Small Claims Court Forms And Procedures

Description

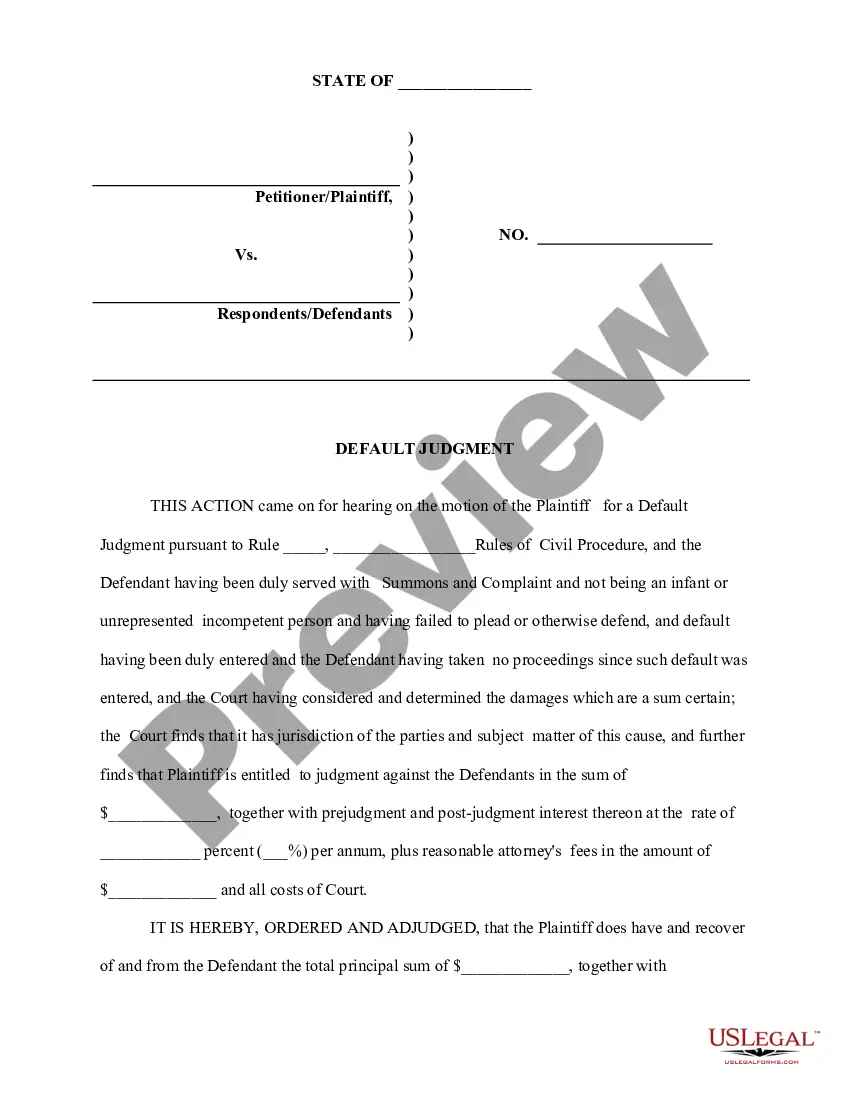

How to fill out Application For Entry Of Default - Affidavit - Motion - Entry Of Default - Default Judgment?

Whether for professional objectives or personal concerns, everyone must handle legal matters at some stage in their life.

Filling out legal documentation requires meticulous focus, starting from selecting the appropriate form template.

Once it is saved, you can complete the form using editing software or print it for manual completion. With a comprehensive US Legal Forms collection available, you will never need to waste time searching for the correct sample online. Make use of the library’s straightforward navigation to locate the right template for any circumstance.

- Obtain the sample you require by utilizing the search box or browsing the catalog.

- Review the description of the form to ensure it aligns with your circumstances, region, and locality.

- Click on the preview of the form to examine it.

- If it is the wrong form, return to the search feature to find the Small Claims Court Forms And Procedures template you are looking for.

- Download the document if it satisfies your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not already have an account, you can acquire the form by selecting Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you may use a credit card or PayPal account.

- Choose the file format you prefer and download the Small Claims Court Forms And Procedures.

Form popularity

FAQ

Top 100 Income Tax Delinquents NameAddressAmount OwedPATRICK COCHRANEPO BOX 708$425,886.69VINCENT CAMBIO & CAROLE CAMBIO39 CENTURY LN$377,946.70ANTHONY J CLANCYPO BOX 1995$377,675.24ROBERT L LACKEY56 S 11TH ST APT 6I$376,149.5395 more rows

Rhode Island's combined state and local general revenues were $16.2 billion in FY 2021, or $14,749 per capita. National per capita general revenues were $12,277. Rhode Island uses all major state and local taxes.

StateTax revenue in billion U.S. dollarsCalifornia280.83New York117.98Texas82.26Illinois62.579 more rows ?

Which Are the Tax-Free States? As of 2023, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.

Taxes represent the largest single source of revenue for state and local governments.

For those not subject to this electronic filing requirement: All forms supplied by the Division of Taxation are in Adobe Acrobat (PDF) format. Most forms are provided in a format allowing you to fill in the form and save it. To have forms mailed to you, please call 401.574. 8970 or email Tax.Forms@tax.ri.gov.