Trust Special Sample For Minor Child

Description

How to fill out Trust Agreement - Family Special Needs?

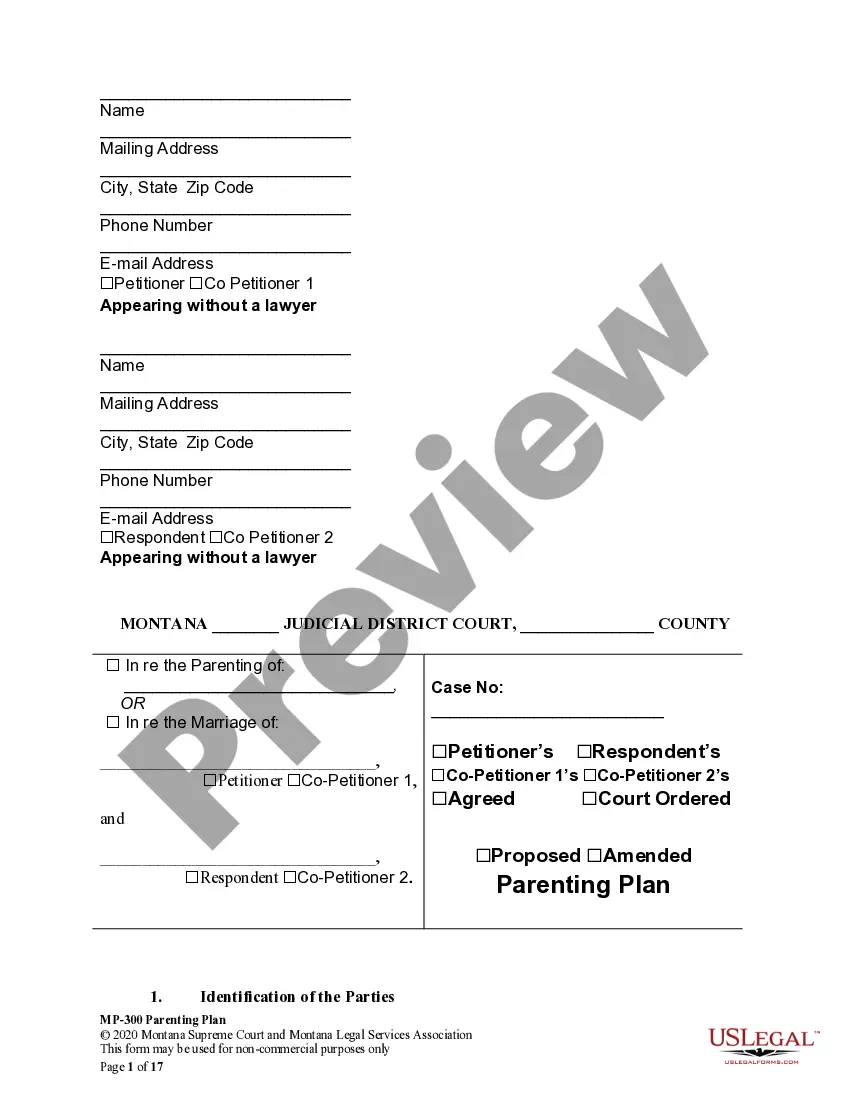

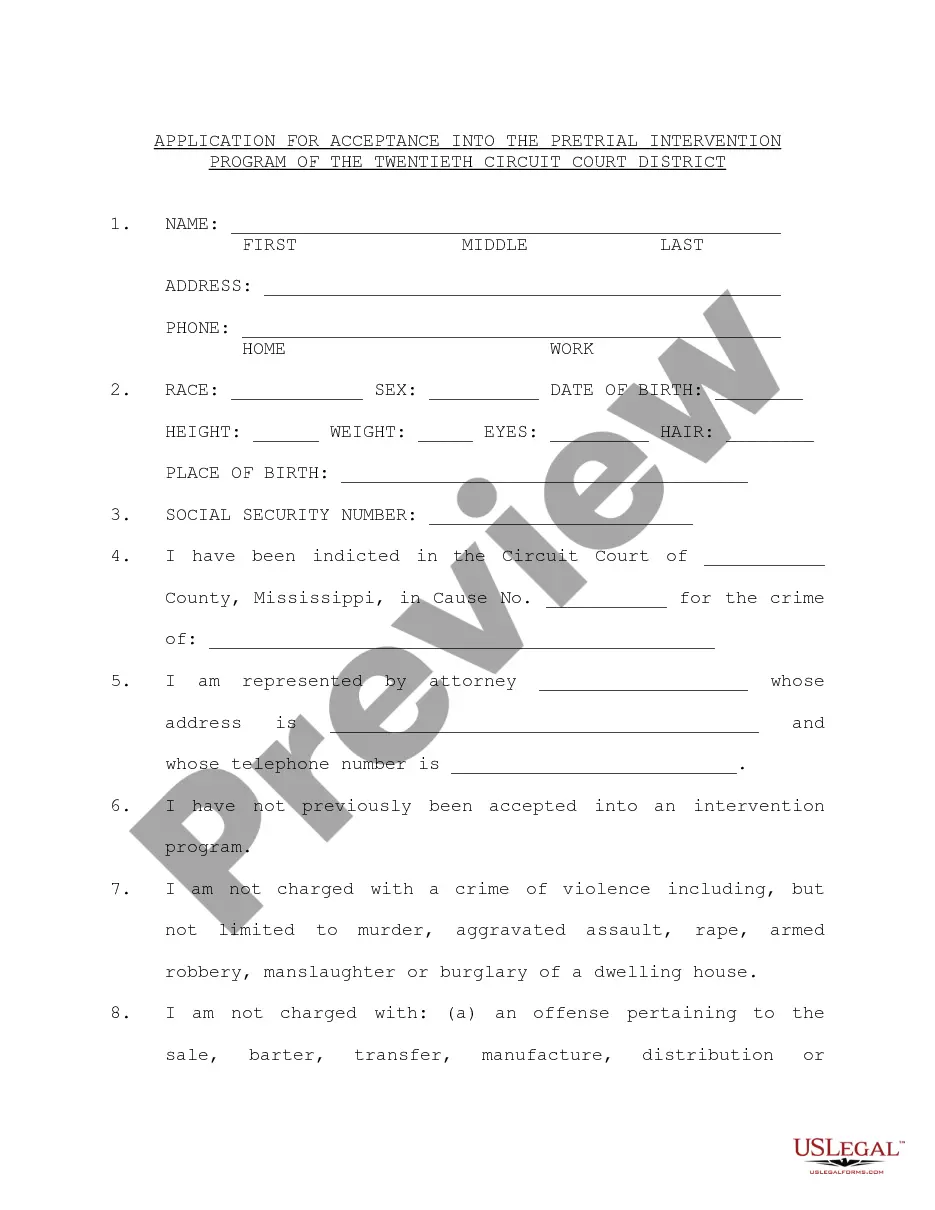

The Trust Special Template For Minor Child you notice on this site is a reusable official document crafted by expert attorneys in accordance with national and local statutes and guidelines.

For over 25 years, US Legal Forms has delivered individuals, businesses, and legal professionals with over 85,000 confirmed, state-specific documents for any commercial and personal circumstances. It’s the quickest, easiest, and most reliable method to acquire the forms you require, as the service ensures bank-level data protection and anti-malware security.

Reuse your documents whenever necessary. Access the My documents tab in your profile to redownload any previously acquired forms.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or review the form description to confirm it meets your requirements. If it does not, utilize the search bar to find the correct one. Click Buy Now when you have identified the template you need.

- Subscribe and Log In. Choose the payment plan that fits you and set up an account. Use PayPal or a credit card for a rapid payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template. Select the format you desire for your Trust Special Template For Minor Child (PDF, Word, RTF) and download the sample to your device.

- Fill out and sign the documents. Print the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to swiftly and accurately fill out and sign your form with an eSignature.

Form popularity

FAQ

A minor trust is a specific type of trust designed to hold and manage assets for a child who is under the legal age of majority. These trusts ensure that the assets are used responsibly until the child reaches adulthood. Typically, a minor trust stipulates how and when the funds can be accessed. By using a Trust special sample for minor child, you can create a tailored trust that meets your needs while ensuring the child's financial security.

To create a trust for a minor child, you need to start by choosing a suitable trustee who will manage the trust. Next, you should specify how assets will be distributed, ensuring that they are used for the child's benefit. It is important to draft a trust document, which outlines the terms, and you may consider using a Trust special sample for minor child to guide your process. Utilizing platforms like US Legal Forms can simplify this task by providing accessible templates.

Determining whether your parents should place their assets in a trust depends on their financial goals and family situation. A trust can provide excellent benefits, like avoiding probate and protecting assets from creditors. However, it requires thoughtful planning and legal guidance to ensure it meets specific needs. Utilizing a trust special sample for minor child can simplify the process, making it a beneficial option for your family.

