Rent For Grazing Land

Description

How to fill out Lease Of Land For Pasturing And Grazing Of Cattle?

Creating legal documents from the ground up can at times be daunting.

Certain situations may entail extensive research and significant financial investment.

If you’re seeking a more straightforward and budget-friendly solution for preparing Rent For Grazing Land or other documents without excessive hassle, US Legal Forms is readily available to you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal affairs.

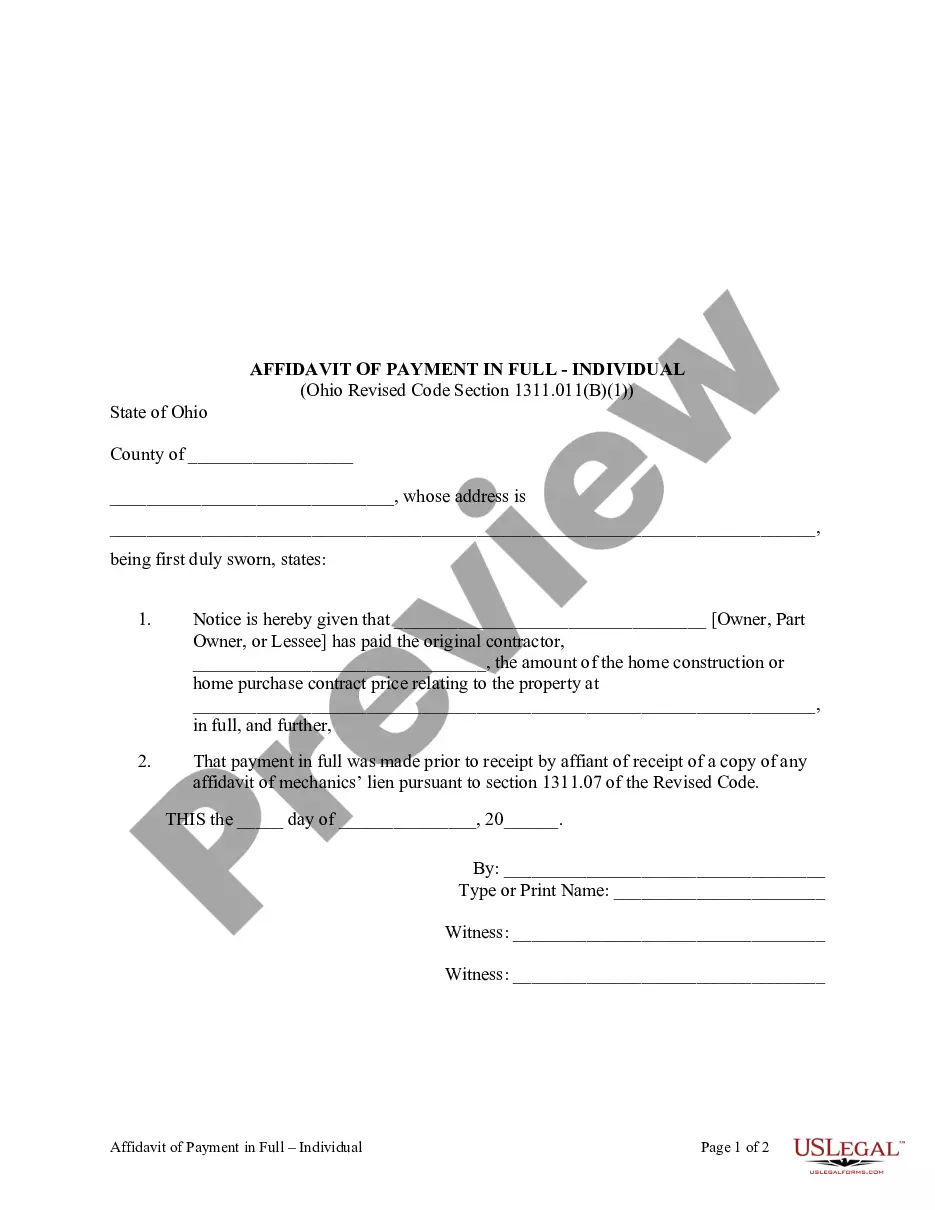

Review the form preview and descriptions to confirm that you have located the correct form. Ensure that the template you select meets the requirements of your state and county. Choose the most appropriate subscription plan to obtain the Rent For Grazing Land. Download the document, then fill it out, certify it, and print it. US Legal Forms prides itself on a pristine reputation and over 25 years of experience. Join us today and make form completion simple and efficient!

- With a few clicks, you can promptly access state- and county-specific templates meticulously crafted by our legal experts.

- Utilize our service whenever you need a dependable and trustworthy source to swiftly find and download the Rent For Grazing Land.

- If you’re already familiar with our services and have set up an account previously, just Log In to your account, find the template, and download it or re-download it anytime from the My documents section.

- Haven't registered yet? No worries. Setting up is quick and easy, allowing you to browse the catalog.

- Before diving directly into downloading Rent For Grazing Land, consider these tips.

Form popularity

FAQ

To report farmland rental income, gather documentation related to the rental payments you received throughout the year. This income should be reported on Schedule E of your federal tax return. It is vital to track expenses associated with maintaining the pasture land, as these can often be deducted, reducing your tax burden. For detailed guidance, consult a tax professional who understands agricultural income.

Report your rental income and expenses on Part I, Income or Loss From Rental Real Estate Royalties on Supplemental Income and Loss, Schedule E (IRS Form 1040) .

Earned income includes all the taxable income and wages you get from working for someone else, yourself or from a business or farm you own.

Landowners and sub-lessors that do not materially participate in the operation or management of the farm (for self-employment tax purposes), file this form to report farm rental income based on crops or livestock produced by the tenant.

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees.

Earned income does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, worker's compensation benefits, or social security benefits. For tax years after 2003, members of the military who receive excludable combat zone compensation may elect to include it in earned income.