Notice Lien Contractor Withholding

Description

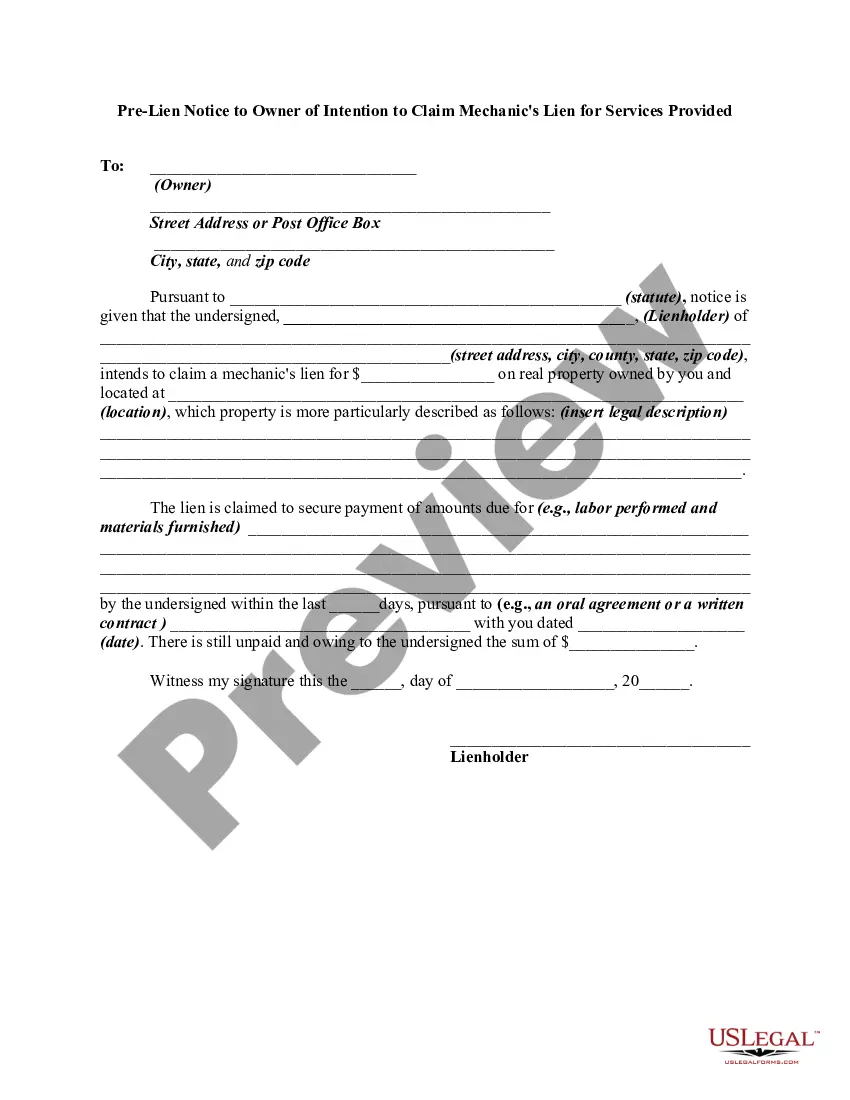

How to fill out Pre-Lien Notice To Owner Regarding Potential Mechanic's Lien For Services To Be Provided To General Contractor?

- Log in to your existing account or create a new one at US Legal Forms.

- Preview the available lien templates to find the one that fits your requirements. Ensure it adheres to your local jurisdiction's stipulations.

- If necessary, employ the search functionality to locate additional templates that may better suit your situation.

- Click 'Buy Now' on your selected form and choose a subscription plan that aligns with your needs.

- Complete your purchase using your credit card or PayPal, and confirm your payment.

- Download your completed form to your device and access it anytime through the 'My documents' section of your profile.

Using US Legal Forms not only streamlines your document acquisition but also empowers you with a robust selection of legal forms and access to expert assistance. This ensures you are equipped with legally sound documents tailored to your specific situation.

Start your journey toward a hassle-free legal process today. Visit US Legal Forms to explore your options!

Form popularity

FAQ

To fill out a waiver of lien, include your name, contact details, and the information of the entity responsible for the payment. Indicate the payment amount received and specify the project involved. Ensure that all parties involved sign the waiver to complete it according to the standards set by Notice lien contractor withholding regulations.

Filling out a lien affidavit requires you to provide details about the property, including the address and the owner’s name. List the work performed and the amount owed, then sign and date the affidavit. By completing this process correctly, you align with the expectations around the Notice lien contractor withholding, ensuring your rights are safeguarded.

To fill out a lien affidavit, start by including your name, contact information, and a description of the property in question. Clearly articulate the amount owed and the services provided, making sure to sign the document in the presence of a notary. Following these steps can help ensure compliance with the Notice lien contractor withholding requirements.

When a contractor signs a waiver of lien, it signifies their acceptance of payment and relinquishment of any future claims to the property. This waiver protects the property owner from potential disputes and provides clarity on project completion. It is crucial for both parties to be aware of the Notice lien contractor withholding to avoid complications.

A final lien waiver in construction is a document that confirms full payment for the work completed on a project. It acts as a legal protection for the property owner, ensuring that no further claims will arise from the contractor. Understanding this waiver is essential to avoid issues with the Notice lien contractor withholding.

When writing a letter to release a lien, start by including your contact information and the property details. In the body of the letter, state the reasons for the release and reference the original lien. Be sure to include the date of the original lien and both parties' signatures to make it official under the Notice lien contractor withholding guidelines.

To fill out a construction lien waiver, begin by identifying the parties involved, including the property owner's name and the contractor's name. Clearly state the amount of payment received and specify that the waiver applies to the work completed. Finally, ensure that both parties sign and date the document, which helps protect your rights under the Notice lien contractor withholding.

In Nebraska, construction liens generally remain valid for 2 years from the filing date, provided no actions have been taken that would affect their enforceability. If a contractor does not pursue the claim within this period, they may lose their right to payment through the lien. Understanding this duration is critical to prevent potential payment withholding for contractors. US Legal Forms offers resources to help contractors track these timelines efficiently.

A lien becomes enforceable when it meets specific legal requirements, such as proper filing and notice delivery. For contractors, adhering to the laws regarding notice lien contractor withholding is critical. In addition, the lien must be filed within the statutory time limits and reflect accurate information about the debt. Consult US Legal Forms for documentation that helps meet these legal standards.

In Illinois, contractors typically have four months from the date of the last work done to file a lien on a property. This timeline is essential to secure rights to payment before facing potential withholding. It's important for contractors to stay aware of this deadline to ensure their claims are enforceable. You can find templates and helpful resources at US Legal Forms to streamline this process.