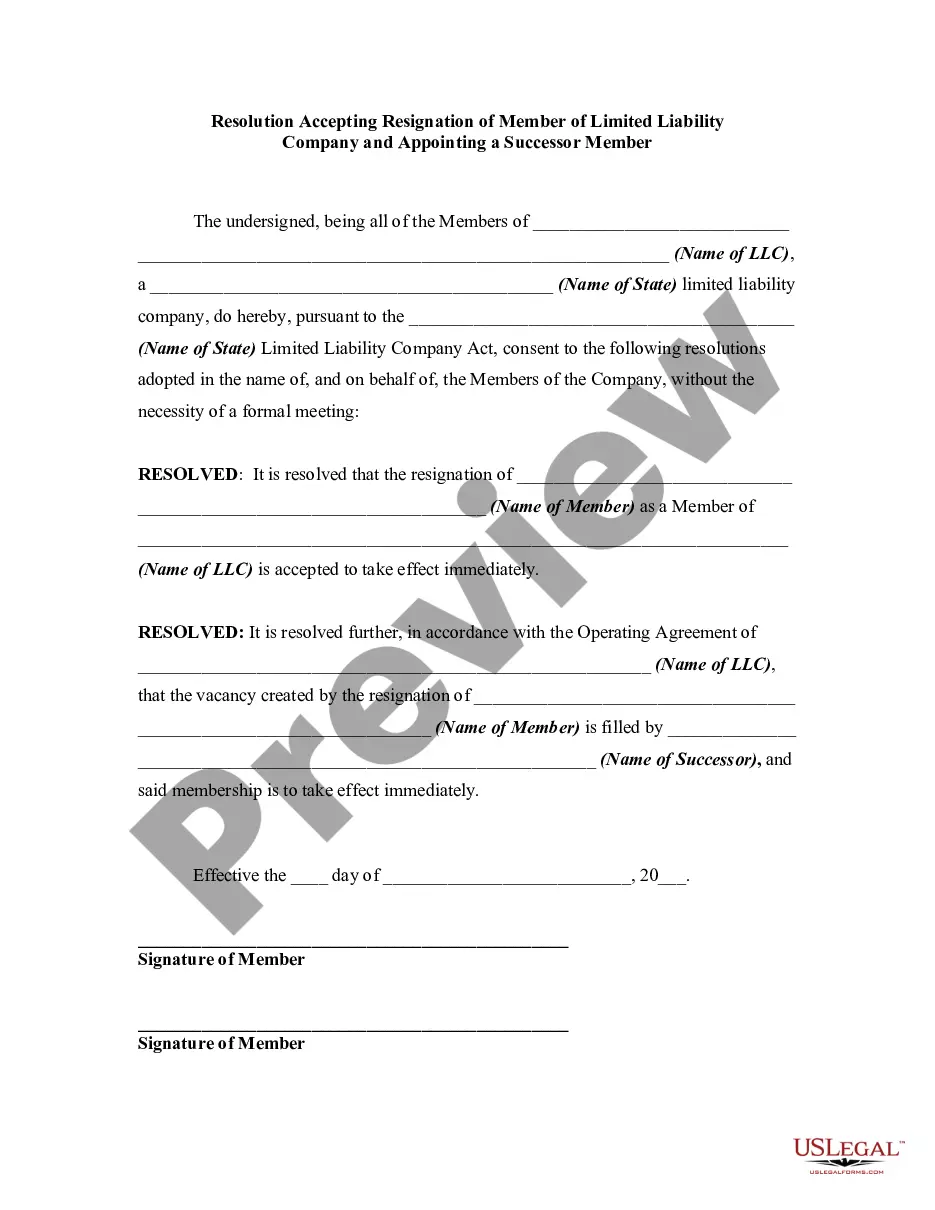

How to fill out Resolution Accepting Resignation Of Member Of Limited Liability Company And Appointing A Successor Member?

- If you're an existing user, log in to your account to access and download the required template directly from your dashboard. Ensure your subscription is active; if not, renew it according to your plan.

- For first-time users, start by checking the Preview mode and the description of the form. Make sure it aligns with your requirements and complies with local jurisdiction laws.

- If you find that the template does not meet your needs, utilize the Search tab to locate another suitable document.

- Once you find the right template, click on the Buy Now button, select your preferred subscription plan, and create an account to access the library's resources.

- Complete the purchase by entering your payment details through credit card or PayPal.

- Finally, download the form to your device for completion and future reference, available at the My documents section of your profile.

By following these steps, you will efficiently acquire the necessary letter to remove a member from your LLC. US Legal Forms not only simplifies this process but also provides access to robust resources and expert support.

Don’t wait to get started—visit US Legal Forms today and ensure your legal documents are handled with precision and care!

