Agreement Business From Withholding

Description

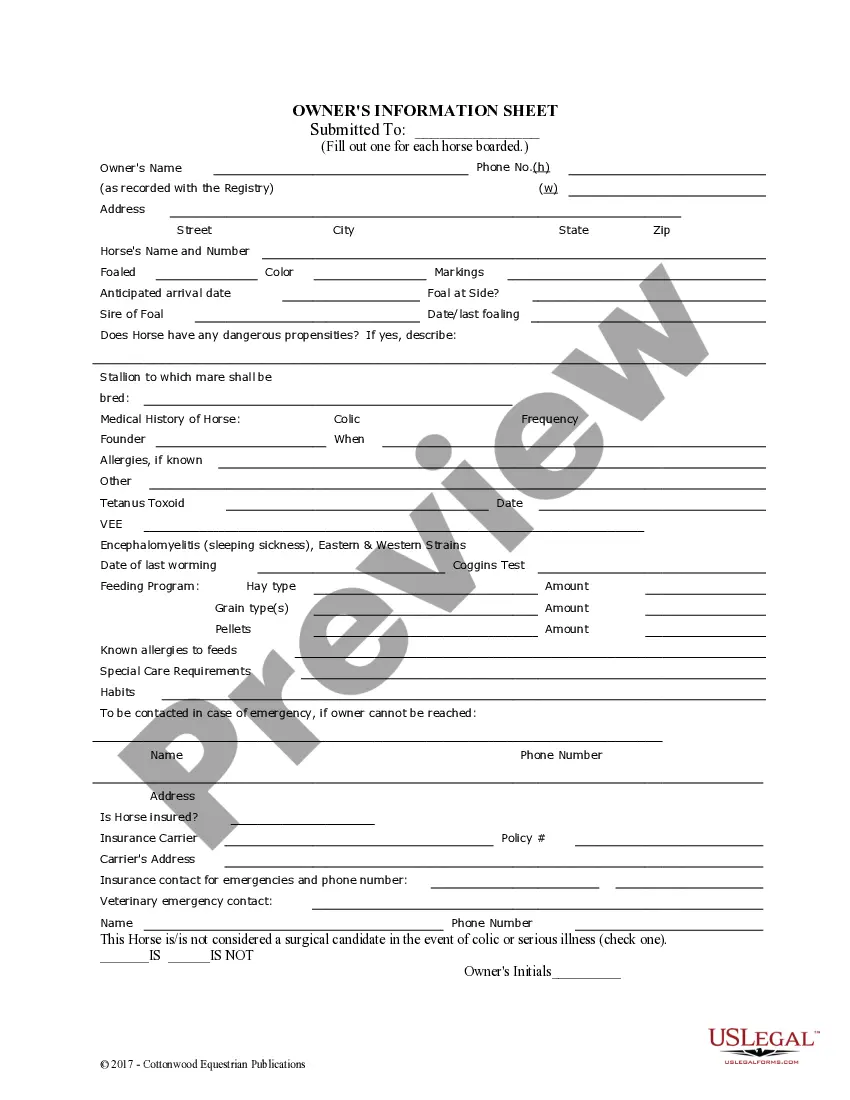

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

Whether you handle paperwork frequently or only need to transmit a legal document from time to time, it is essential to have a resource of information where all the samples are interconnected and current.

The initial step you should take using an Agreement Business From Withholding is to verify that it is indeed the most recent version, as this determines its submittability.

If you want to streamline your search for the latest document samples, look for them on US Legal Forms.

To obtain a form without an account, follow these steps: Use the search bar to locate the form you need. Examine the Agreement Business From Withholding preview and summary to verify it is exactly what you are looking for. After double-checking the document, simply click Buy Now. Select a subscription plan that suits you best. Create an account or Log In to your existing one. Enter your credit card information or PayPal account to complete the transaction. Choose the document format for download and confirm your selection. Eliminate the uncertainty of handling legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that includes nearly every sample document you could need.

- Look for the templates you need, assess their relevance immediately, and learn more about their application.

- With US Legal Forms, you gain access to over 85,000 document templates across various sectors.

- Find the Agreement Business From Withholding samples in just a few clicks and store them at any time in your account.

- A US Legal Forms account enables you to retrieve all of the samples you require with ease and fewer complications.

- Simply click Log In in the site header and navigate to the My documents section containing all the forms you need at your fingertips, eliminating the need to spend time either searching for the suitable template or checking its validity.

Form popularity

FAQ

Three key types of withholding tax are imposed at various levels in the United States:Wage withholding taxes,Withholding tax on payments to foreign persons, and.Backup withholding on dividends and interest.

A Central Withholding Agreement (CWA) is a tool that can help entertainers and athletes who don't live in the United States (U.S.) but who do plan to work here. A CWA is an agreement to have U.S. income tax withheld based on the non-resident's income.

Withholding tax is a set amount of income tax that an employer withholds from an employee's paycheck and pays directly to the government in the employee's name. The money taken is a credit against the employee's annual income tax bill.

A10: The IRS may direct your employer to withhold federal income tax at an increased rate to ensure you have adequate withholding by issuing a lock-in letter. At that point, your employer must disregard any Form W-4 that decreases the amount of withholding. You will receive a copy of the lock-in letter.

You may be subject to backup withholding if you fail to provide a correct taxpayer identification number (TIN) when required or if you fail to report interest, dividend, or patronage dividend income.