Entry Of Default Nc Withholding

Description

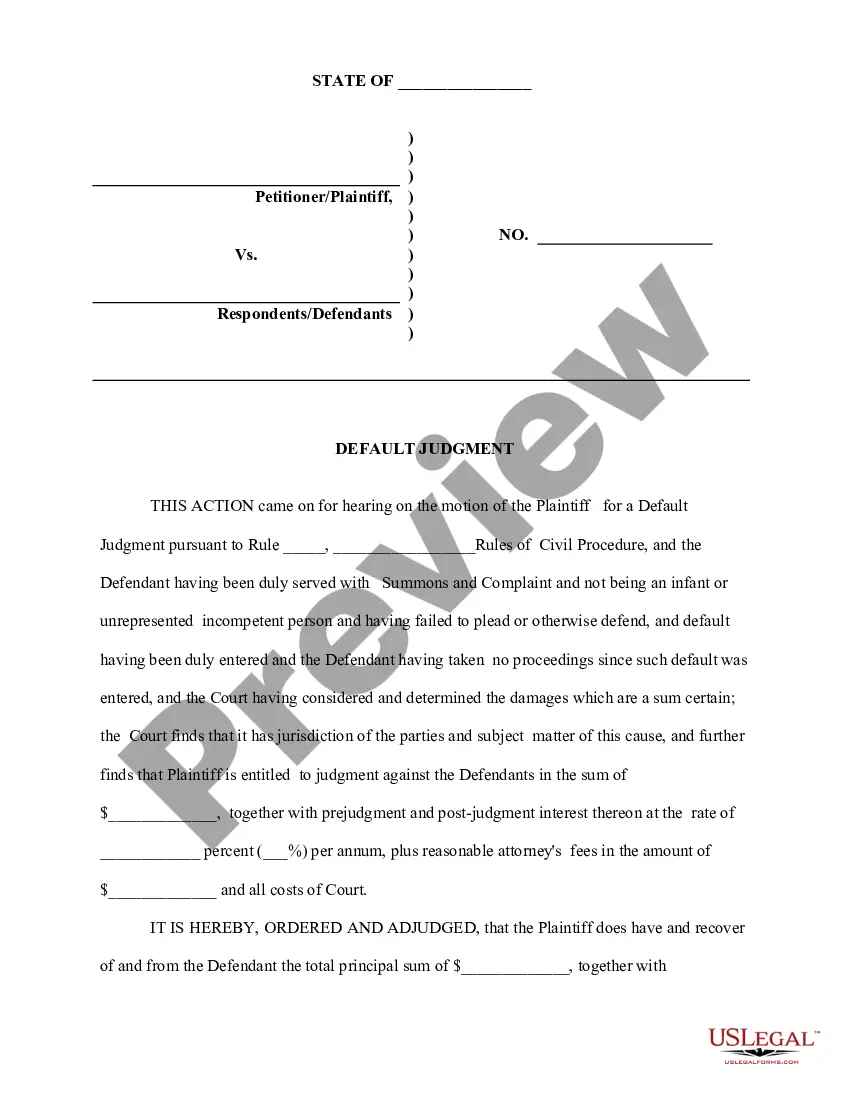

How to fill out Application For Entry Of Default - Affidavit - Motion - Entry Of Default - Default Judgment?

Creating legal documents from the ground up can occasionally be intimidating.

Certain situations may require extensive investigation and significant financial investment.

If you’re seeking a more straightforward and cost-effective method for generating Entry Of Default Nc Withholding or any other documentation without unnecessary hurdles, US Legal Forms is readily available.

Our digital repository of more than 85,000 current legal forms addresses nearly every facet of your fiscal, legal, and personal matters. With just a handful of clicks, you can quickly access state- and county-specific documents expertly crafted by our legal professionals.

Review the document preview and descriptions to confirm that you are on the exact document you seek. Ensure the template you choose complies with your state and county’s stipulations. Select the most suitable subscription plan to purchase the Entry Of Default Nc Withholding. Download the file, then fill it out, sign it, and print it. US Legal Forms enjoys a flawless reputation and boasts over 25 years of experience. Join us today and make document completion a straightforward and efficient process!

- Utilize our system whenever you require a trustworthy and dependable service through which you can easily locate and retrieve the Entry Of Default Nc Withholding.

- If you’re familiar with our services and have set up an account with us before, simply Log In to your account, choose the form, and download it or retrieve it again anytime through the My documents section.

- Don’t possess an account? No problem. It takes minimal time to create one and browse the catalog.

- However, before diving straight into downloading Entry Of Default Nc Withholding, adhere to these recommendations.

Form popularity

FAQ

The default withholding amount refers to the percentage of income that is automatically withheld by the employer for tax purposes. In terms of Entry of default nc withholding, this amount ensures state taxes are deducted from your paycheck. It's crucial for maintaining compliance with North Carolina tax laws, so you don't owe a large sum at tax time. Consider reviewing your withholding status regularly to ensure it meets your financial needs.

To file NC withholding tax, you must gather the required payroll information and complete the Form NC-3. This form should include all the amounts withheld for the year from employee wages. It's essential to submit this form by the due date to avoid penalties associated with entry of default NC withholding. Utilizing the USLegalForms platform can streamline your filing process, making it easier to stay compliant.

Declaring withholding requires you to report the amount withheld from your employees' wages. You must complete the necessary forms, such as the Form NC-3, before the annual deadline. This declaration helps maintain compliance with tax regulations and avoid issues related to entry of default NC withholding. USLegalForms provides resources and forms that simplify this reporting process for you, ensuring accuracy.

To close your North Carolina employer withholding account, you need to notify the North Carolina Department of Revenue. You can do this by submitting Form NC-3, which provides the information needed to officially close your account. Make sure to include any outstanding taxes owed or ensure that all obligations are met. Handling this efficiently will help avoid any complications related to the entry of default NC withholding.

Default withholding is the tax amount automatically deducted by employers when no updating information is provided by employees. It applies when you do not submit a Form W-4. This can impact your entry of default NC withholding and may lead to larger refunds or tax dues, so be sure to review your withholding status regularly.

To contact NC withholding, you can reach out to the North Carolina Department of Revenue through their website or customer service line. They provide valuable resources and assistance for any tax-related questions. Knowing how to contact them can help clarify any issues regarding your entry of default NC withholding.

You might be exempt from NC withholding if you had no tax liability last year and anticipate none this year. Certain categories, like specific students or low-income earners, may also qualify. If you're unsure about your status, consider reviewing your situation to understand your entry of default NC withholding.

A good percentage to withhold for taxes generally varies based on your income and personal situation. Many financial advisors recommend withholding between 10% to 20%. Adjusting this percentage can influence your entry of default NC withholding, helping you avoid surprises at tax time.

Default withholding is the tax amount withheld by an employer if an employee does not submit a tax withholding form. In many cases, this amount may be higher than desired. Be proactive and submit your withholding form to ensure your entry of default NC withholding meets your needs.

Standard withholding typically refers to the amount of tax an employer deducts from an employee's paycheck. In North Carolina, this amount is usually calculated based on the employee’s earnings and their filing status. Understanding the standard withholding helps ensure your entry of default NC withholding aligns with your tax obligations.