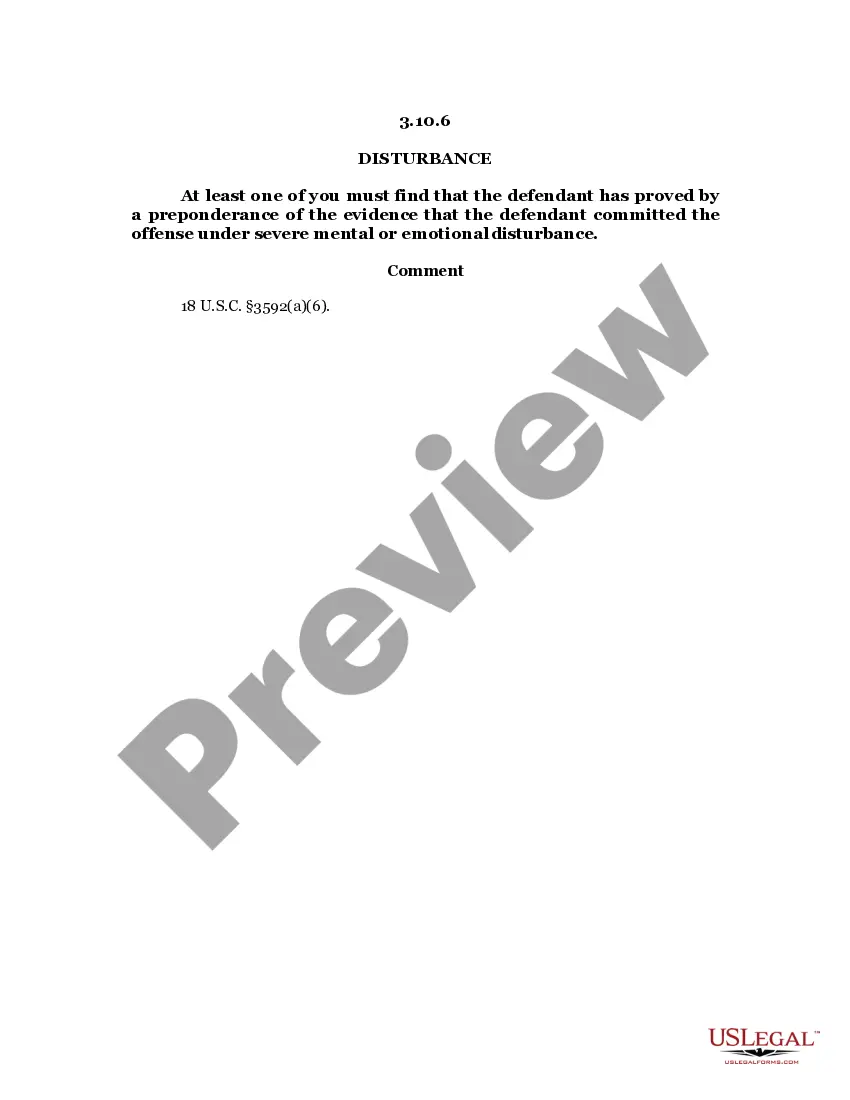

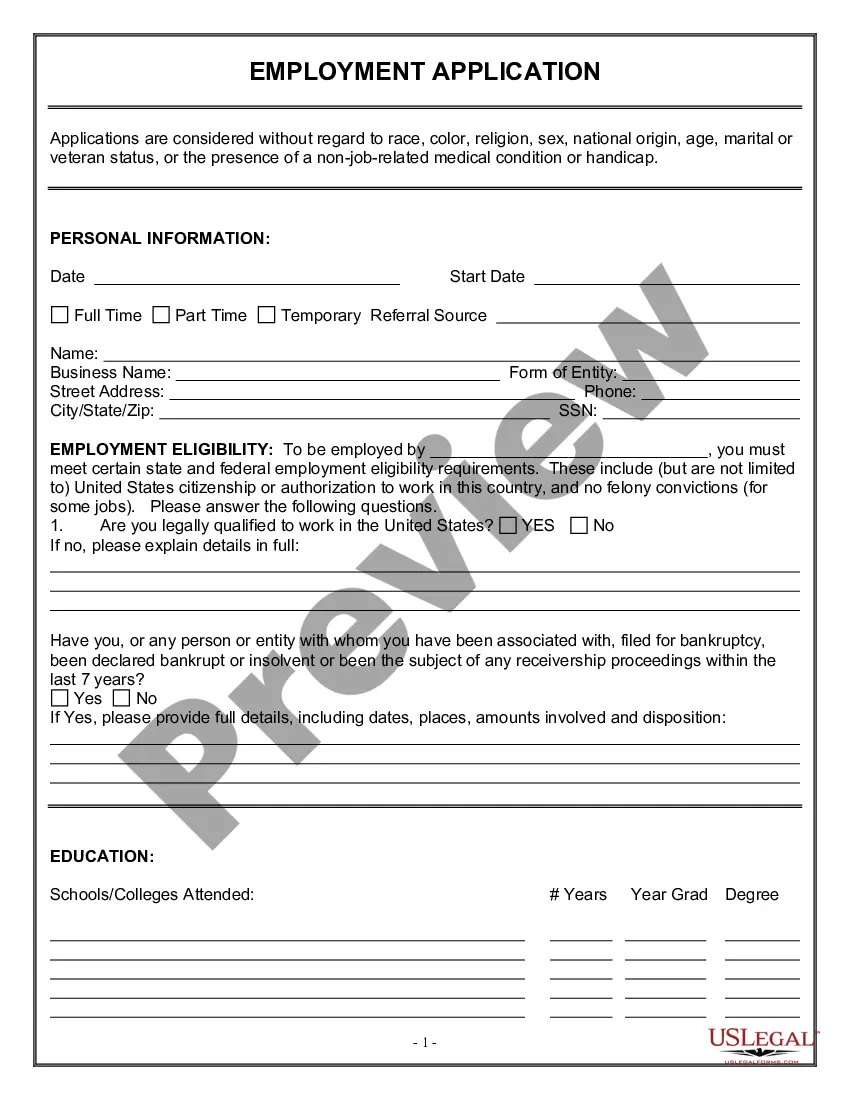

Attorney Court Having Withdrawal

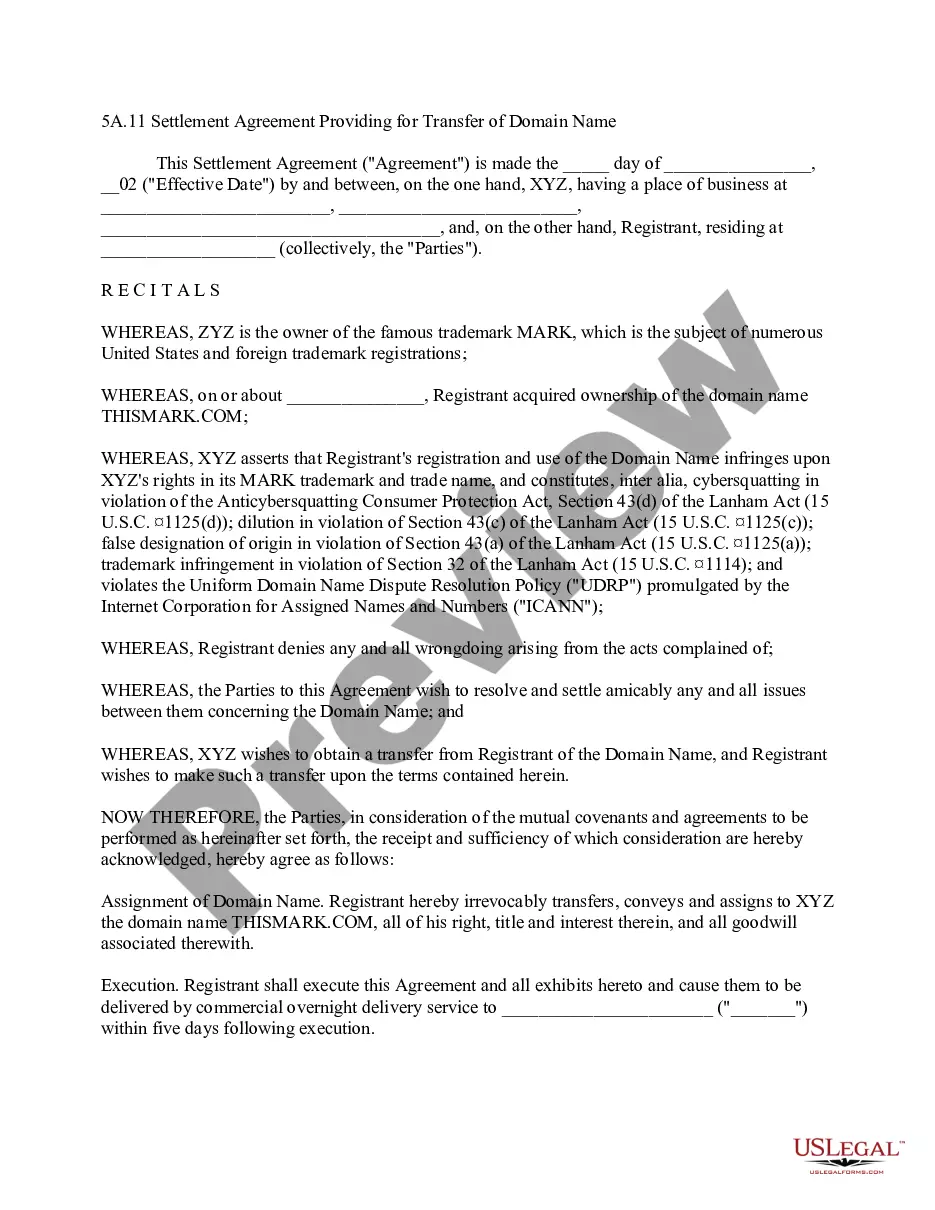

Description

How to fill out Order Appointing Special Prosecutor?

It’s no mystery that you cannot instantly become a legal expert, nor can you swiftly learn to draft Attorney Court Having Withdrawal without possessing a specific background.

Formulating legal documents is a lengthy endeavor that demands specialized education and expertise.

So why not entrust the creation of the Attorney Court Having Withdrawal to the experts.

You can regain access to your documents from the My documents tab at any time.

If you’re an existing customer, you can simply Log In, and find and download the template from the same tab.

- Locate the necessary form using the search bar at the top of the page.

- View it (if this option is available) and read the associated description to determine if Attorney Court Having Withdrawal is what you need.

