Affidavit To Drop Charges In Georgia For Tax Purposes

Description

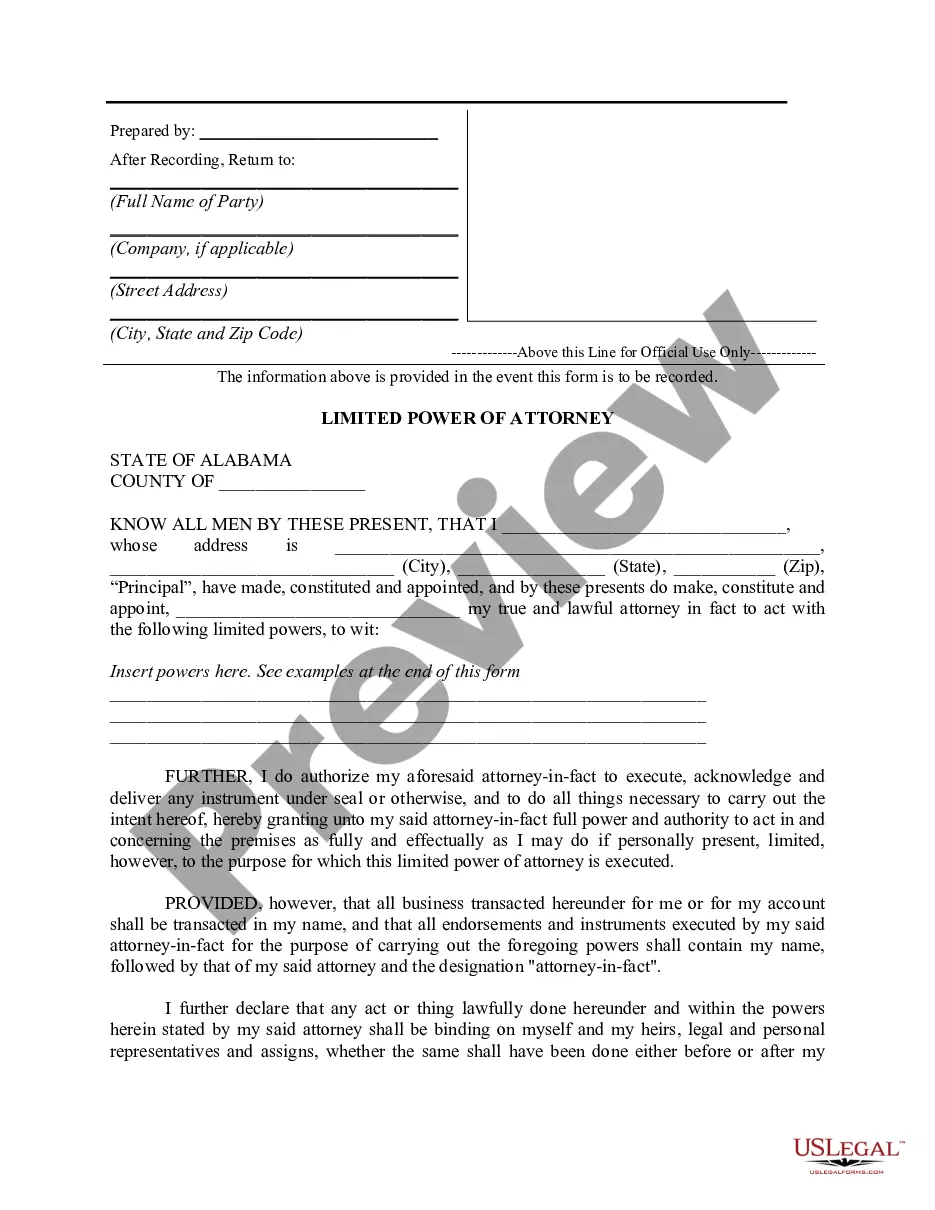

How to fill out Affidavit By Victim For Dismissal?

