Title Liability Company Formal Demand

Description

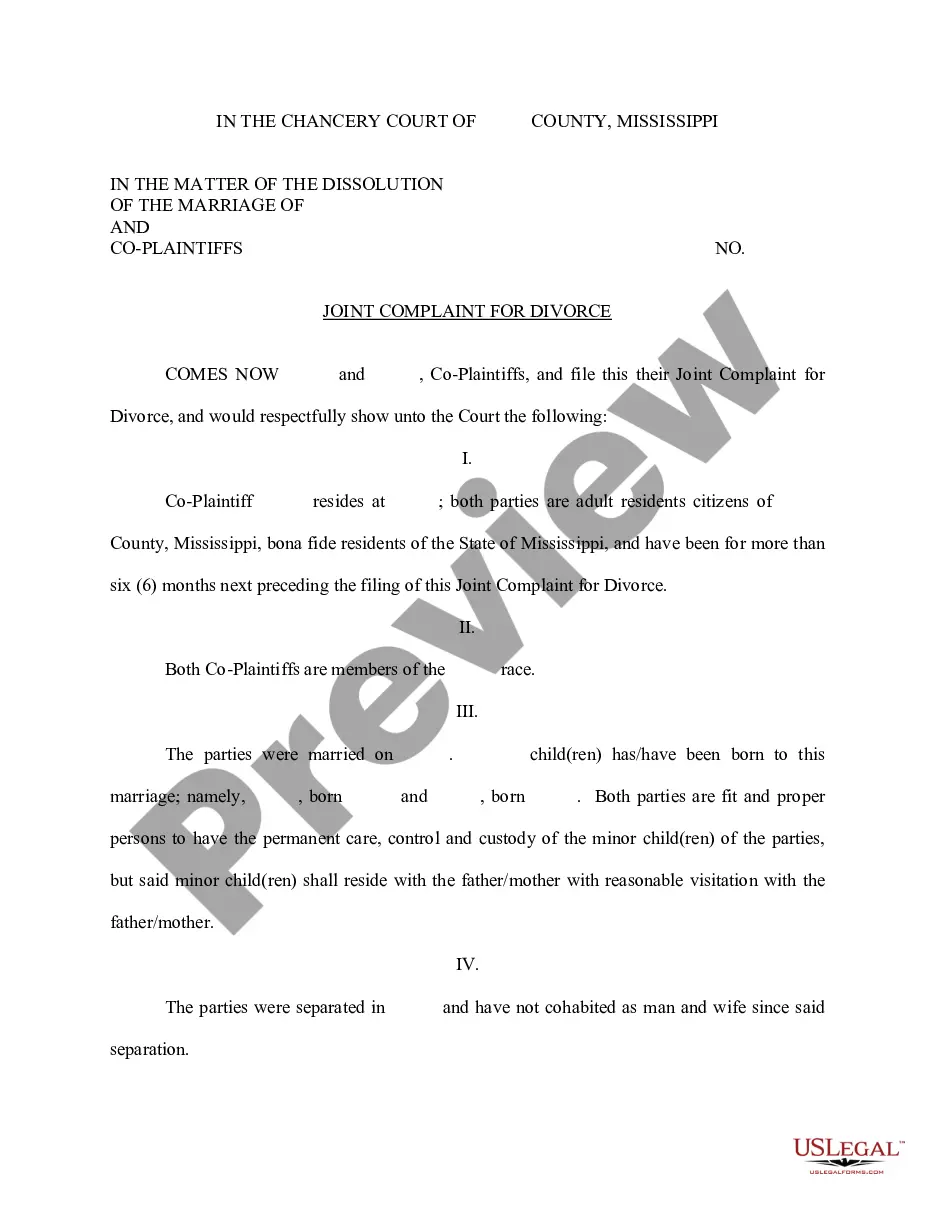

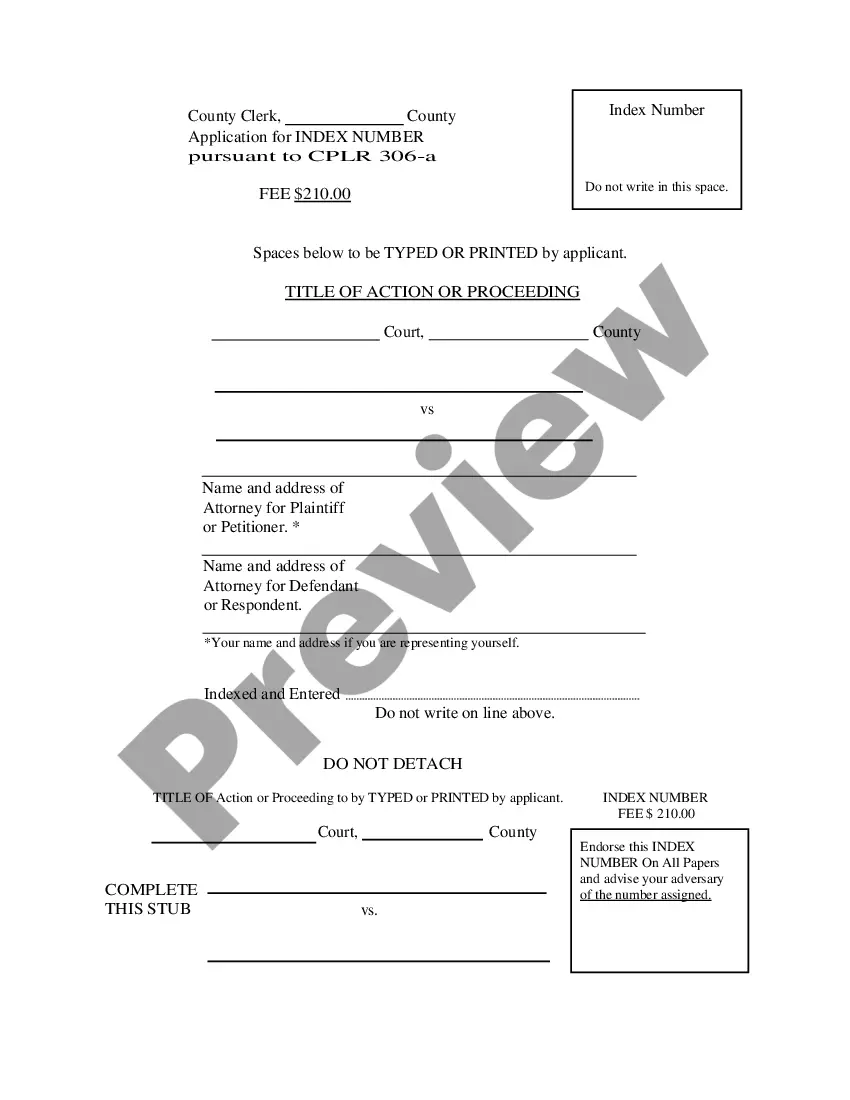

How to fill out Agreement For Sale Of All Rights, Title And Interest In Limited Liability Company LLC?

Regardless of whether it's for corporate objectives or personal matters, everyone inevitably confronts legal issues at some point in their life.

Completing legal forms demands meticulous attention, starting with selecting the appropriate form template.

With a large catalog from US Legal Forms available, you don't have to waste time searching for the right sample online. Utilize the library’s easy navigation to find the suitable template for any circumstance.

- For example, if you select an incorrect version of a Title Liability Company Formal Demand, it will be declined upon submission.

- Thus, having a trustworthy source for legal documents like US Legal Forms is essential.

- If you need to obtain a Title Liability Company Formal Demand template, follow these simple steps.

- 1. Locate the sample you require using the search box or catalog navigation.

- 2. Review the form’s details to ensure it aligns with your circumstances, state, and county.

- 3. Click on the form’s preview to examine it.

- 4. If it's the incorrect document, return to the search feature to find the Title Liability Company Formal Demand sample you need.

- 5. Acquire the template if it meets your specifications.

- 6. If you possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- 7. If you don't have an account yet, you can download the form by clicking Buy now.

- 8. Choose the appropriate pricing option.

- 9. Fill out the account registration form.

- 10. Select your payment method: either a credit card or PayPal account.

- 11. Choose the document format you prefer and download the Title Liability Company Formal Demand.

- 12. Once downloaded, you can fill out the form using editing applications or print it and complete it manually.

Form popularity

FAQ

If you have an LLC, here's how to fill in the California Form 568: Line 1?Total income from Schedule IW. Enter the total income. Line 2?Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.

Just go to California's Franchise Tax Board website, and under 'Business,' select 'Use Web Pay Business. ' Select 'LLC' as entity type and enter your CA LLC entity ID. Pay the annual fee for the full calendar year (1/1 to 12/31) using your business bank account.

California LLCs don't pay an $800 fee for their 1st year (if the LLC is formed after January 1st, 2021). This completely eliminates the back-to-back $1,600 payment issue! And it moves an LLC's first $800 payment 12-16 months after the LLC is approved.

Finally, having an LLC means you are also required to pay ongoing fees. The California LLC fee schedule includes a California LLC annual fee, which is $800 annually, and is due within 3.5 months of forming your LLC and then every April 15th thereafter.

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.