One of the main downfalls of having a trust is the ongoing maintenance required to keep it compliant with legal regulations. Trusts may also face complications during tax seasons, as they can create complex tax implications. However, understanding these responsibilities can turn potential pitfalls into manageable aspects of asset ownership. Using a trust special sample for minor child ensures you stay organized and informed about your obligations.

A significant disadvantage of a family trust is that it can limit flexibility in managing the assets. Once established, the trust terms are binding, which might restrict how and when assets can be accessed or modified. Although this structure provides certainty for beneficiaries, it may not allow for adjustments based on changing family circumstances. Therefore, consider utilizing a trust special sample for minor child to tailor it specifically to your family's needs.

A sample trust for grandchildren serves as a legal document to manage and protect assets for your grandchildren's future. This type of trust can ensure that the funds are used for essential needs, like education or healthcare. Many families consider this option to provide financial support while maintaining control over how the assets are distributed. You can find templates, like a trust special sample for minor child, that simplify the process of creating this important document.

To set up a trust fund for a disabled child, begin by choosing a specialized trust, such as a special needs trust or discretionary trust. Outline your objectives and the types of assets to be included, ensuring they won't disqualify your child from receiving benefits. Using platforms like US Legal Forms allows you to create a trust special sample for minor child that meets legal standards.

One downside of a special needs trust is the complexity in the setup and management of the trust. This complexity can lead to misunderstandings about the trust's rules and how it interacts with government benefits. Leveraging tools like US Legal Forms can simplify the process and provide a clear trust special sample for minor child that clarifies these aspects.

The best type of trust for a minor often depends on your family’s situation, but commonly used options include irrevocable trusts or uniform transfers to minors acts (UTMA). Each type serves specific purposes, such as protecting assets and delaying distributions until the minor reaches adulthood. Using a trust special sample for minor child can help you decide on the most suitable option.

One major mistake parents make when setting up a trust fund is underfunding the trust. Insufficient funds can limit the benefits it provides and impact your child's quality of life. To avoid this, make sure to carefully assess the required funding for your trust special sample for minor child with the guidance of legal experts.