The Declaration To Withdraw Charges In Georgia For Tax Reasons you see on this page is a versatile legal template crafted by expert attorneys in accordance with federal and state laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 approved, state-specific documents for any business and personal need. It’s the quickest, easiest, and most reliable method to acquire the paperwork you require, as the service ensures the highest degree of data protection and anti-malware safeguards.

Select the format you desire for your Declaration To Withdraw Charges In Georgia For Tax Reasons (PDF, Word, RTF) and save the template on your device. Complete and sign the document. Print out the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with a legally-recognized electronic signature.

- Search for the document you require and assess it.

- Browse through the file you looked for and preview it or examine the form description to confirm it meets your needs. If it does not, utilize the search bar to locate the suitable one. Click Buy Now when you have discovered the template you need.

- Register and Log In.

- Choose the pricing plan that best suits your needs and establish an account. Utilize PayPal or a credit card to make a quick payment. If you already have an account, Log In and verify your subscription to proceed.

- Obtain the fillable template.

Form popularity

FAQ

An affidavit may be deemed invalid if it lacks notarization or if it contains false statements. Additionally, if the signer was not competent at the time of signing, that can also nullify the document. When using an affidavit to drop charges in Georgia for tax purposes, ensure all information is accurate and that it meets legal standards. Always consider working with legal experts or reliable platforms for guidance.

Georgia has recently updated its laws regarding notaries to enhance the efficiency and security of notarizations. One key aspect includes allowing remote online notarization, which can expedite the process. When preparing an affidavit to drop charges in Georgia for tax purposes, be sure to check the latest guidelines to comply with state laws. Resources like US Legal Forms can offer additional assistance.

Affidavits in Georgia do need notarization to be legally enforceable. A notary public must witness the signing of the affidavit to certify its authenticity. If you are using an affidavit to drop charges in Georgia for tax purposes, ensure that it is properly notarized to avoid rejection in court. Familiarizing yourself with the rules can help ensure your affidavit is accepted.

Yes, in Georgia, an affidavit must be notarized to carry legal weight. This notarization verifies that the person signing the document is doing so willingly and truthfully. If you intend to use an affidavit to drop charges in Georgia for tax purposes, be sure to have it notarized. You can find notary services at many banks or through legal offices.

An affidavit needs to be notarized to be considered valid in most cases. A notarized affidavit confirms that the statements are true and have been sworn before a notary public. If you are pursuing an affidavit to drop charges in Georgia for tax purposes, ensure that you follow this requirement to avoid complications. Take the time to consult with legal resources to confirm your steps.

To write an affidavit letter to drop charges, start by stating your full name and relationship to the case. Clearly outline the reasons for requesting that the charges be dropped. Include the phrase 'affidavit to drop charges in Georgia for tax purposes' to clarify your intentions. Consulting resources like US Legal Forms can provide a template to guide your writing.

To drop charges in Georgia, the victim typically needs to file a motion or affidavit with the court. This process usually involves expressing a desire for the charges to be dismissed. Using an affidavit to drop charges in Georgia for tax purposes may streamline this request. It's advisable to seek help from an attorney to ensure proper procedures are followed.

If the victim fails to appear in court, the prosecution may consider dropping the case. However, it often depends on the specific circumstances surrounding the charges. An affidavit to drop charges in Georgia for tax purposes can support your request to the court. Always consult a legal expert to understand your options.

To write a powerful affidavit, focus on clarity and conciseness. Organize your thoughts logically, and use specific examples to support your claims. When addressing legal matters like dropping charges, make sure to utilize resources like US Legal Forms for guidance and templates to create an effective affidavit.

A good example of an affidavit includes a clear statement of facts, the affiant's identity, and the purpose of the affidavit. For instance, an affidavit to drop charges in Georgia for tax purposes might describe specific events or reasons why charges should be withdrawn. This clarity helps convey your message effectively.