Defendant Affirmative Defense For Debt Collection

Description

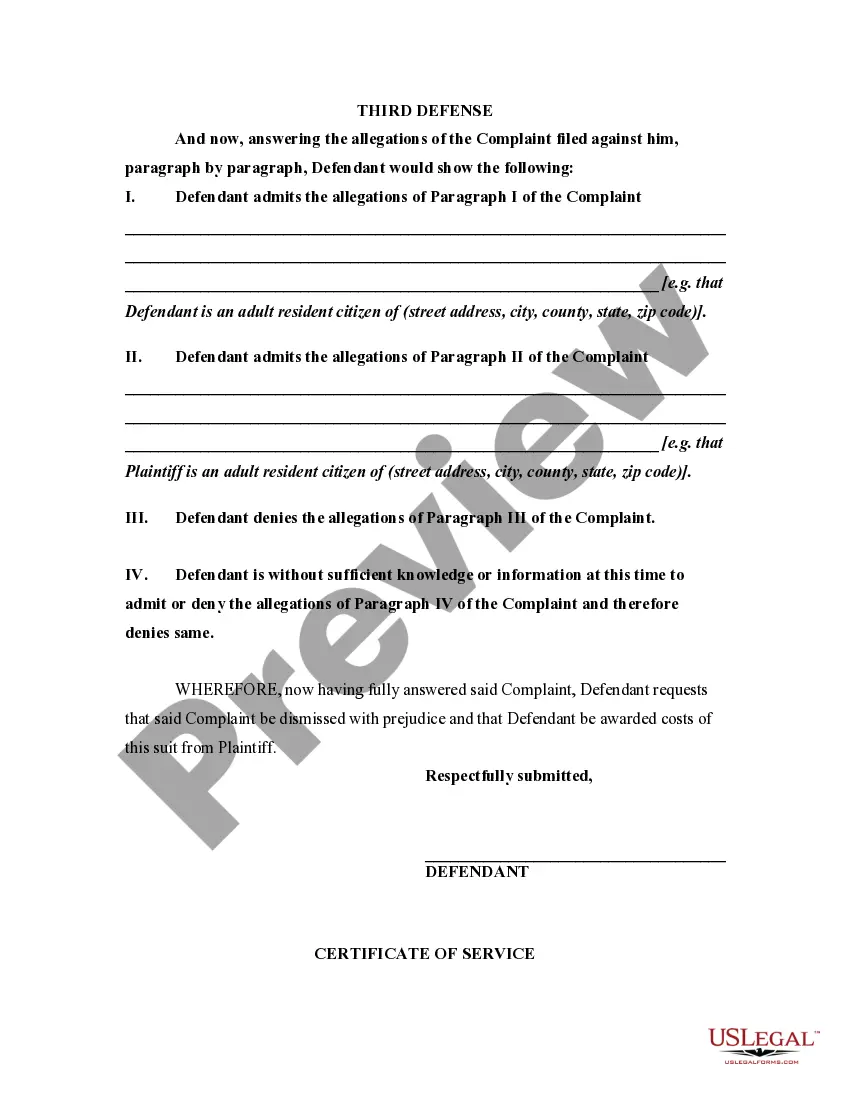

How to fill out Answer By Defendant In A Civil Lawsuit Alleging The Affirmative Defense Of The Cause Of Action Being Barred By Waiver Of Terms Of Contract By Plaintiff?

Accessing legal document samples that comply with federal and local laws is essential, and the internet offers many options to choose from. But what’s the point in wasting time searching for the right Defendant Affirmative Defense For Debt Collection sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal situation. They are simple to browse with all documents collected by state and purpose of use. Our experts stay up with legislative updates, so you can always be confident your paperwork is up to date and compliant when obtaining a Defendant Affirmative Defense For Debt Collection from our website.

Getting a Defendant Affirmative Defense For Debt Collection is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, follow the instructions below:

- Take a look at the template using the Preview feature or via the text description to make certain it meets your needs.

- Look for a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the right form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Defendant Affirmative Defense For Debt Collection and download it.

All documents you find through US Legal Forms are multi-usable. To re-download and complete earlier purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

If you file an Answer to the lawsuit and defend yourself in court, you can state an affirmative defense. You can deny what the plaintiff says you did without saying anything else. But you can also have affirmative defenses. You must raise it in your Answer or you may give up your right to bring it up later.

Affirmative defenses are reasons or excuses why you should win your debt collection case. A properly asserted affirmative defense can help you win the lawsuit even if the plaintiff can otherwise prove the other elements of its case. Timing is critical, however.

Summary: If you're being sued by a debt collector, here are five ways you can fight back in court and win: 1) Respond to the lawsuit, 2) make the debt collector prove their case, 3) use the statute of limitations as a defense, 4) file a Motion to Compel Arbitration, and 5) negotiate a settlement offer.

Affirmative defense?Examples On [Date], after making the contract and the alleged breach, and before this action was commenced, defendant paid to the plaintiff the sum of [specify amount], which was accepted by the plaintiff in full satisfaction and discharge of the damages claimed in the petition.