Special Needs Trust Near Me

Description

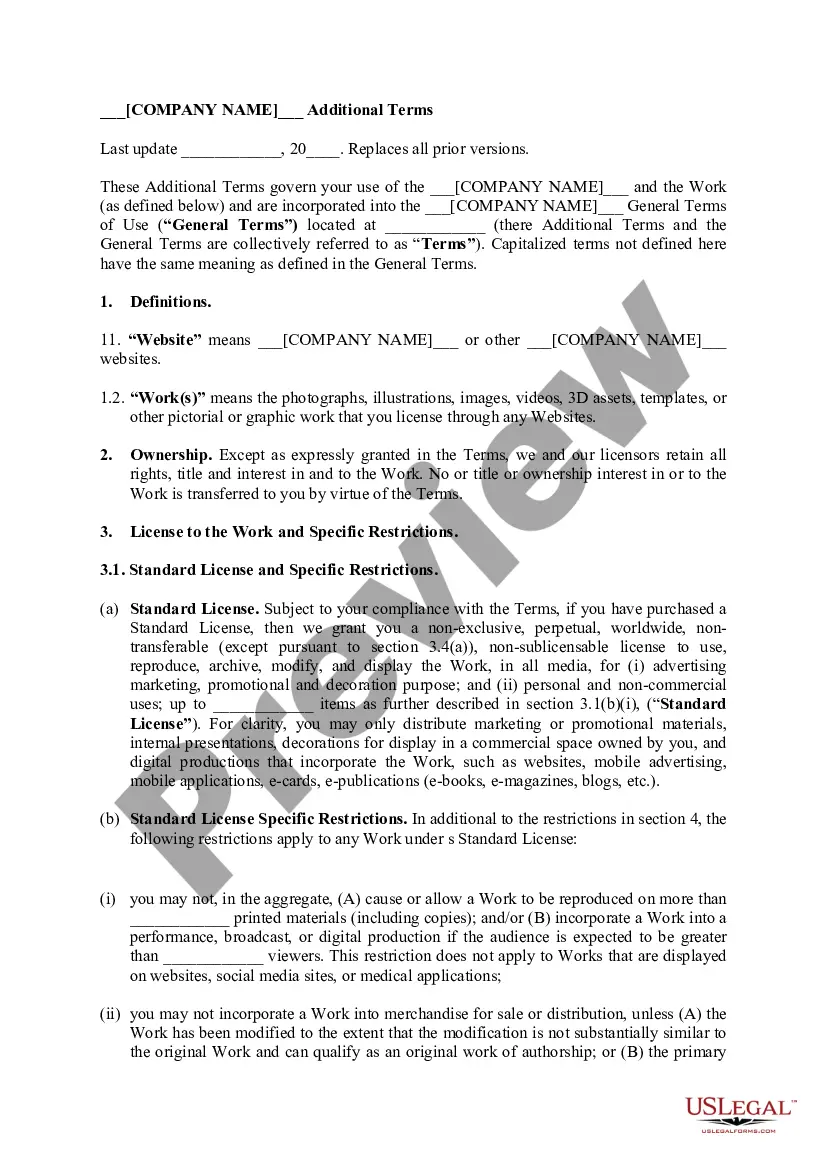

How to fill out Trust Agreement - Family Special Needs?

Creating legal documents from the ground up can often be daunting.

Certain situations may require extensive research and significant financial investment.

If you're seeking a simpler and more affordable method for generating Special Needs Trust Near Me or any other forms without hassle, US Legal Forms is always available to you.

Our online library of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can effortlessly access state- and county-specific templates meticulously crafted by our legal experts.

Check the form preview and descriptions to ensure you have located the form you need. Verify that the template you select adheres to your state and county regulations and laws. Choose the appropriate subscription plan to purchase the Special Needs Trust Near Me. Download the file, then complete, sign, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and simplify your document completion process!

- Utilize our website whenever you require reliable and trustworthy services to swiftly locate and download the Special Needs Trust Near Me.

- If you’re already familiar with our services and have created an account previously, simply Log In to your account, select your desired form, and download it or re-download it anytime later in the My documents section.

- Not signed up yet? No problem. Setting it up and browsing the catalog takes hardly any time.

- However, before diving straight into the download of Special Needs Trust Near Me, keep these pointers in mind.

Form popularity

FAQ

Commonly, family members will create a SNT and leave money and property to that trust through their estate plan (their will, trust, life insurance, or other beneficiary designation). The trustee of that trust then uses trust funds to support the person with special needs.

What are the main benefits of an SDT? The asset value limit of $781,250 (indexed annually on 1 July) and income from the trust may be disregarded for the purposes of the principal beneficiary's income support payment. Assets above that limit are added to the assessable assets of the principal beneficiary.

Typically, a third party special needs trust is set up by the family of the disabled person. The family then gifts money to the trust, rather than the disabled person, so the gifts do not interfere with the disabled persons Supplemental Security Income (SSI), Medicaid, vocational rehabilitation, and subsidized housing.

Cons of Special Needs Trusts The trust must be maintained, and yearly management costs can be high. Depending on who manages the fund, there may be a minimum amount required to set up the trust. It may be financially difficult for the settlor to actually establish the trust, depending upon their circumstances.

Only the disabled person can be the sole beneficiary of the trust, no one else. Upon death of the trust beneficiary, the New Jersey Medicaid program must be reimbursed up to the total amount of Medicaid benefits paid on behalf of the trust beneficiary during his/her lifetime.