Form popularity

FAQ

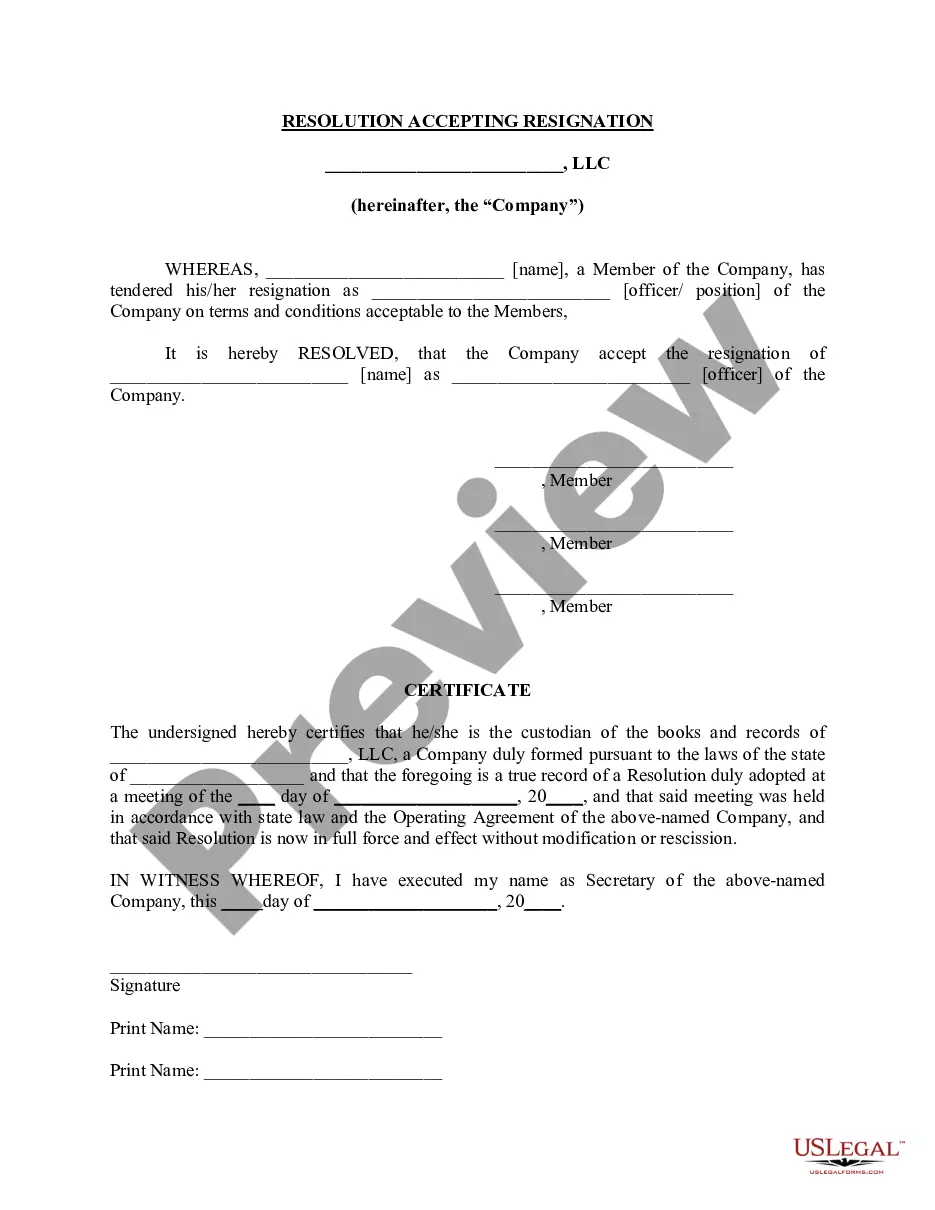

Disassociating from an LLC requires clear communication and compliance with the operating agreement's provisions. You should prepare a Letter to remove member from LLC that outlines your request to disassociate. Filing this letter with the members not only informs them of your decision but also provides a record of your departure from the LLC.

Resigning from an LLC involves understanding the terms set forth in the operating agreement. Once you clarify the process, you can draft a formal Letter to remove member from LLC. This letter serves as an official notice to the remaining members, ensuring that everything is documented properly.

To resign as a member of an LLC, you should first review the operating agreement for specific guidelines. After that, it is essential to create a written notice or a Letter to remove member from LLC, which outlines your intention to resign and any relevant details. This letter should then be submitted to the other members for their records.

When a member decides to leave an LLC, several steps must follow according to the operating agreement. Typically, the remaining members must agree to the resignation. To formally document this decision, the member should draft a Letter to remove member from LLC to ensure all parties acknowledge the change.

Form 8978 is used to compute and report the amount of a partnership’s large partnership dispositional loss. Although primarily relevant for larger partnerships, understanding this form can help in the context of member removal, as such changes might affect how gains and losses are reported. If you need to include any tax implications related to the departure, a well-structured letter to remove a member from your LLC could assist in documenting these aspects.

To remove a member from your LLC, you generally need to follow the procedures outlined in your operating agreement first. Prepare and submit the necessary amendments to your documents, including any relevant IRS forms such as Form 1065. Additionally, a clear letter to remove a member from your LLC can clarify the situation to all parties involved and ensure compliance with legal requirements.

Form 8822-B is used to notify the IRS of changes in your business's responsible party. This form is crucial if an LLC member leaves, as the responsible party must remain current to avoid any issues with tax filings. If you are drafting a letter to remove a member from your LLC, consider filing this form to keep your records accurate with the IRS.

When one partner wishes to leave an LLC, it often triggers a formal process that should adhere to the existing operating agreement. Depending on the agreement, the remaining members may need to buy out the departing member's interest. Crafting a letter to remove a member from your LLC is a critical step in facilitating this process legally and smoothly.

While there is no specific IRS form solely for removing a member from an LLC, changes in membership can be reported through amendments to your LLC's operating agreement. You may also need to file Form 1065 and provide information regarding the changes in member participation. A well-prepared letter to remove a member from your LLC can streamline this process.

The IRS Form 1065 is used by partnerships to report their income, deductions, gains, and losses. It is essential for the partnership and its members because it helps the IRS understand how the profits and losses are distributed among each member. When drafting a letter to remove a member from your LLC, you may need to refer to this form to ensure your reporting is accurate.