Liability Employer Buy For New Employee

Description

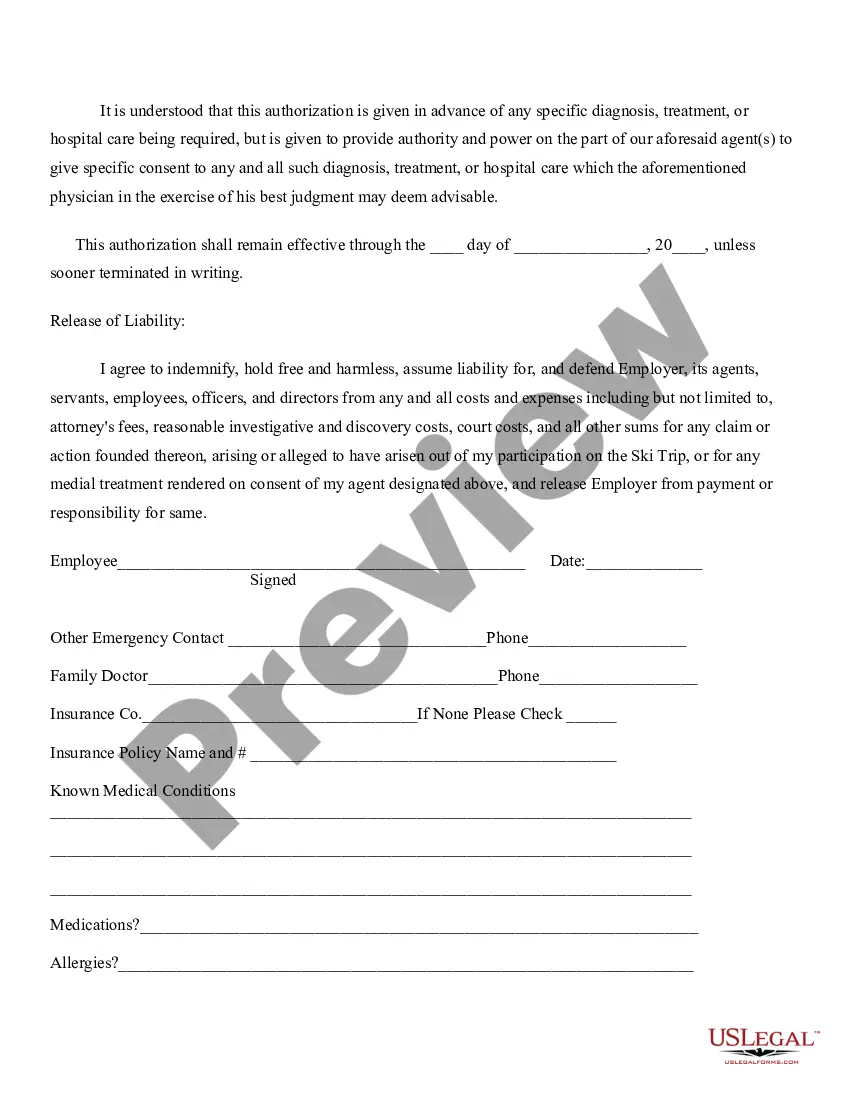

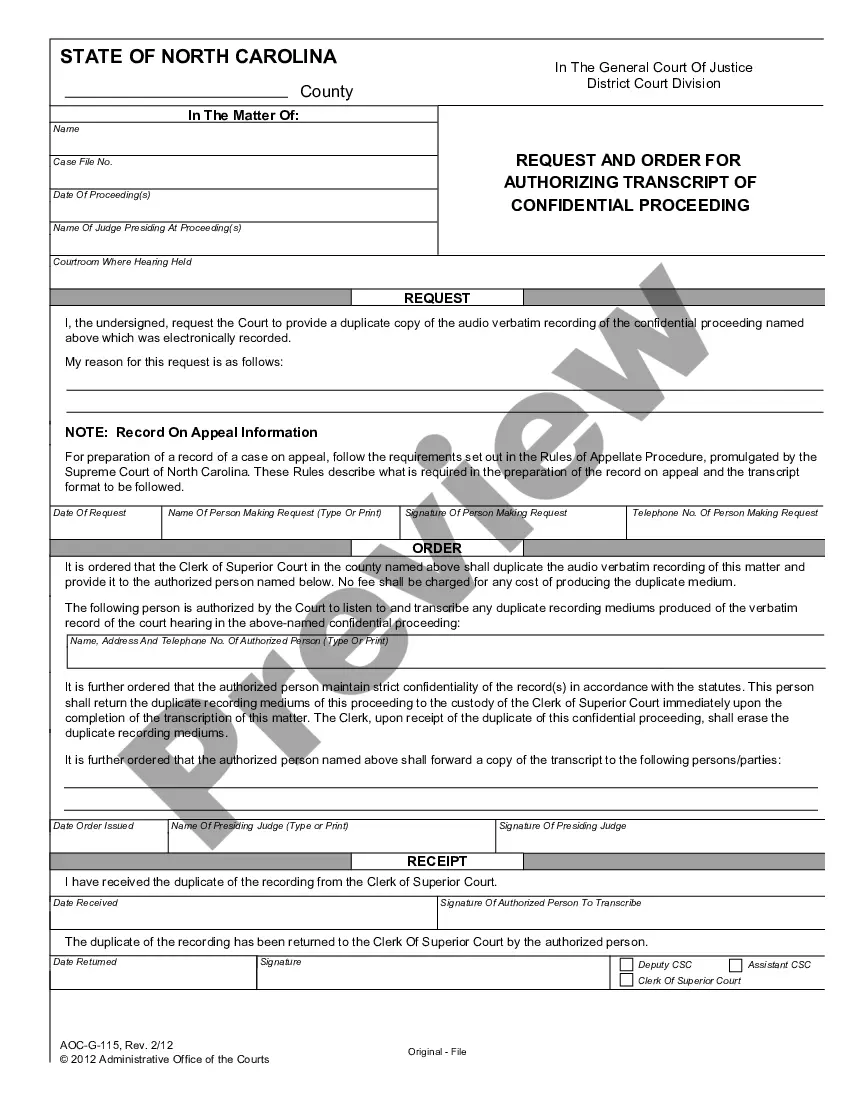

How to fill out Release Of Liability Of Employer - Ski Trip?

Working with legal papers and operations could be a time-consuming addition to the day. Liability Employer Buy For New Employee and forms like it often need you to search for them and navigate how to complete them appropriately. Consequently, if you are taking care of economic, legal, or individual matters, using a thorough and hassle-free online catalogue of forms close at hand will go a long way.

US Legal Forms is the best online platform of legal templates, featuring more than 85,000 state-specific forms and a number of resources to assist you to complete your papers quickly. Explore the catalogue of appropriate papers open to you with just one click.

US Legal Forms gives you state- and county-specific forms offered by any time for downloading. Safeguard your document management operations with a top-notch service that lets you prepare any form in minutes without any additional or hidden fees. Simply log in in your profile, identify Liability Employer Buy For New Employee and acquire it immediately from the My Forms tab. You can also gain access to formerly saved forms.

Would it be your first time utilizing US Legal Forms? Register and set up an account in a few minutes and you’ll gain access to the form catalogue and Liability Employer Buy For New Employee. Then, stick to the steps below to complete your form:

- Ensure you have found the correct form using the Preview option and reading the form description.

- Pick Buy Now once ready, and choose the subscription plan that fits your needs.

- Select Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of experience supporting users manage their legal papers. Obtain the form you want today and streamline any process without having to break a sweat.

Form popularity

FAQ

The most common types of employment forms to complete are: W-4 form (or W-9 for contractors) I-9 Employment Eligibility Verification form. State Tax Withholding form. Direct Deposit form. E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

One example: A piece of a ceiling in the workplace falls and hits a worker, and they file suit against their company in its dual capacity as employer and as the premises owner.

In the United States, there are two documents that nearly every new employee will need to complete before they begin working. These documents are the Form I-9 and the Form W-4. In addition to these documents, most new employees will also complete a direct deposit form so that their paychecks can be properly routed.

Here are some of the forms required for hiring new employees: W-4 (or W-9) form. The W-4 form tells employers how much money the employee wants to withhold from their pay for the correct federal tax income. ... I-9 form. ... State tax withholding form. ... Direct deposit form. ... Internal forms. ... Personal data for emergencies form.

New employees need to fill out a Form I-9 to verify employment eligibility as well as a W-4 for income tax. In states with an income tax, it's necessary to fill out a second W-4.