Debt Secure Loan For Students

Description

How to fill out Agreement For Accord And Satisfaction By Refinancing Debtor's Property In Name Of Creditor?

Finding a reliable source for the latest and pertinent legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents demands accuracy and careful consideration, which is why it is crucial to obtain samples of Debt Secure Loan For Students exclusively from reputable providers, such as US Legal Forms. An incorrect template can squander your time and delay your situation.

Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms catalog where you can discover legal templates, verify their relevance to your situation, and download them immediately.

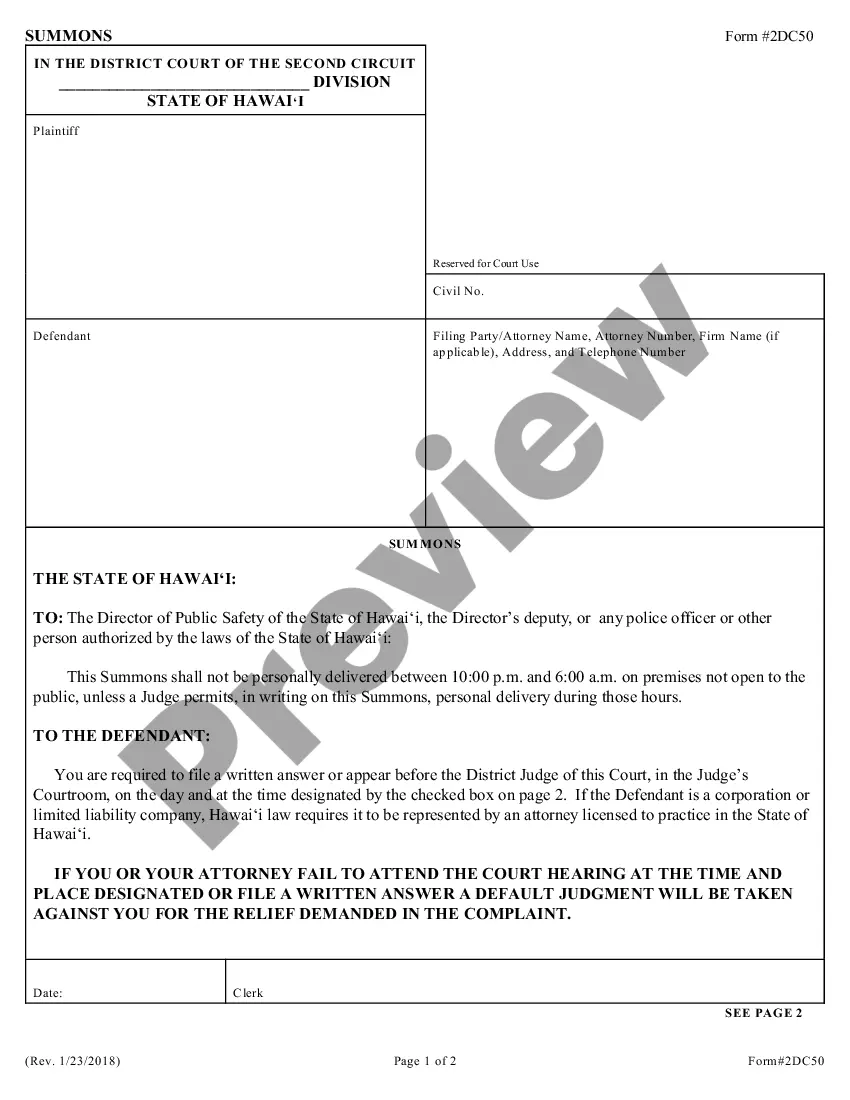

- Utilize the library navigation or search bar to locate your template.

- Access the form's details to determine if it meets the criteria of your state and locality.

- View the form preview, if available, to ensure the template is the one you seek.

- Return to the search and identify the suitable template if the Debt Secure Loan For Students does not satisfy your requirements.

- Once you are certain about the form's suitability, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Select the pricing option that fits your needs.

- Proceed to the registration to complete your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Debt Secure Loan For Students.

- Once you have the form on your device, you can modify it using the editor or print it and fill it out manually.

Form popularity

FAQ

You can use the PSLF Help Tool to assist you in completing and submitting the Public Service Loan Forgiveness (PSLF) form electronically with both your and your employer's signatures. You can also download the form, manually sign it and have your employer sign it, and submit it by mail or fax (see below).

How do I get a federal student loan? To apply for a federal student loan, you must first complete and submit a Free Application for Federal Student Aid (FAFSA®) form. Based on the results of your FAFSA form, your college or career school will send you a financial aid offer, which may include federal student loans.