- Initiate another search if you require a different form.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. Once the payment is processed, you can download the Attorney Court Having Withdrawal, complete it, print it, and send or mail it to the intended recipients or organizations.

Form popularity

FAQ

When an attorney states that they have 'withdrawn', it indicates they have officially terminated their relationship with a client and no longer represent them in the legal matter. This declaration is often formalized through a court filing in an attorney court having withdrawal, ensuring that all parties are aware of the change. Clients should carefully consider their next steps, as this may significantly affect their case and require seeking new legal representation.

Personal Income Tax - Pennsylvania personal income taxpayers can access myPATH, which offers a free option for filing Pennsylvania personal income tax returns without needing to log in. This option is also available for Spanish-speaking Pennsylvania taxpayers.

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: ? You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or ? You incurred a loss from any transaction as an individual, sole proprietor, partner in a ...

You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

Use PA-40 Schedule O to report the amount of deductions for contributions to Medical Savings or Health Savings Ac- counts and/or the amount of contributions to an IRC Section 529 Qualified Tuition Program and/or IRC Section 529A Pennsylvania ABLE Savings Program by the taxpayer and/or spouse.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

Use Form PA to register the underlying musical composition or dramatic work. Form SR has been developed specifically to register a ?sound recording? as defined by the Copyright Act?a work resulting from the ?fixation of a series of sounds,? separate and distinct from the underlying musical or dramatic work.