Lease Rate Formula

Description

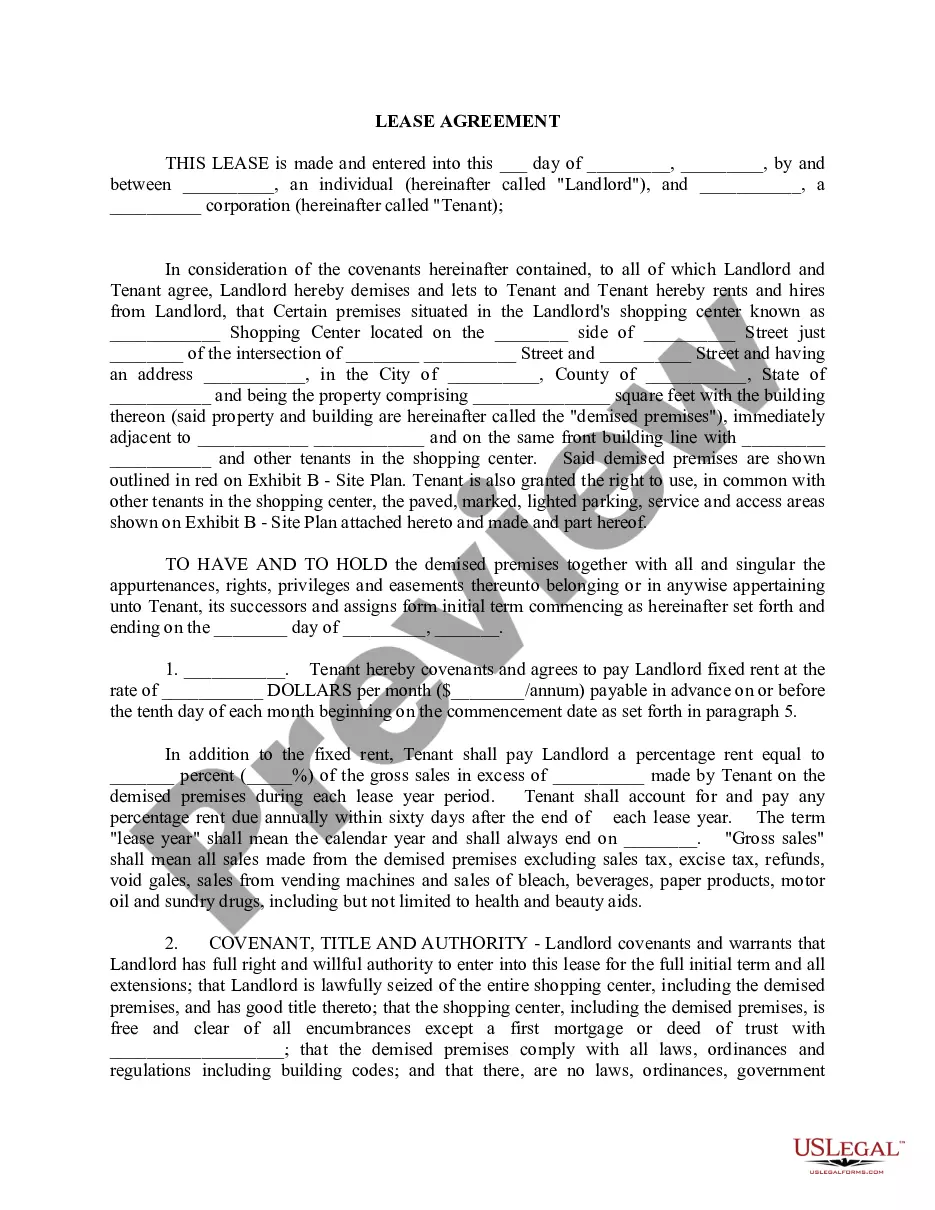

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

Finding a reliable location to retrieve the latest and most suitable legal templates is a significant portion of managing bureaucratic processes.

Identifying the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to obtain Lease Rate Formula samples exclusively from trustworthy sources, such as US Legal Forms. An incorrect template can consume your time and exacerbate your current situation.

Remove the hassle associated with your legal paperwork. Explore the extensive US Legal Forms catalog where you can find legal templates, assess their relevance to your particular situation, and download them instantly.

- Utilize the catalog navigation or search box to locate your template.

- Review the form’s details to confirm its compliance with your state and region’s needs.

