Rental Totvs

Description

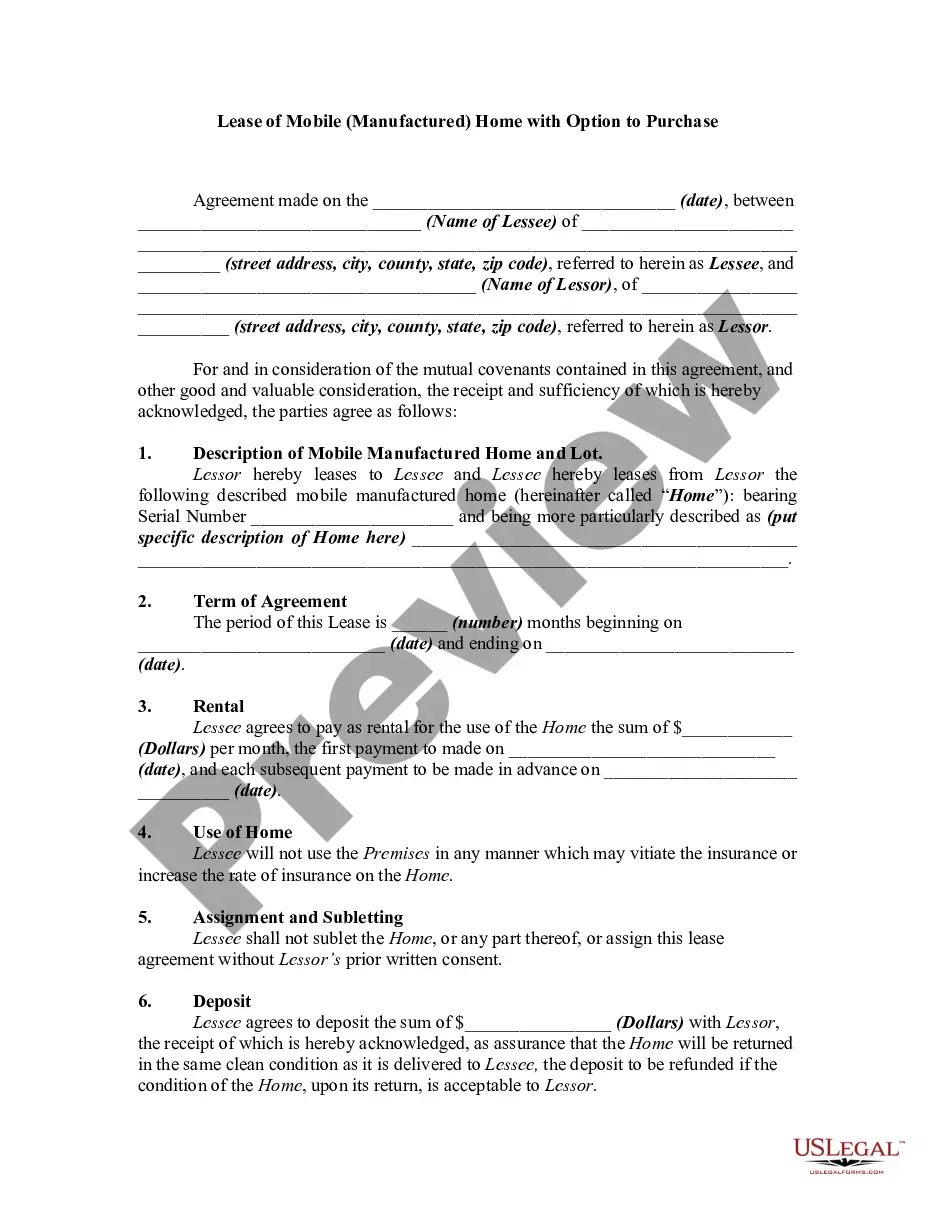

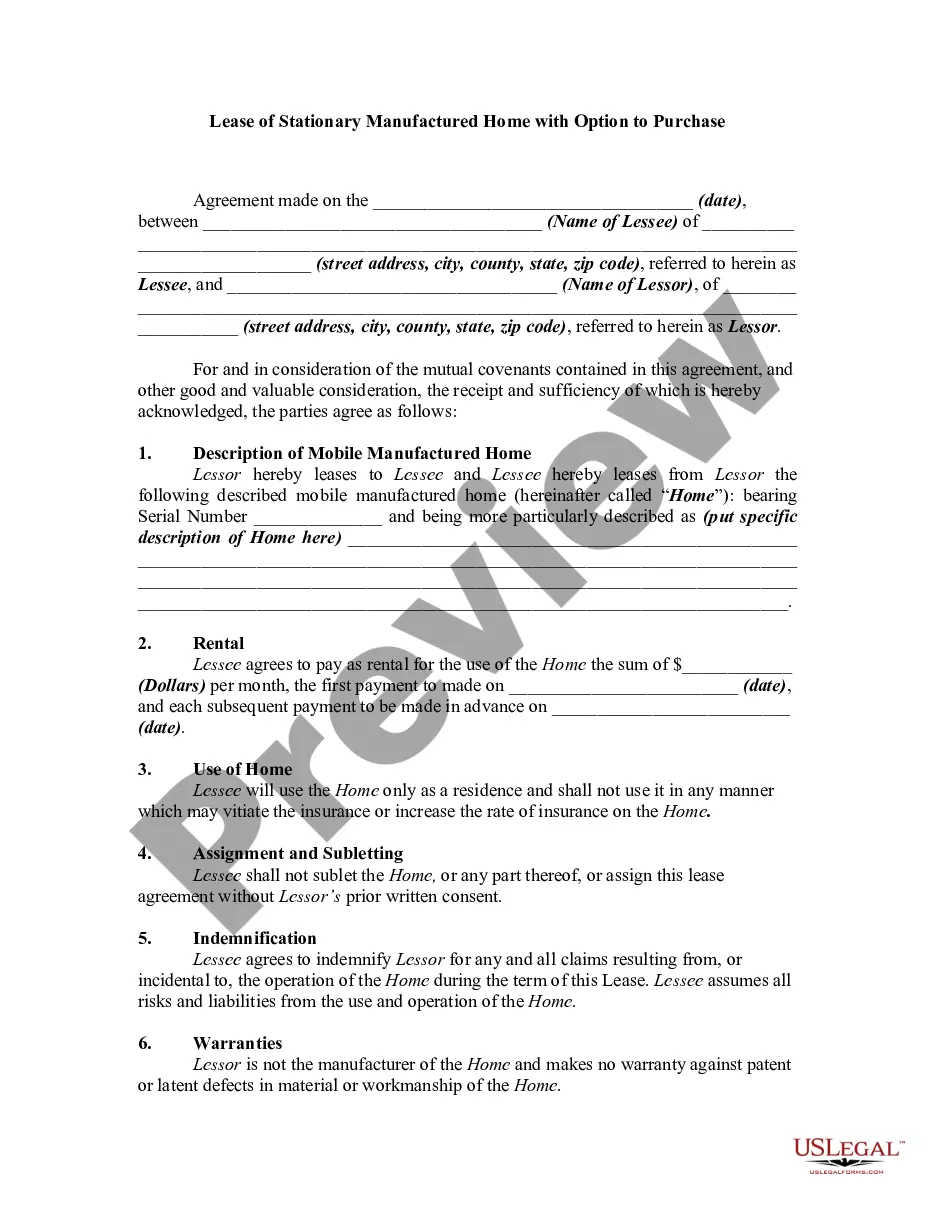

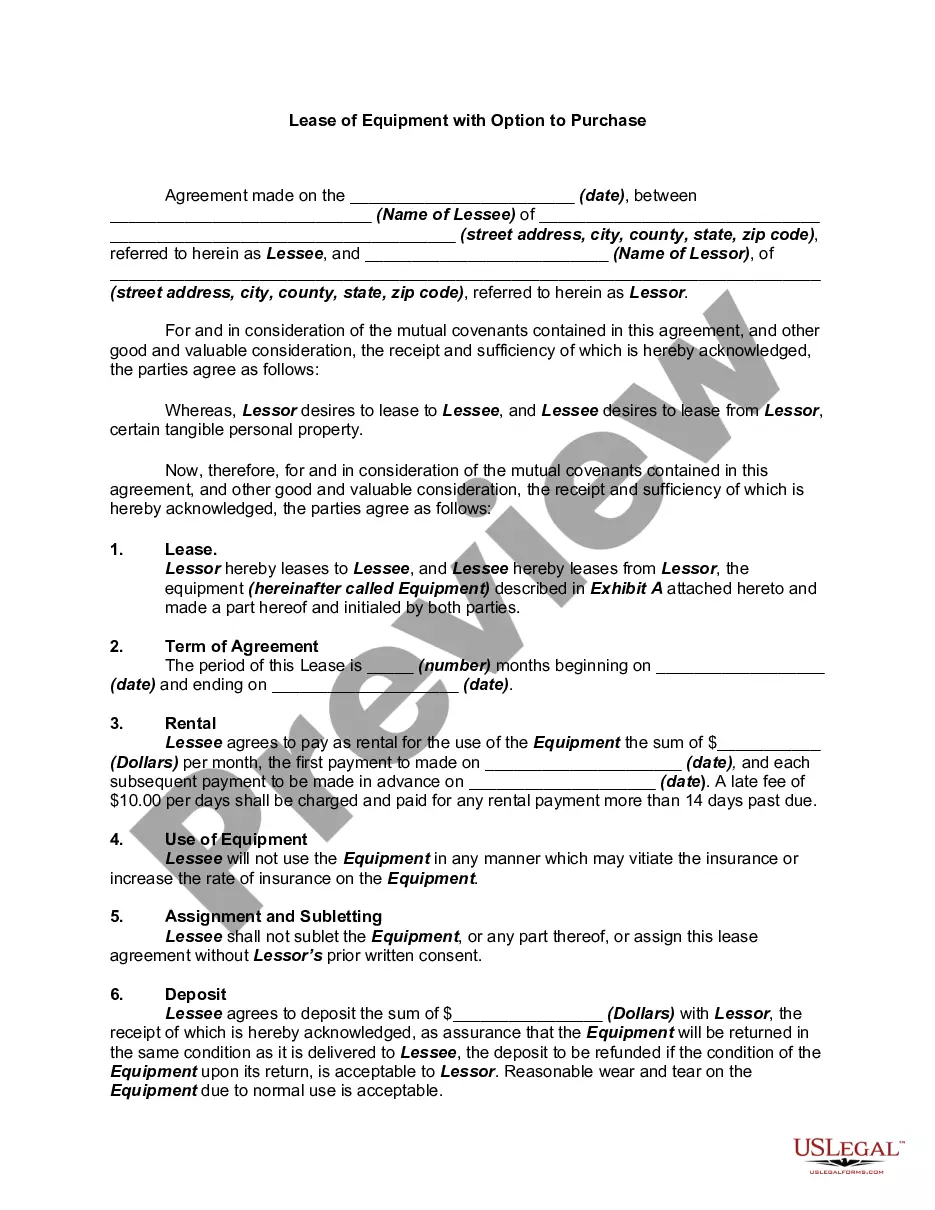

How to fill out Lease Or Rental Agreement Of Recreational Vehicle With Option To Purchase And Own - Lease Or Rent To Own?

- Log in to your US Legal Forms account if you've used our service before and ensure your subscription is still valid. Click the Download button to get your desired template.

- For first-time users, start by browsing the Preview mode to review the form descriptions. Make sure the selected form meets your local jurisdiction requirements.

- If the initial form doesn’t fit your needs, utilize the Search tab at the top to find an appropriate alternative.

- Once you've found the correct document, click on the Buy Now button and select your preferred subscription plan.

- Complete your purchase by entering your credit card details or using your PayPal account.

- Download the legal form to your device. You can access it anytime via the My Forms menu in your profile.

Using US Legal Forms empowers individuals and attorneys alike to execute legal documents quickly and accurately, thanks to a robust collection that surpasses competitors’ offerings.

Get started today to access expertly crafted legal forms that ensure precision and compliance with legal standards.

Form popularity

FAQ

