Limited Between Partner With 50

Description

How to fill out Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

Regardless of whether it is for commercial reasons or personal matters, everyone must confront legal circumstances at some point in their lives.

Filling out legal documents requires meticulous focus, beginning with selecting the appropriate form template.

Choose the file format you wish and download the Limited Between Partner With 50. Once saved, you can fill out the form using editing software or print it and complete it by hand. With a comprehensive US Legal Forms catalog at your disposal, you will never need to waste time searching for the correct sample online. Utilize the library’s easy navigation to find the appropriate template for any scenario.

- For example, if you choose an incorrect version of a Limited Between Partner With 50, it will be denied upon submission.

- Thus, it is crucial to have a trustworthy source of legal documents such as US Legal Forms.

- If you need to acquire a Limited Between Partner With 50 template, follow these straightforward steps.

- Locate the sample you need using the search bar or catalog navigation.

- Review the form’s details to ensure it aligns with your circumstances, state, and county.

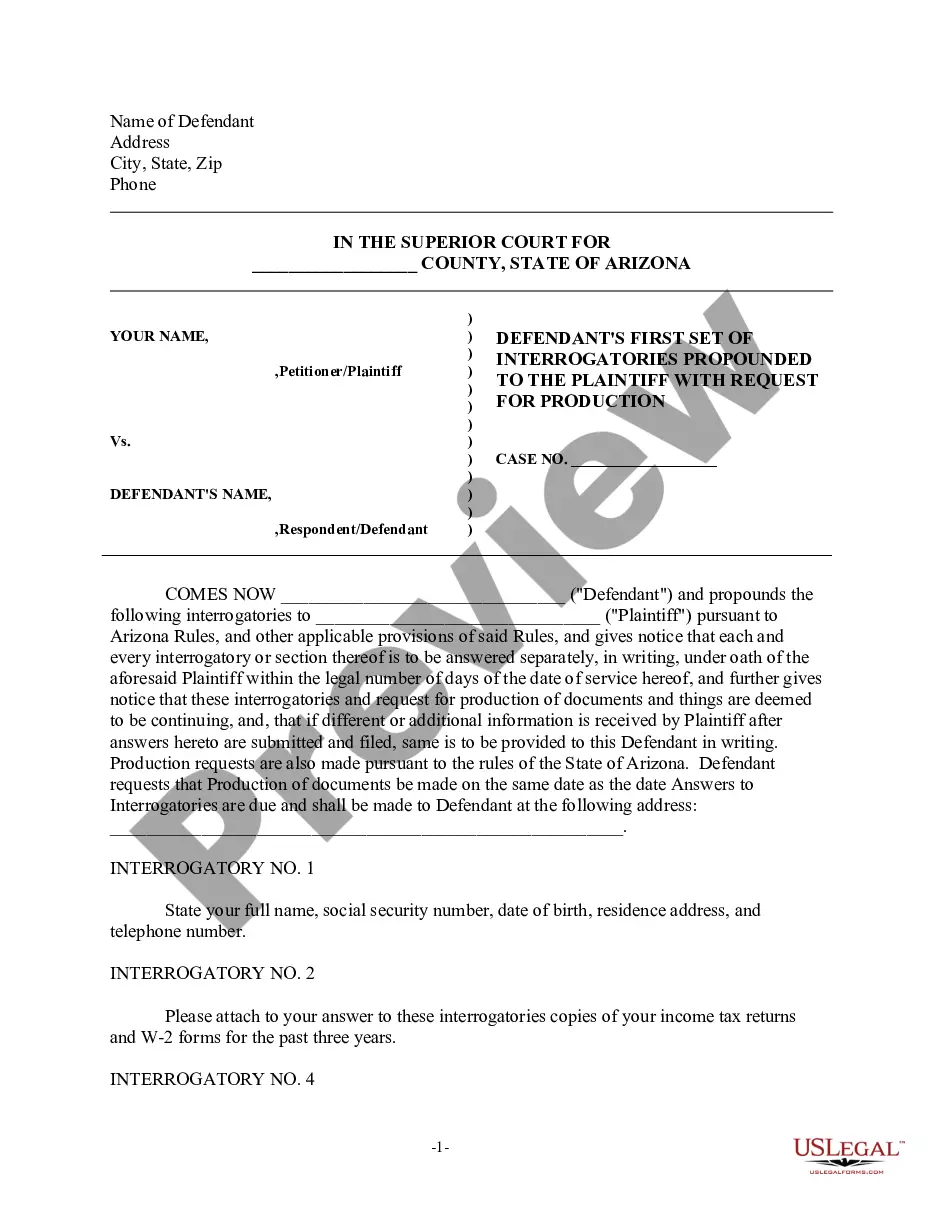

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search function to find the Limited Between Partner With 50 sample you need.

- Download the template when it fits your criteria.

- If you possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: you can use a credit card or PayPal account.

Form popularity

FAQ

A 51/49 operating agreement names one person as the majority owner in the company and the other as the minority owner. This means that the majority owner has the final say in decisions related to the company, including issues like: Prices for products or services.

If you form an equal partnership (50/50) between two people, both co-owners must approve the final profit-sharing agreement. But if you have an uneven partnership ratio, the partner with the majority share in the business will make the final decision regarding profit-sharing ratios.

If one limited partner directly or indirectly owns more than 50 percent of a limited partnership's kick-out rights through voting interests, then that limited partner shall be deemed to have a controlling financial interest in the limited partnership and shall consolidate the limited partnership.

If one limited partner directly or indirectly owns more than 50 percent of a limited partnership's kick-out rights through voting interests, then that limited partner shall be deemed to have a controlling financial interest in the limited partnership and shall consolidate the limited partnership.

When entering into business arrangements, partners must decide on the ownership split of the new business. Although a 50/50 split is intuitively the most logical way to divide the business, it is important to know that the 50/50 split can lead to problems.