California Trust Probate Code For Beneficiaries

Description

How to fill out Nominee Trust?

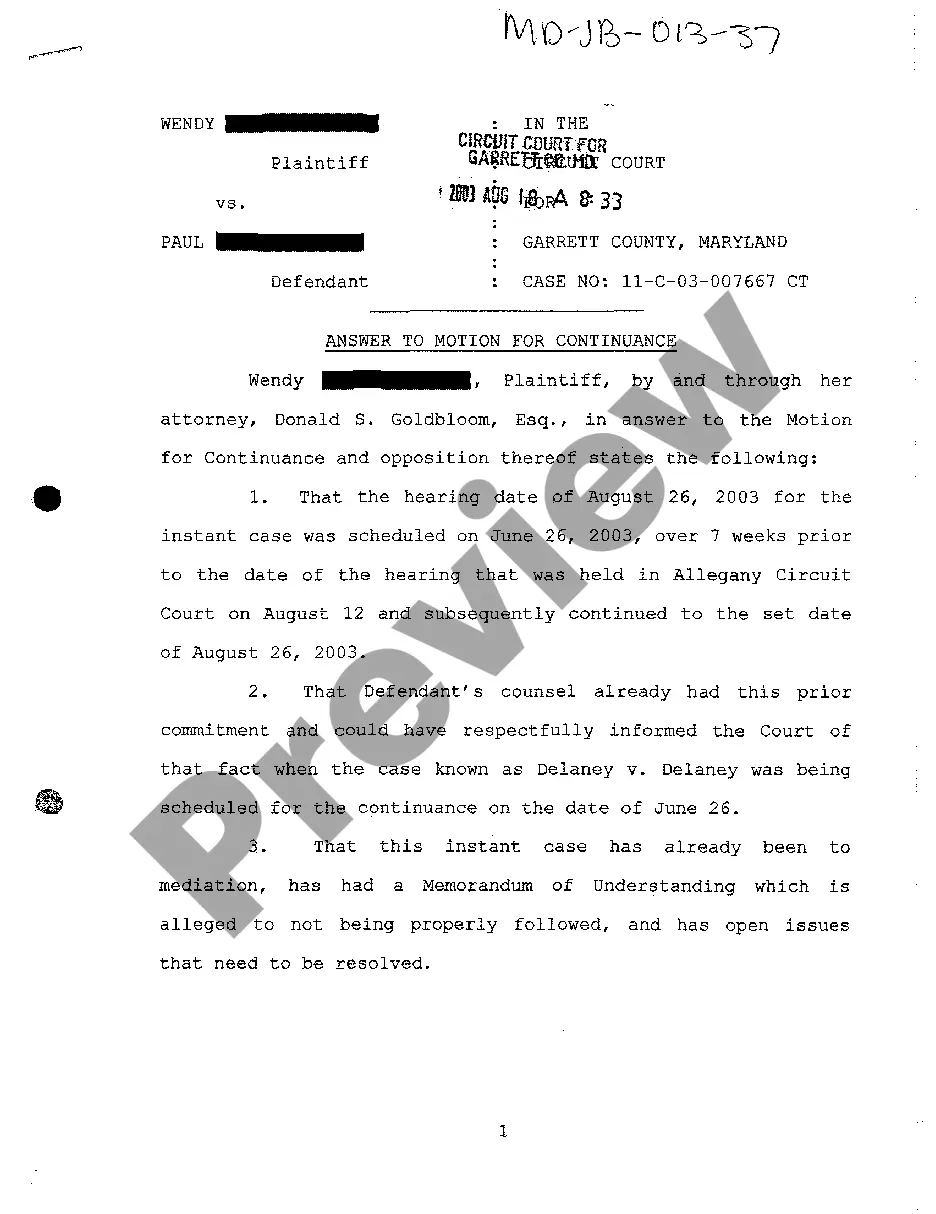

The California Trust Probate Code For Beneficiaries showcased on this site is a reusable official template crafted by expert attorneys in accordance with national and state regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal professionals with over 85,000 confirmed, state-specific documents for any business and personal needs. This is the fastest, simplest, and most dependable method to acquire the paperwork you require, as the service ensures bank-level data security and anti-virus safeguards.

Re-download your documents whenever necessary. Access the My documents tab in your profile to redownload any previously retrieved forms. Subscribe to US Legal Forms to have credible legal templates accessible for every aspect of life.

- Search for the document you require and review it.

- Browse the file you searched and preview it or check the form description to confirm it meets your needs. If it doesn't, use the search feature to find the correct one. Click Buy Now when you've found the template you want.

- Choose a pricing plan that works for you and create an account. Make a quick payment via PayPal or credit card. If you already have an account, Log In and review your subscription to proceed.

- Select the format you wish for your California Trust Probate Code For Beneficiaries (PDF, Word, RTF) and download the sample to your device.

- Print the template to fill it out by hand. Alternatively, utilize an online multi-functional PDF editor to swiftly and accurately complete and sign your form with a valid signature.

Form popularity

FAQ

15200. Subject to other provisions of this chapter, a trust may be created by any of the following methods: (a) A declaration by the owner of property that the owner holds the property as trustee. (b) A transfer of property by the owner during the owner's lifetime to another person as trustee.

"Heir" means any person, including the surviving spouse, who is entitled to take property of the decedent by intestate succession under this code.

Under probate code section 16061.7, when a trust or a portion of a trust becomes irrevocable, the Trustee has a legal obligation to send notice to all legal heirs of the decedent and beneficiaries of a trust within 60 days following the irrevocability of the trust.

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.

The California Probate Code Section 16061.7 states that a successor trustee has a legal obligation to notify all beneficiaries and heirs in the case of the settlor's death to ensure that all parties involved are well-informed.