Parent Child Support With Disability

Description

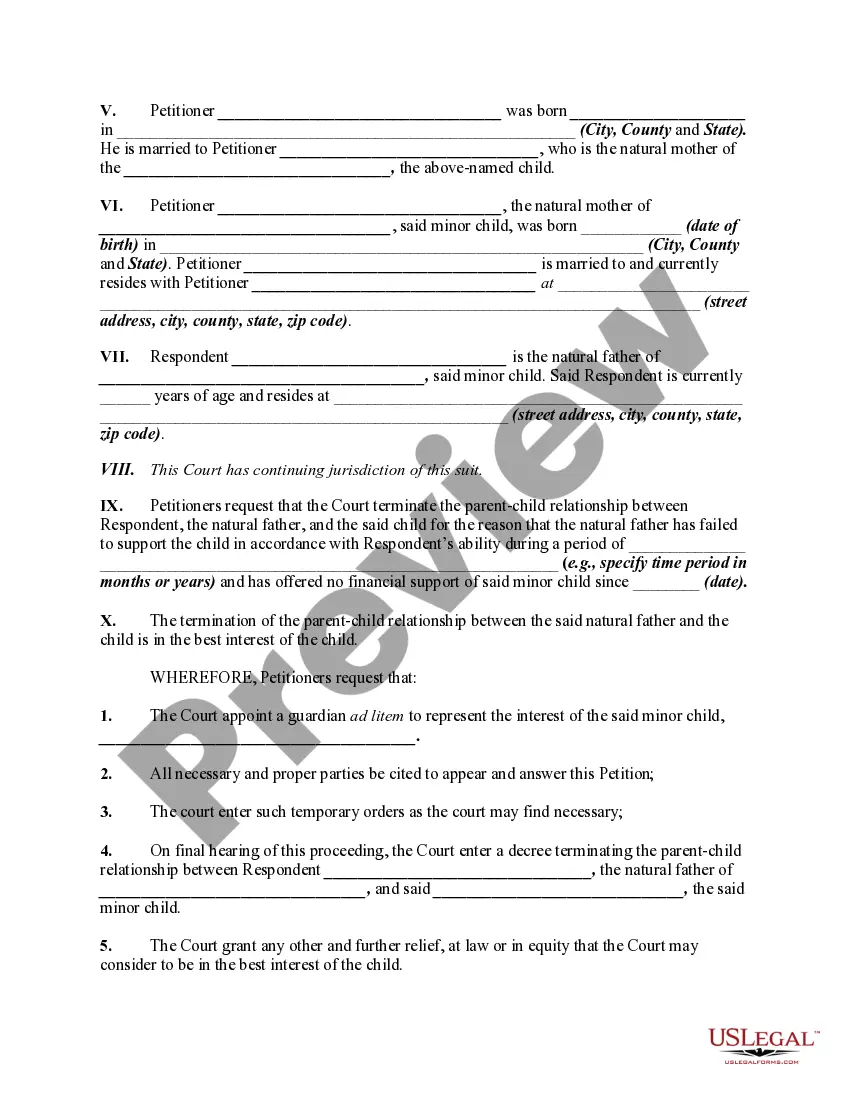

How to fill out Petition By Stepfather And Natural Mother To Terminate Natural Fathers Parent / Child Relationship For Failure To Support Child - Release Of Parental Rights?

Utilizing legal templates that comply with federal and local regulations is essential, and the internet provides numerous alternatives to select from.

However, what's the benefit of spending time looking for the appropriate Parent Child Support With Disability template online when the US Legal Forms digital library already has such templates collected in one location.

US Legal Forms is the premier online legal repository with more than 85,000 editable templates crafted by legal professionals for various business and personal scenarios.

Review the template using the Preview feature or through the text outline to ensure it meets your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts stay informed on legal updates, ensuring your documents are current and compliant when acquiring a Parent Child Support With Disability from our platform.

- Obtaining a Parent Child Support With Disability is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document template you require in the appropriate format.

- If you are new to our platform, follow the instructions below.

Form popularity

FAQ

When a parent receives Social Security retirement or disability benefits, or dies, their child may also receive benefits. Under certain circumstances, a stepchild, adopted child, or dependent grandchild or step-grandchild also may qualify. To receive benefits, the child must be unmarried and: Younger than age 18.

Parents with earned income may earn up to $3,689 a month for single parents with one eligible child, or $4,329 for two-parent households in 2023.

When you qualify for Social Security disability benefits, your children may also qualify to receive benefits on your record. Your eligible child can be your biological child, adopted child, or stepchild. A dependent grandchild may also qualify.

Since such a social security benefit is generally considered income for child support purposes, the disabled parent may have a child support obligation to the other "custodial" parent. The less time the disabled parent has with the child or children, the more his or her child support obligation may be.

Regardless of whether a parent has become injured, ill, or disabled, they cannot stop making court-ordered child support payments on their own volition. But they may have the option of requesting a modification to make payments more manageable.