Bond Reduction Letter With Letter

Description

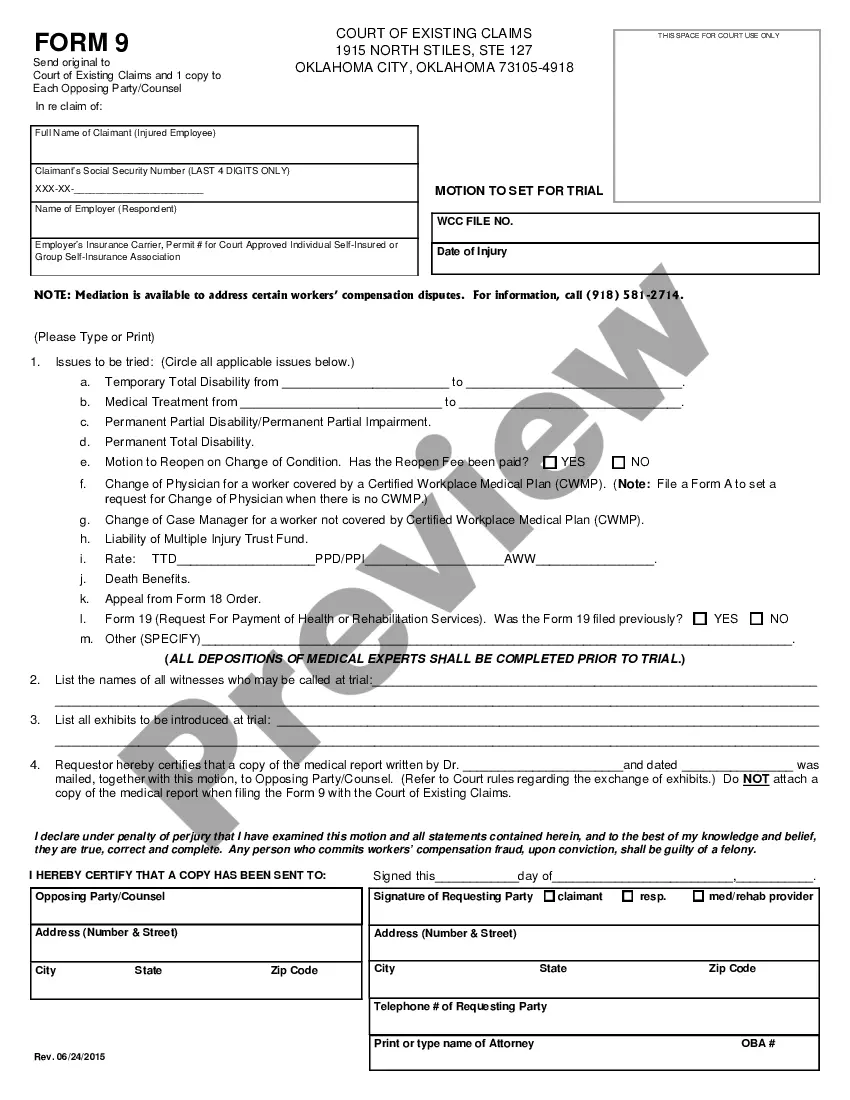

How to fill out Order To Reduce Bond?

Whether for professional reasons or personal issues, everyone must navigate legal circumstances at some point in their lives.

Completing legal documents requires meticulous attention, starting with selecting the correct form template.

With an extensive library of US Legal Forms available, you do not need to waste time searching for the correct template online. Use the library’s straightforward navigation to find the right form for any situation.

- For example, if you select an incorrect version of the Bond Reduction Letter With Letter, it will be denied upon submission.

- Hence, it is vital to have a reliable source of legal documents like US Legal Forms.

- If you need to obtain a Bond Reduction Letter With Letter template, follow these straightforward steps.

- 1. Acquire the required template by using the search bar or catalog browsing.

- 2. Review the form’s details to ensure it suits your situation, state, and area.

- 3. Click on the form’s preview to examine it.

- 4. If it is the wrong document, return to the search function to find the Bond Reduction Letter With Letter sample you need.

- 5. Obtain the file when it matches your requirements.

- 6. If you have a US Legal Forms account, click Log in to access previously stored documents in My documents.

- 7. If you do not have an account yet, you can download the form by clicking Buy now.

- 8. Choose the appropriate pricing option.

- 9. Fill out the profile registration form.

- 10. Select your payment method: use a credit card or PayPal.

- 11. Select the document format you want and download the Bond Reduction Letter With Letter.

- 12. Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

A bond letter is a formal document that assures a party that someone will fulfill a financial obligation. It plays a crucial role in various types of agreements, providing the necessary security for both sides. When you request a bond reduction, the bond reduction letter with letter becomes a vital tool to communicate your needs effectively.

To reduce your bond, you typically need to file a motion in court accompanied by a compelling bond reduction letter with letter. This letter should articulate your reasons for requesting the reduction, supported by evidence such as changed financial circumstances. Engaging with a legal expert can significantly enhance your chances of a successful reduction.

Creating a bond letter involves outlining the parties involved, the obligation being secured, and the financial terms clearly. Additionally, you will include specifics regarding the agreement to ensure it meets legal standards. Using a service like US Legal Forms can simplify this process by providing templates for a bond reduction letter with letter that you can customize.

A letter bond is often used interchangeably with a bond letter. It confirms a party's financial capacity to carry out specific obligations under a contract. When discussing a bond reduction letter with letter, it serves to alleviate some financial pressure while ensuring compliance and commitment to the agreement.

To get a bond reduction in Texas, you typically need to file a motion in court, along with a well-prepared bond reduction letter with letter. This letter should outline your reasons for the reduction and include any supporting documentation. It's advisable to seek guidance from legal professionals or platforms like US Legal Forms, which can provide templates and resources for your needs.

No, a bond is not the same as a Letter of Credit. A bond serves as a guarantee that a party will fulfill their obligations, while a Letter of Credit is a document provided by a bank that guarantees payment to a seller upon meeting certain conditions. Understanding these distinctions helps when preparing a bond reduction letter with letter to navigate your financial responsibilities.

The timeframe for obtaining a bond reduction varies based on several factors, including the specific court's processes and the complexity of your case. Generally, you can expect the process to take a few weeks after submitting your bond reduction letter with letter. It's crucial to maintain open communication with the relevant authorities for updates and further requirements.

A bond letter is a document that confirms an individual or business has the financial backing to fulfill a contractual obligation. It typically serves as assurance to the party requiring the bond that funds are available if needed. In the context of a bond reduction letter with letter, this document can help lower the amount of collateral required for a bond.

Formatting a letter to a judge starts with including your address and the date at the top. Follow this with the judge's name and address. Use clear paragraphs to structure your content, keeping it concise and respectful. For requests like a bond reduction letter with letter, formatting clearly helps convey your message and maintain professionalism.

Yes, a judge can deny a bond reduction request based on various factors, such as the nature of the offense or the individual’s criminal history. If you are seeking a bond reduction, it's crucial to present a strong case, often by including a bond reduction letter with letter that clearly outlines your reasons and supportive documentation.