Debt Collector For Attorney

Description

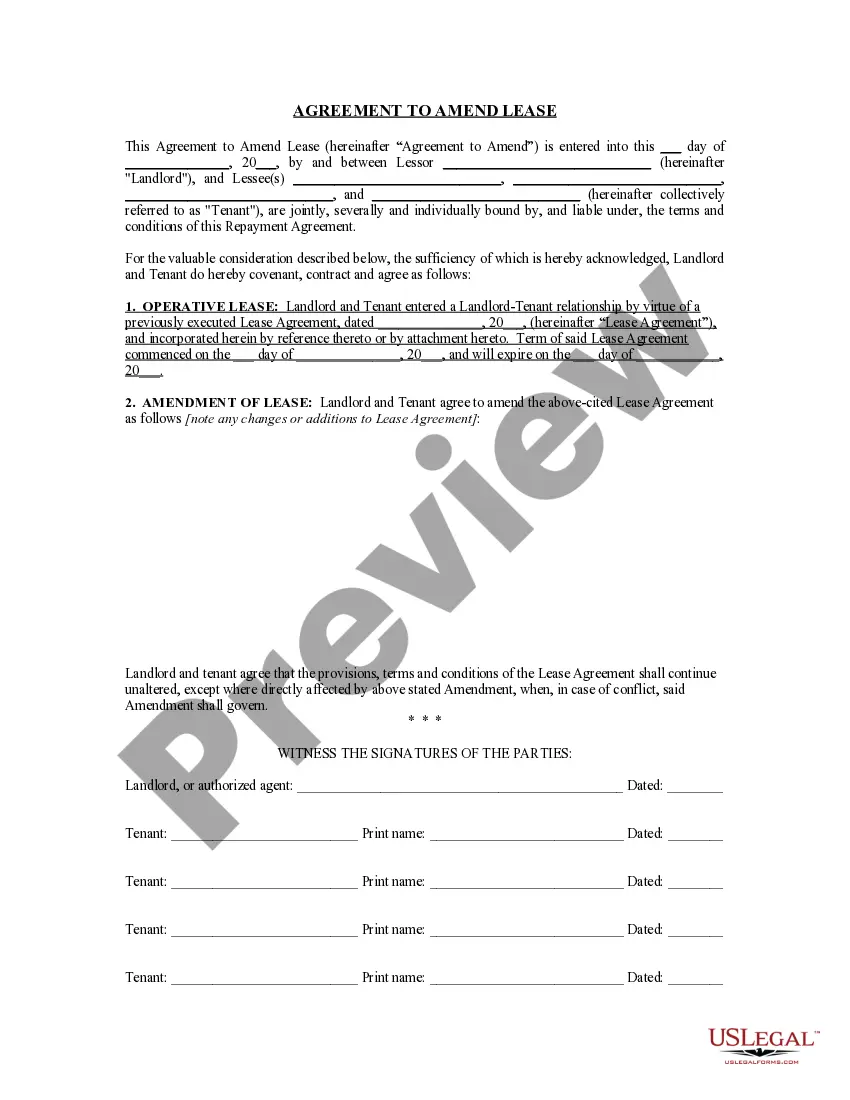

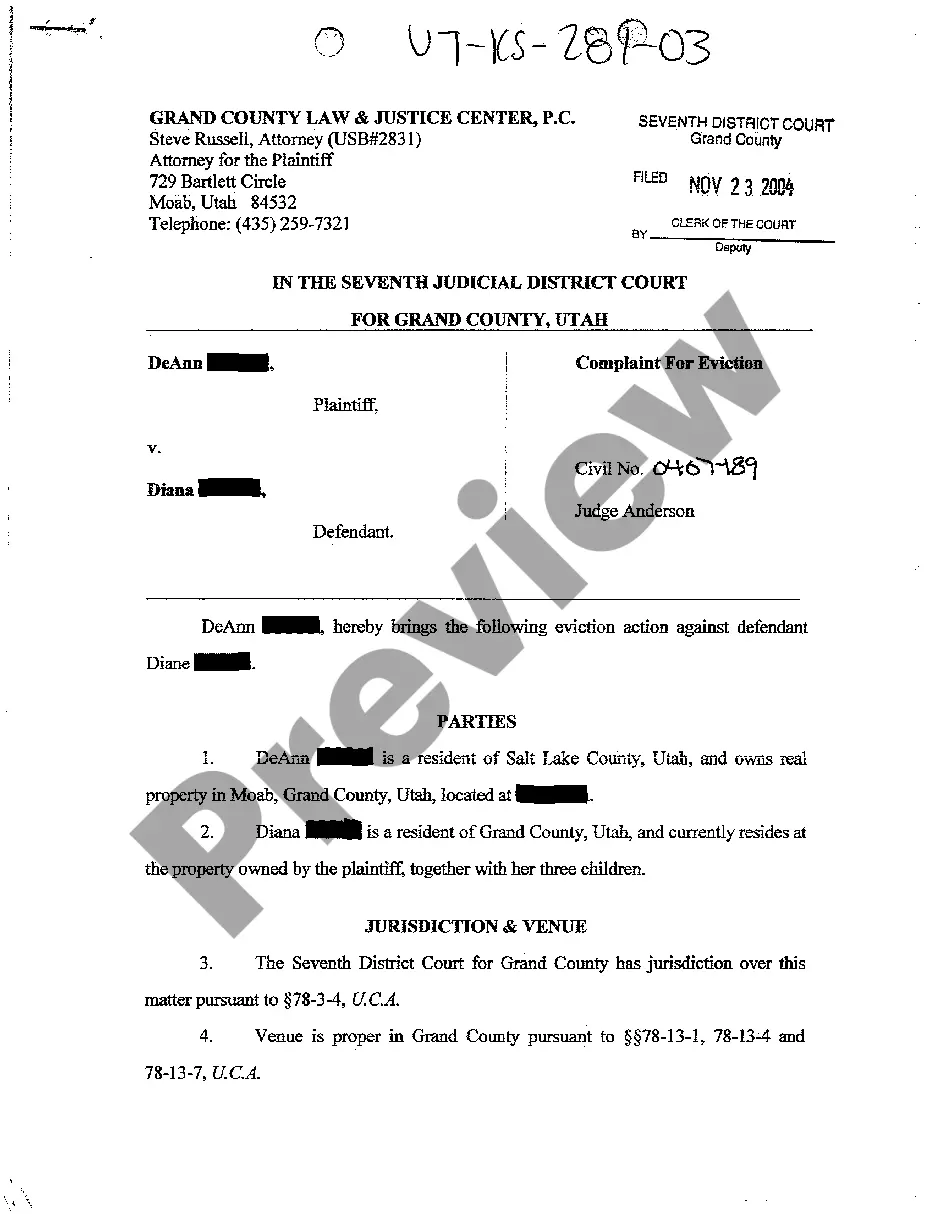

How to fill out Debt Adjustment Agreement With Creditor?

It’s clear that you cannot become a legal expert in a day, nor can you swiftly learn how to draft a Debt Collector For Attorney without possessing a unique skill set.

Assembling legal documents is a lengthy task that necessitates specific education and expertise. So why not entrust the preparation of the Debt Collector For Attorney to professionals.

With US Legal Forms, one of the most extensive legal template collections, you can discover everything from court papers to templates for internal business communication. We recognize the importance of compliance and adherence to federal and state regulations. That’s why, on our platform, all templates are specific to locations and current.

- Locate the document you require using the search bar at the top of the webpage.

- Preview it (if this feature is available) and read the descriptive information to determine if the Debt Collector For Attorney is what you need.

- Start your search again if you need another template.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. Once your payment is completed, you can download the Debt Collector For Attorney, fill it out, print it, and send it by mail to the necessary parties or organizations.

Form popularity

FAQ

If a debt collector knows that an attorney is representing you about the debt, the debt collector generally must stop contacting you and must contact the attorney instead. This is only true if the debt collector knows, or can easily find out, the name and contact information of your attorney.

Here's what every debt letter should include: Date of the letter. Lawyer's name, firm, and address. Client's name and address. A subject line that states its purpose. The precise amount the client owed your firm and the date when the payment was due. Instructions on how to pay the debt and the new deadline.

On the other hand, here's what you shouldn't do. Don't give a collector any personal financial information, make a "good faith" payment, make promises to pay, or admit the debt is valid.

?Offering 25%-50% of the total debt as a lump sum payment may be acceptable. The actual percentage may vary depending on the circumstances of the borrower as well as the prevailing practices of that particular collection agency.? One benefit of negotiating settlement terms is likely to reduce stress.

A debt collection letter should include the following information: The amount the debtor owes you. The initial due date of the payment. A new due date for the payment, whether ASAP or in the future. Instructions on how to pay the debt.