Debt Lawsuit Answer Template With Credit Card

Description

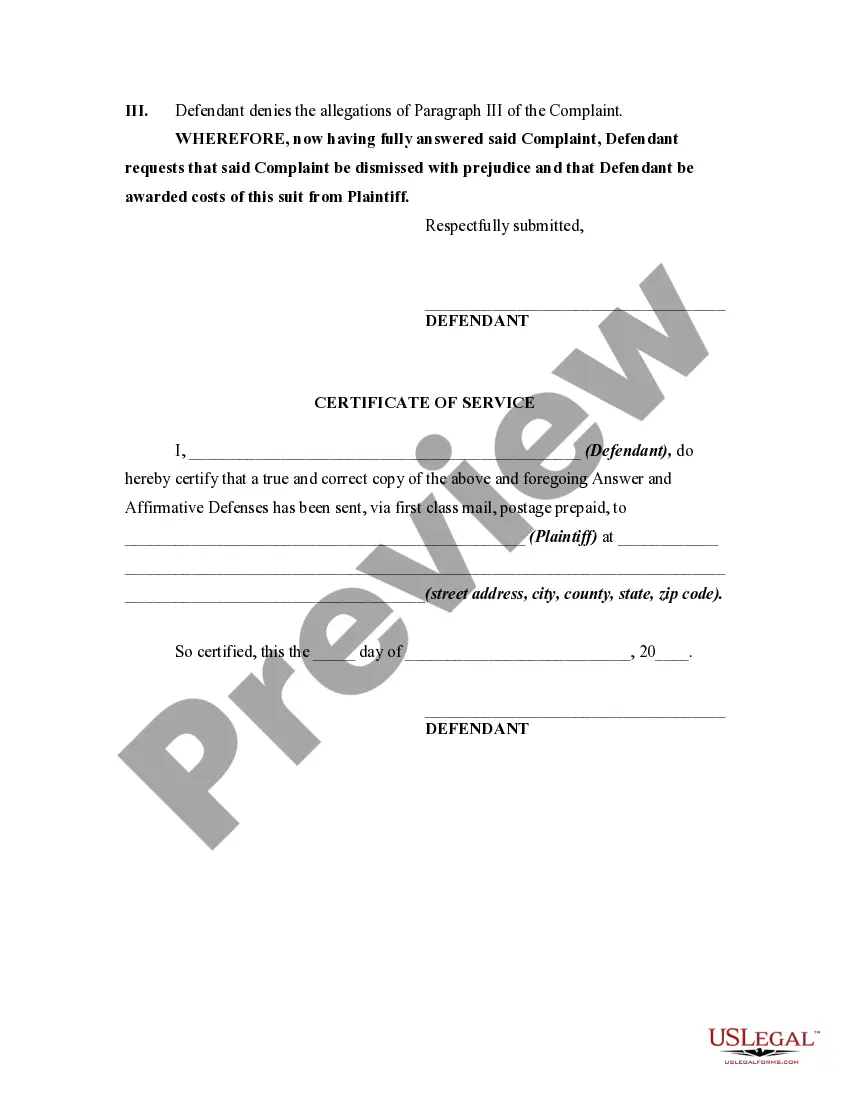

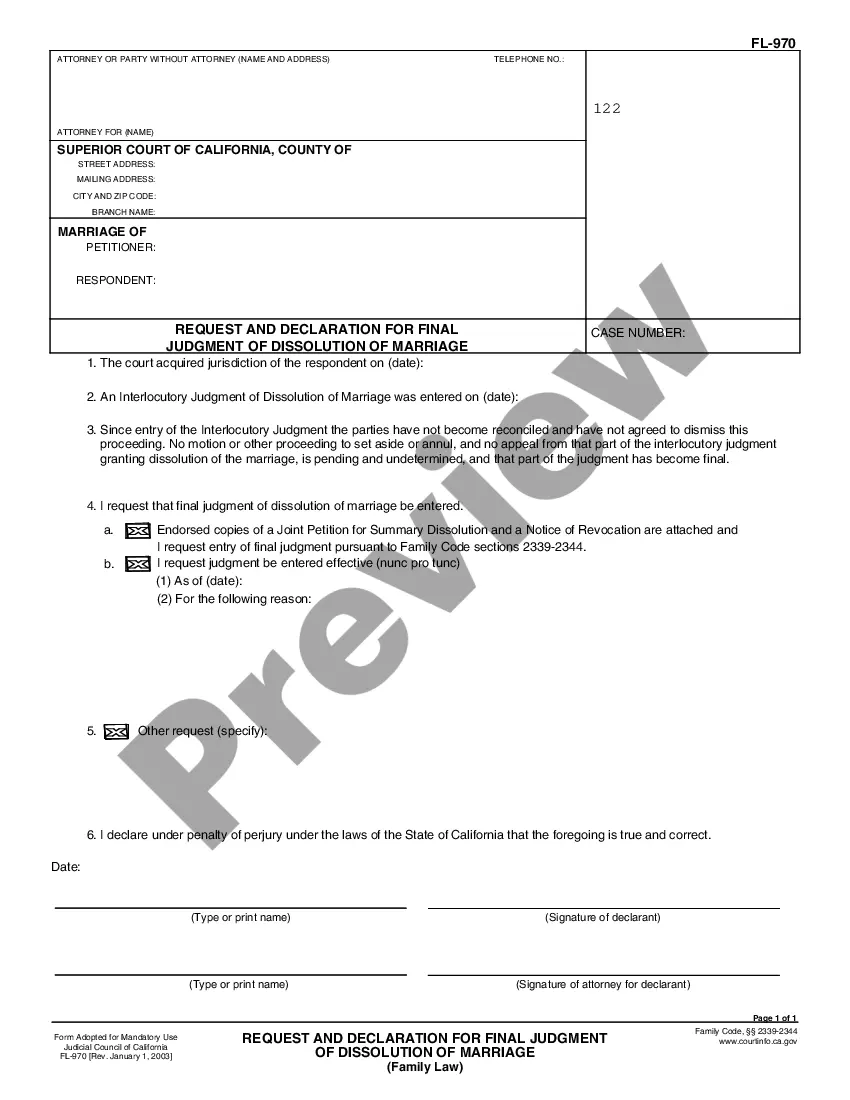

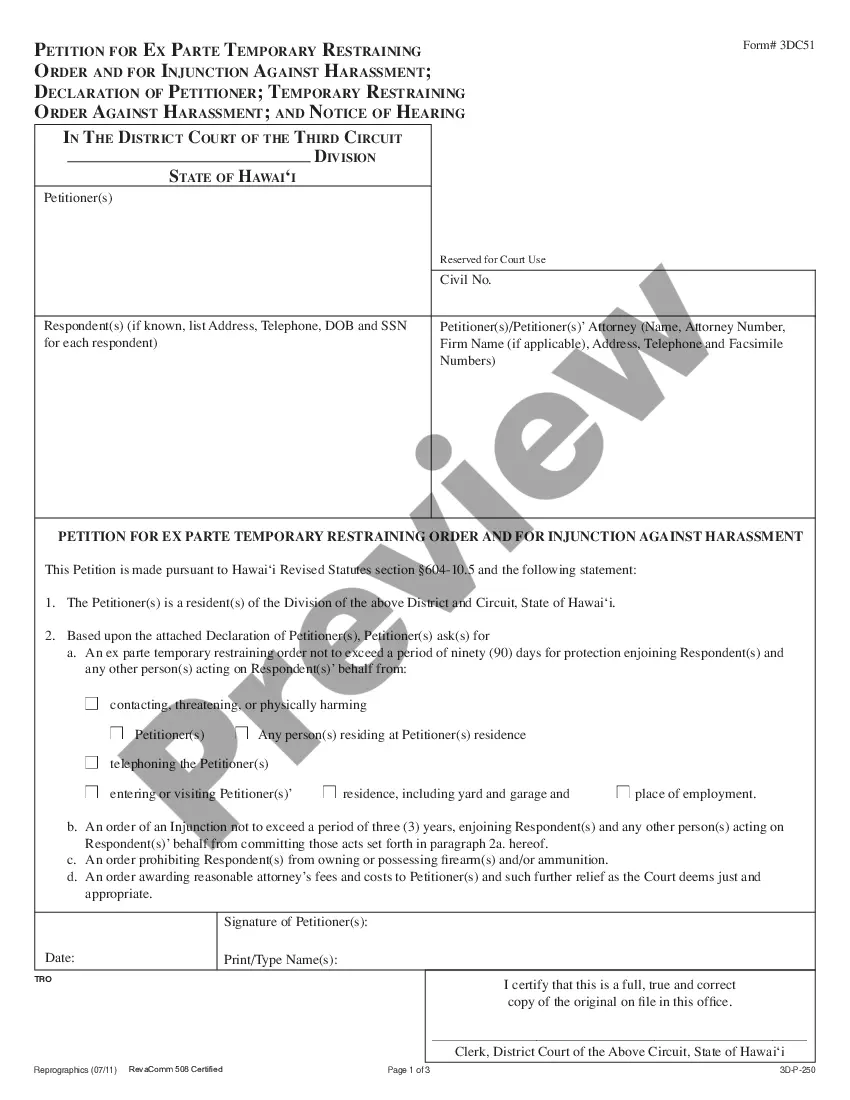

How to fill out General Form Of An Answer By Defendant In A Civil Lawsuit?

Creating legal documents from the beginning can often feel daunting.

Some situations may require extensive research and significant expenses.

If you’re looking for a simpler and more cost-effective method for preparing Debt Lawsuit Answer Template With Credit Card or other papers without unnecessary obstacles, US Legal Forms is always available to you.

Our online library of over 85,000 updated legal documents encompasses nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can swiftly access state- and county-specific templates carefully crafted for you by our legal experts.

Review the form previews and descriptions to ensure you are selecting the correct document.

- Utilize our website whenever you require a dependable and trustworthy service through which you can effortlessly locate and obtain the Debt Lawsuit Answer Template With Credit Card.

