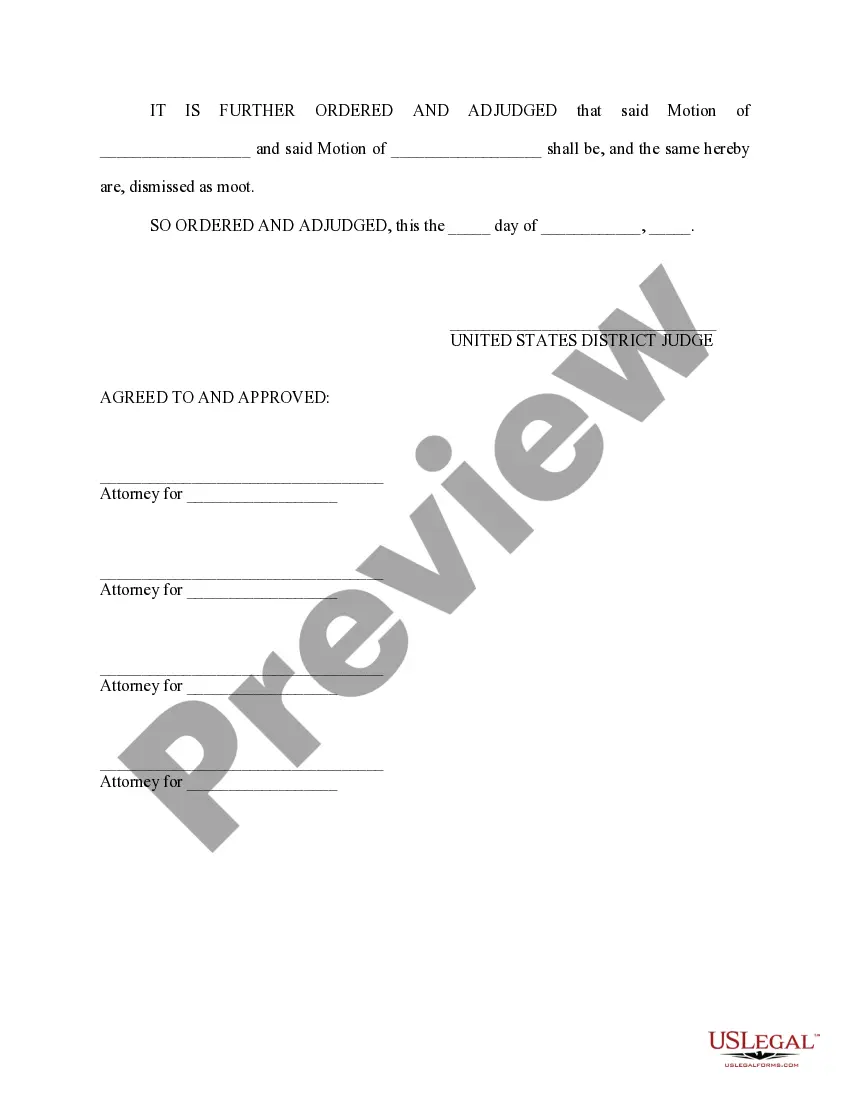

Agreed Order Example

Description

How to fill out Agreed Order Authorizing Release And Payment Of Funds Held In The Court Registry?

Utilizing legal document examples that conform to federal and state laws is essential, and the web provides numerous alternatives to select from.

However, what's the benefit of spending time looking for the properly drafted Agreed Order Example sample online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for any professional and personal matter. They are simple to navigate with all documents organized by state and intended use. Our experts keep updated with legislative shifts, ensuring that your paperwork is consistently current and compliant when acquiring an Agreed Order Example from our site.

All documents you find through US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents tab in your profile. Experience the most extensive and user-friendly legal document service!

- Obtaining an Agreed Order Example is fast and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you require in your preferred format.

- If you are unfamiliar with our website, follow the steps below.

- Review the template using the Preview feature or through the text description to confirm it meets your requirements.

- Search for another sample using the search tool at the top of the page if needed.

- Click Buy Now once you've found the appropriate form and select a subscription plan.

- Create an account or Log In and make a payment via PayPal or a credit card.

- Choose the most suitable format for your Agreed Order Example and download it.

Form popularity

FAQ

Applying for an Employer Identification Number (EIN) is a free service offered by the Internal Revenue Service. Beware of websites on the Internet that charge for this free service.

Your previously filed return should be notated with your EIN. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933.

You should apply for an EIN early enough to have your number when you need to file a return or make a deposit. You can get an EIN immediately by applying online.

How much does it cost to get an EIN? Applying for an EIN for your Minnesota LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

If you need a Minnesota Tax ID Number, you can apply: Online ? Go to Business Tax Registration. By phone ? Call 651-282-5225 or 1-800-657-3605 (toll-free)

For tax purposes, LLCs must apply for a federal Employer ID Number from the Internal Revenue Service (IRS), and a Minnesota Tax ID Number from the Minnesota Department of Revenue.

You may apply for an EIN in various ways, and now you may apply online. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. You must check with your state to make sure you need a state number or charter.

The simple answer to the question of how many EINs you are allowed is as many as the number of business entities you have. A single business or entity can have only one, although there are situations where you will need to apply for a new one due to changes to your business.