Answer To Debt Collection Lawsuit Example With No Money

Description

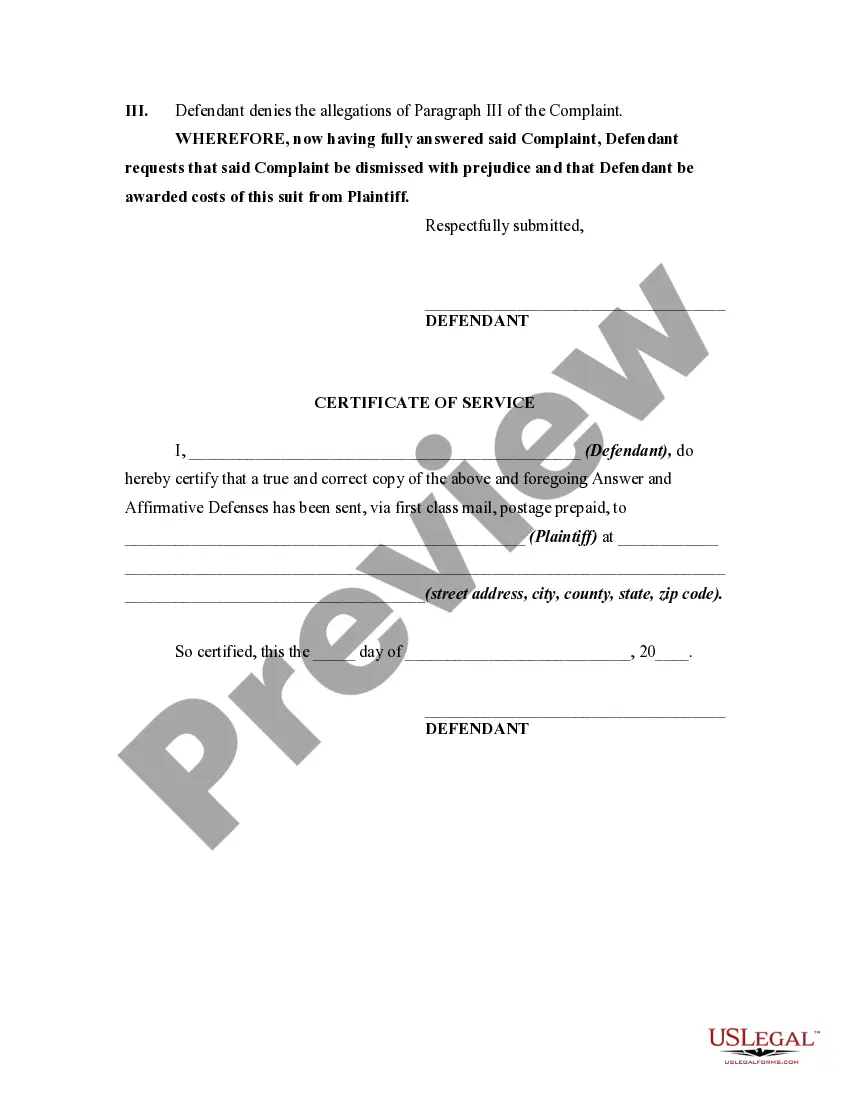

How to fill out General Form Of An Answer By Defendant In A Civil Lawsuit?

The Answer To Debt Collection Lawsuit Example With No Money you see on this page is a multi-usable legal template drafted by professional lawyers in compliance with federal and state laws and regulations. For more than 25 years, US Legal Forms has provided individuals, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, easiest and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Answer To Debt Collection Lawsuit Example With No Money will take you only a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or review the form description to confirm it suits your requirements. If it does not, utilize the search option to get the appropriate one. Click Buy Now once you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Select the format you want for your Answer To Debt Collection Lawsuit Example With No Money (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a eSignature.

- Download your papers one more time. Make use of the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

As a rule of thumb, lawyers advise you to deny, deny, deny. Let the plaintiff prove your responsibility for the debt. Include your affirmative defenses: These are reasons why you think the plaintiff is wrong to sue you. Assert your affirmative defenses for each paragraph.

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

Summary: If you're being sued by a debt collector, here are five ways you can fight back in court and win: 1) Respond to the lawsuit, 2) make the debt collector prove their case, 3) use the statute of limitations as a defense, 4) file a Motion to Compel Arbitration, and 5) negotiate a settlement offer.