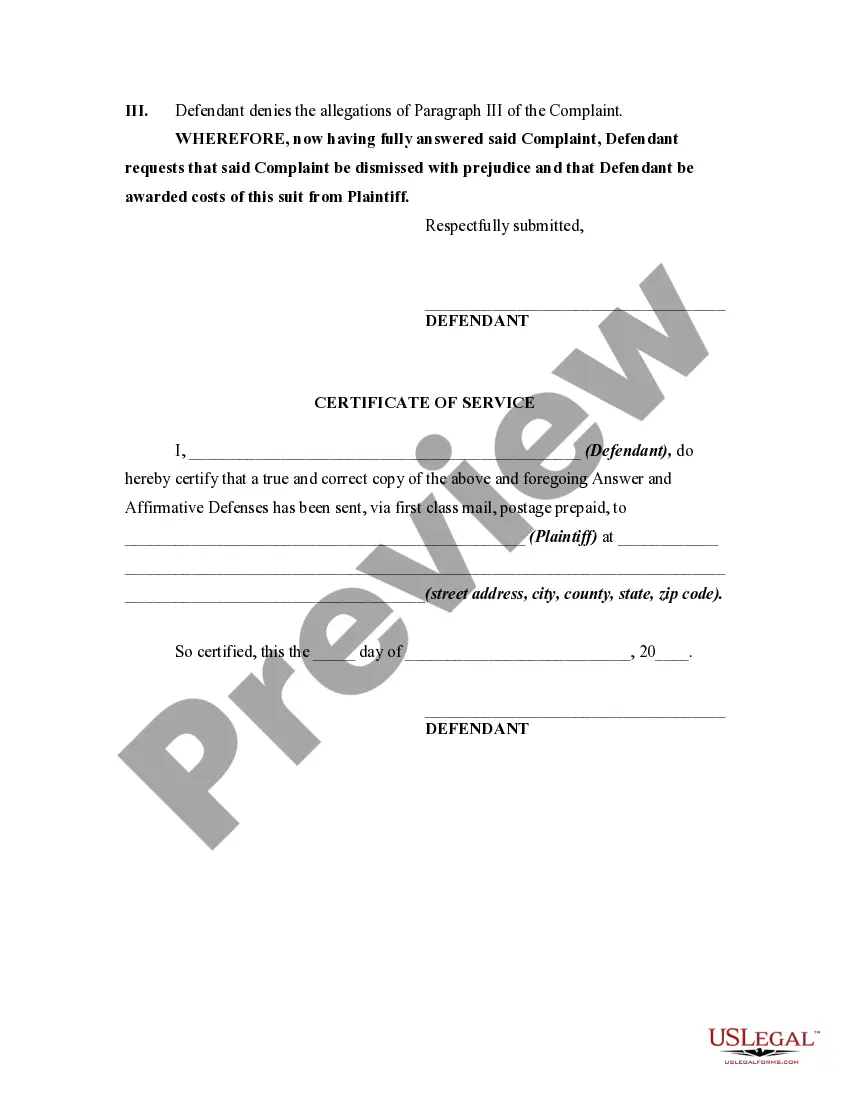

Answer Civil Sample For Interview

Description

How to fill out General Form Of An Answer By Defendant In A Civil Lawsuit?

Whether for professional objectives or personal matters, everyone must confront legal circumstances at some point in their lives.

Completing legal documents demands meticulous care, starting with selecting the appropriate form example.

Once saved, you can fill out the document using editing software or print it and complete it by hand. With an extensive US Legal Forms catalog available, you do not have to waste time searching for the right sample on the internet. Utilize the library’s user-friendly navigation to locate the correct template for any circumstance.

- Locate the required sample using the search box or catalog browsing.

- Review the form’s details to ensure it aligns with your matter, jurisdiction, and area.

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search function to find the Answer Civil Sample For Interview form you need.

- Download the file when it fulfills your needs.

- If you possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you have not set up an account yet, you can acquire the form by clicking Buy now.

- Select the suitable payment option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you want and retrieve the Answer Civil Sample For Interview.

Form popularity

FAQ

Full probate may be avoided when handling small estates. Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

By way of introduction, an estate is a ?small estate? if the total value of the assets that need to be administered does not exceed the following values: $200,000 for real property and $75,000 for personal property. Small estates can be administered through a formal probate proceeding, just like larger estates.

You must petition the probate court to admit any will to probate and to appoint you as the personal representative. The petition contains some basic background information of the decedent, and this information is described in ORS 113.035 -Petition for appointment of personal representative and probate of will.

ESTATE. You can only file a Small Estate Affidavit if the total value of the estate is under $275,000 and: ? No more than $75,000 of the fair market value of the estate is from personal property. and. ? No more than $200,000 of the fair market value of the estate is from real property.

An Oregon small estate affidavit is a document that can be used to claim property from a deceased person's estate, so long as the estate meets certain criteria.

A notice to creditors is published in a local newspaper. This public notice to creditors tells the creditors that they have four months to bring any claim against the estate for debts the deceased person owes them.

An affidavit can be filed if the fair market value of the estate is $275,000 or less. Of that amount, no more than $200,000 can be attributable to real property and no more than $75,000 can be attributable to personal property.

Personal property in the estate must have a value less than $75,000. Real property in the estate must have a fair market value less than $200,000.