Recording rental income effectively involves tracking each payment received and documenting any related expenses. You can use Rental totvs tools to automate this process, ensuring accuracy and ease of access. Keeping a detailed record helps you manage your finances and simplifies tax preparation.

To report rental income to the IRS, you will typically use Schedule E, which is part of your personal tax return. This form allows you to summarize your Rental totvs income and expenses. It is crucial to fill out this form accurately to meet IRS requirements and avoid potential penalties.

To document rental income effectively, maintain detailed records such as lease agreements, payment receipts, and bank statements. Using Rental totvs, you can streamline this documentation process. Consistent and organized records help support your financial claims and simplify tax reporting.

You can report rental income without a 1099 by being diligent about record-keeping. Simply track your incoming rental payments and report them on Schedule E of your tax return when using Rental totvs. Proper documentation can protect you in case of audits, ensuring you stay compliant with tax laws.

Recording rental income is straightforward. Use a dedicated accounting software or ledger to track all income received from Rental totvs. Document each transaction, including the date, amount, and source, for clear financial oversight and easy reference during tax season.

To claim rental payments on your taxes, report your earnings on Schedule E. Include all income received from Rental totvs and any related expenses, such as property management fees or maintenance costs. Keeping organized records simplifies this process and helps you optimize your tax return.

Reporting LLC rental income involves using Schedule E on your personal tax return. You can include all rental income and expenses related to Rental totvs on this form. This approach ensures compliance with IRS regulations while maximizing your allowable deductions and minimizing your tax liabilities.

To show proof of rental income, collect documents such as bank statements, rent receipts, and invoices. These documents validate your earnings from Rental totvs. Additionally, maintaining records of your lease agreements can strengthen your claims when applying for loans or other financial services.

When applying without a rental history, it’s crucial to include alternative proof of your reliability. You should showcase your employment history, salary, and any personal references that can vouch for your character. Furthermore, consider explaining your situation briefly to offer context. USLegalForms can guide your application to ensure you present the best version of yourself.

Filling out a rental verification form involves providing accurate details about your tenancy history, income, and references. Be thorough and honest, ensuring all information aligns with supporting documents. If you lack a rental history, focus on your current employment and financial status. Utilizing USLegalForms can simplify this process for you.