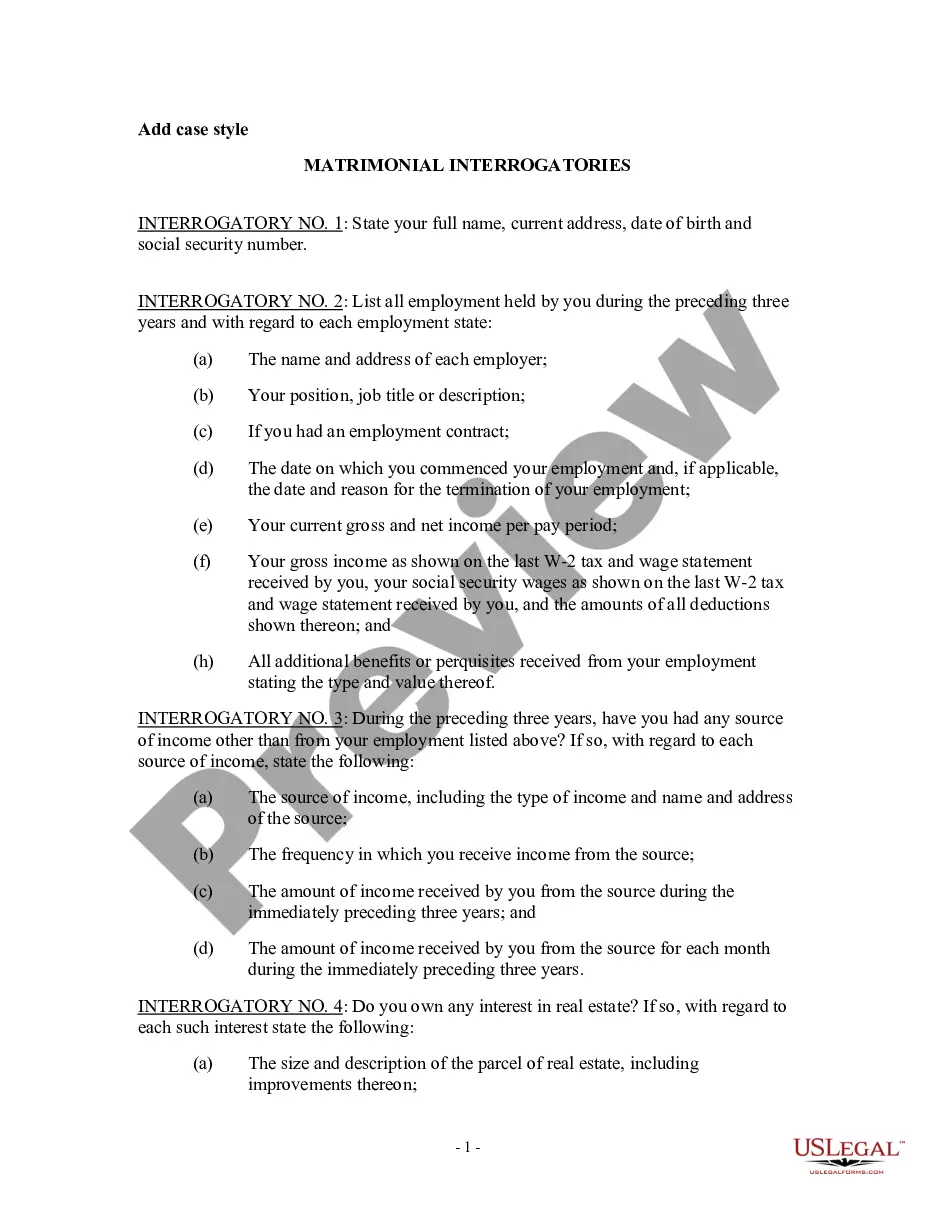

What will I need to fill out the FAFSA? Your Social Security Number. Your Alien Registration Number (if you are not a U.S. citizen) Your federal income tax returns, W-2s, and other records of money earned. ... Bank statements and records of investments (if applicable) Records of untaxed income (if applicable)

After you make your 120th qualifying monthly payment for PSLF, you'll need to submit the PSLF form to receive loan forgiveness. You must be working for a qualifying employer at the time you submit the PSLF form and at the time the remaining balance on your loan is forgiven.

If you're working toward PSLF, complete and submit the Public Service Loan Forgiveness (PSLF) & Temporary Expanded PSLF (TEPSLF) Certification & Application (PSLF form) annually or when you change employers. If you've made 120 qualifying payments, fill out and submit this same form.