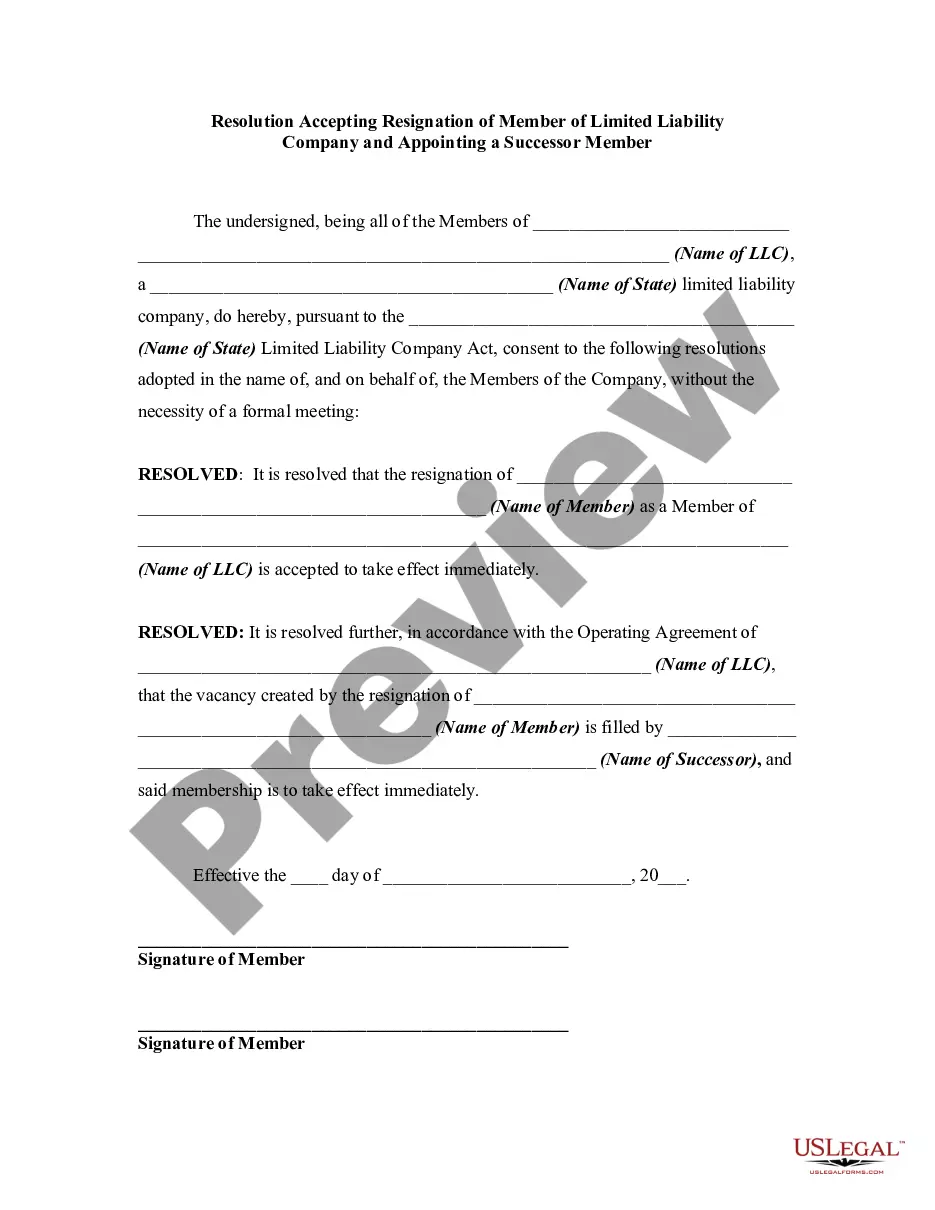

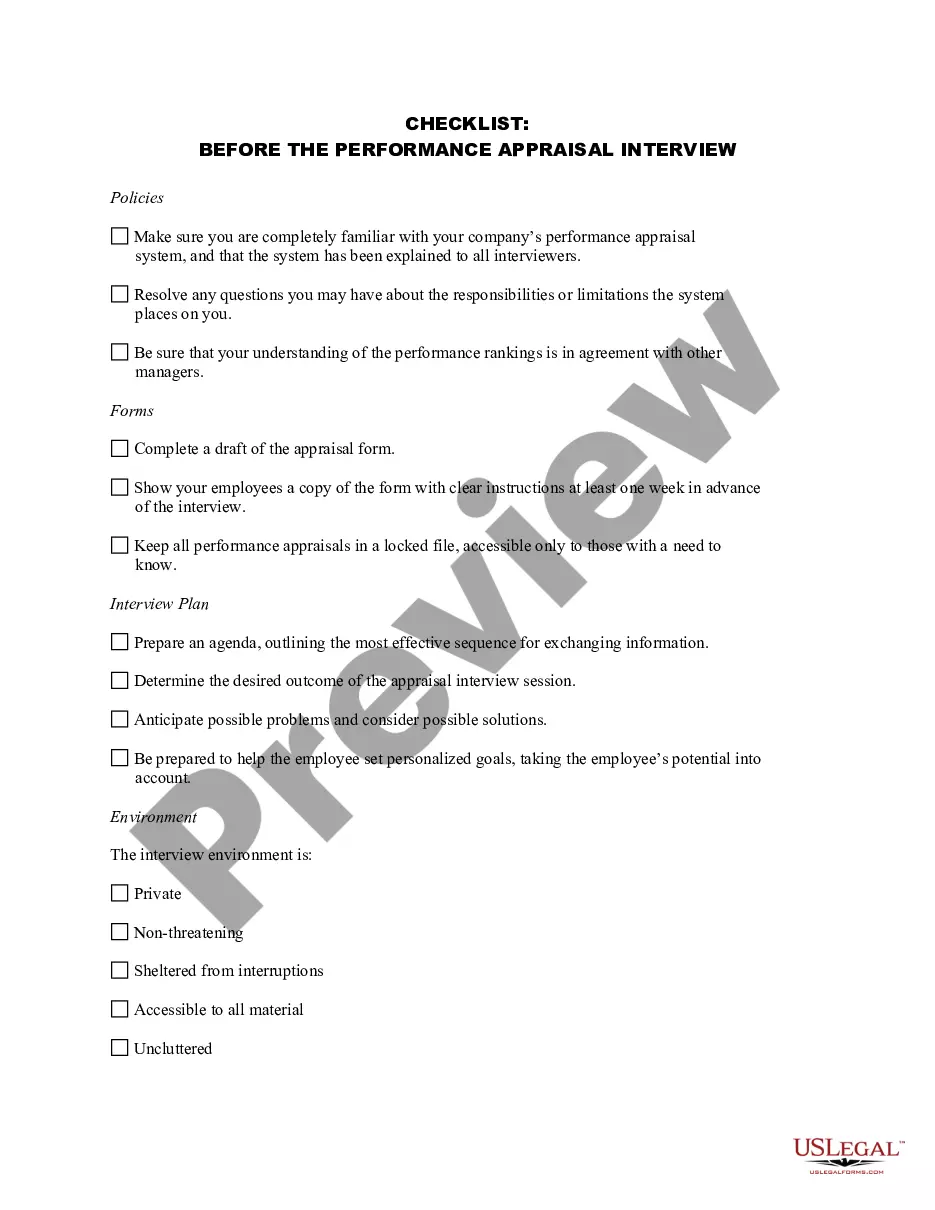

- Examine the form preview, if accessible, to ensure it is the template you wish to utilize.

- If the Lease Rate Formula does not meet your needs, return to the search to find the correct document.

- If you are confident about the form’s appropriateness, proceed to download it.

- As a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not possess an account yet, click Buy now to acquire the form.

- Choose the pricing plan that matches your needs.

- Proceed to the registration to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Lease Rate Formula.

- After obtaining the form on your device, you can modify it with the editor or print it and complete it manually.

Form popularity

FAQ

Calculating a lease rate involves a few clear steps. Start by gathering the total rent amount for the year and the total area in square feet. Then, apply the lease rate formula by dividing the total rent by the square footage. Using platforms like US Legal Forms can guide you through this calculation, making it easier to understand and apply.

To calculate a lease rate, first determine the total annual rent and the total square footage of the property. Then, use the lease rate formula by dividing the annual rent by the square footage. This will provide you with the lease rate per square foot. Utilizing tools like US Legal Forms can simplify this process and ensure accurate calculations.

The formula for calculating a lease is straightforward. It involves dividing the total annual rent by the square footage of the leased space. This gives you the lease rate per square foot. Understanding this lease rate formula helps both landlords and tenants make informed decisions.

The 1.25% rule of leasing suggests that the monthly lease payment should be approximately 1.25% of the vehicle's total value. This rule helps potential lessees estimate their monthly payments based on the lease rate formula. By applying this principle, you can better understand the financial implications of leasing a vehicle. Utilizing this rule simplifies your decision-making process when entering a lease agreement.

Can You Reduce the Lease Money Factor? The lower the money factor, the less interest you'll pay over your lease term. Generally, a money factor of 0.0025 and below (the equivalent of 6% APR) is considered a good rate.

Suppose an equipment of cost $10,000 has a lease rate factor of . 0260, it means a monthly payment of (10,000 *. 0260) = $260. It means that the lessee must pay $260 for leasing the equipment in consideration of the required number of periods, which is set in the lease.

The interest rate (?money factor?) - another major factor that can be negotiated, especially if you have an excellent credit score (740 or higher).

A lease rate factor is the regular lease payment as a percentage of the total cost of the leased equipment. Stated another way, if you multiply the lease rate factor by the cost of the leased equipment, you will determine the regular payment amount.

The residual value percentage rate represents the amount the lessor expects the vehicle to be worth at the end of the lease. Most vehicles are about 50 to 60 percent of their original MSRPs at the end of the lease term.