- If you're familiar with our services and have previously registered an account with us, simply Log In to your account, find the form, and download it or re-download it at any time later in the My documents section.

- Don't have an account? No worries. Setting it up and navigating the library takes just a few minutes.

- However, before proceeding to download the Debt Lawsuit Answer Template With Credit Card, please adhere to these suggestions.

Form popularity

FAQ

You are here. Includes all State of Oregon tax forms, instructions and publications. Personal income tax forms and publications are included. You can print any available form at the library.

An Oregon tax power of attorney (Form 150-800-005) is the document you must use to appoint an agent with the principal authority to represent you before the Oregon Department of Revenue.

Download forms from the Oregon Department of Revenue website or request paper forms be mailed to you. Order forms by calling 1-800-356-4222. The IRS provides 1040 forms and instructions and schedules 1-3 for the library to distribute.

Full-year residents File Form OR-40 if you (and your spouse, if married and filing a joint return) are a full-year resident. You're a full-year resident if all of the following are true: You think of Oregon as your permanent home. Oregon is the center of your financial, social, and family life.

Last Known Address (a) ?In writing? means a letter written to the department, a completed Form 150-800-738 Change of Address/Name, or a completed Form 150-211-156 Oregon Combined Payroll Tax Business Change in Status submitted to the department by the taxpayer or the taxpayer's authorized representative.

Download forms from the Oregon Department of Revenue website or request paper forms be mailed to you. Order forms by calling 1-800-356-4222. The IRS provides 1040 forms and instructions and schedules 1-3 for the library to distribute.

Oregon State Tax Forms If you filed a paper form last year, you will receive a paper form in the mail this year. If you need a booklet, call Oregon Department of Revenue at 503.378. 4988 or 1.800. 356.4222 or e-mail questions.dor@state.or.us.

These forms and publications are available on the Internet, on CD-ROM, through fax on demand, over the telephone, through the mail, at local IRS offices, at some banks, post offices, and libraries, and even at some grocery stores, copy centers and office supply stores.