Leaseback Agreement Meaning

Description

How to fill out Sale And Leaseback Agreement For Commercial Building?

Whether for business purposes or for individual matters, everybody has to manage legal situations sooner or later in their life. Filling out legal documents needs careful attention, starting with picking the right form template. For instance, if you choose a wrong version of a Leaseback Agreement Meaning, it will be rejected when you submit it. It is therefore crucial to get a dependable source of legal papers like US Legal Forms.

If you need to obtain a Leaseback Agreement Meaning template, stick to these simple steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Look through the form’s description to make sure it suits your situation, state, and county.

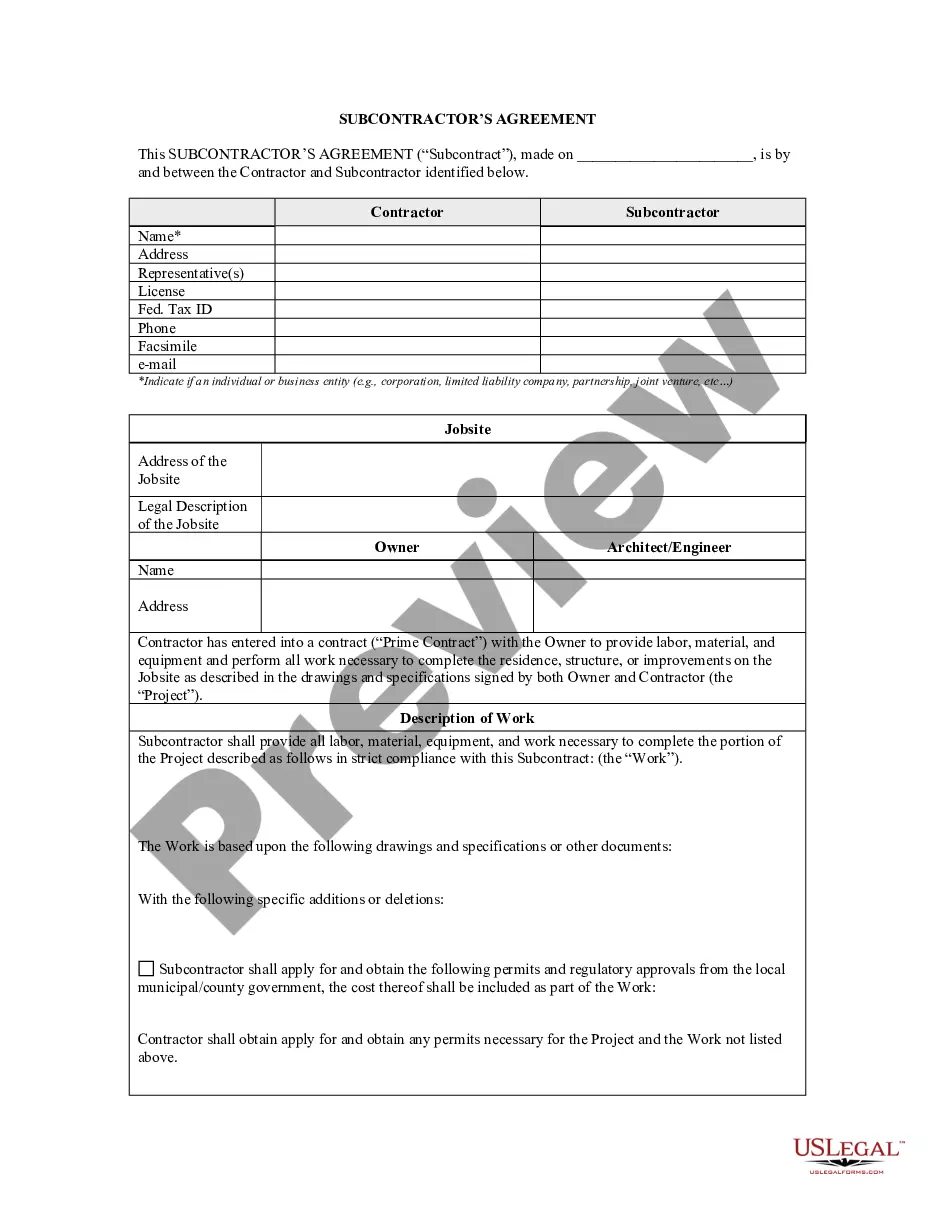

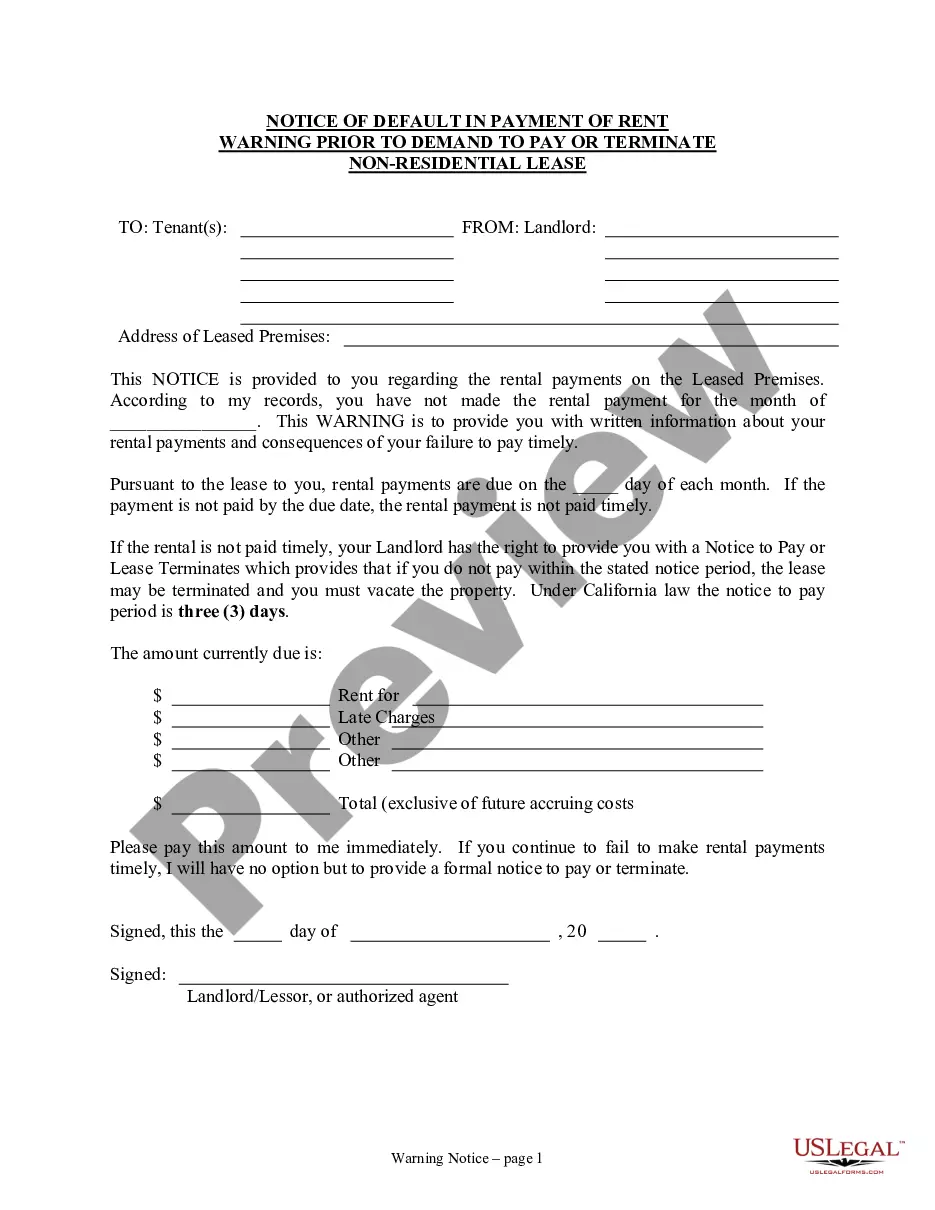

- Click on the form’s preview to examine it.

- If it is the wrong document, go back to the search function to find the Leaseback Agreement Meaning sample you need.

- Get the template if it matches your needs.

- If you already have a US Legal Forms profile, just click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Pick your payment method: use a bank card or PayPal account.

- Choose the document format you want and download the Leaseback Agreement Meaning.

- After it is saved, you are able to complete the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you don’t need to spend time searching for the appropriate sample across the internet. Make use of the library’s straightforward navigation to get the appropriate template for any occasion.

Form popularity

FAQ

With a sale and leaseback, the homeowner sells their home to an investor, who rents their home back to them. The homeowners eliminate the risk by choosing not to partake in the real estate market's fluctuations but also forgo the potential that their home realizes a sudden real estate market surge in price.

Disadvantages of a sale-leaseback are loss of control over the asset, lack of equity, and risk of non-renewal of the lease.

How to account for sale-leaseback and ASC 842 Recognize the sale and any gain or loss the difference between the cash received and the book value of the asset when the buy-lessor takes control of the asset. Derecognize the asset, removing it from the balance sheet.

Examples of sale leasebacks Companies typically sell higher-valued assets to increase liquidity and working capital. For example, construction companies often sell their real estate property and immediately lease it back from the new owner to develop.

Leaseback transactions also have disadvantages, such as the company not getting the benefit of appreciation, the seller losing control over the asset over time and the sale of assets reducing the company's valuation.