Special Needs Trust Form For Florida

Description

How to fill out Trust Agreement - Family Special Needs?

Securing a reliable location to access the most up-to-date and pertinent legal templates is a significant part of navigating bureaucracy.

Locating the appropriate legal documents requires precision and careful attention, which is why it is crucial to obtain examples of Special Needs Trust Form For Florida exclusively from reputable sources like US Legal Forms. An incorrect template can squander your time and delay your situation.

After you have the form on your device, you can edit it with the editor or print it to fill out manually. Eliminate the inconveniences related to your legal paperwork. Explore the extensive US Legal Forms library where you can find legal templates, verify their suitability for your situation, and download them immediately.

- Use the library navigation or search bar to find your sample.

- Check the form’s details to ensure it aligns with your state and area requirements.

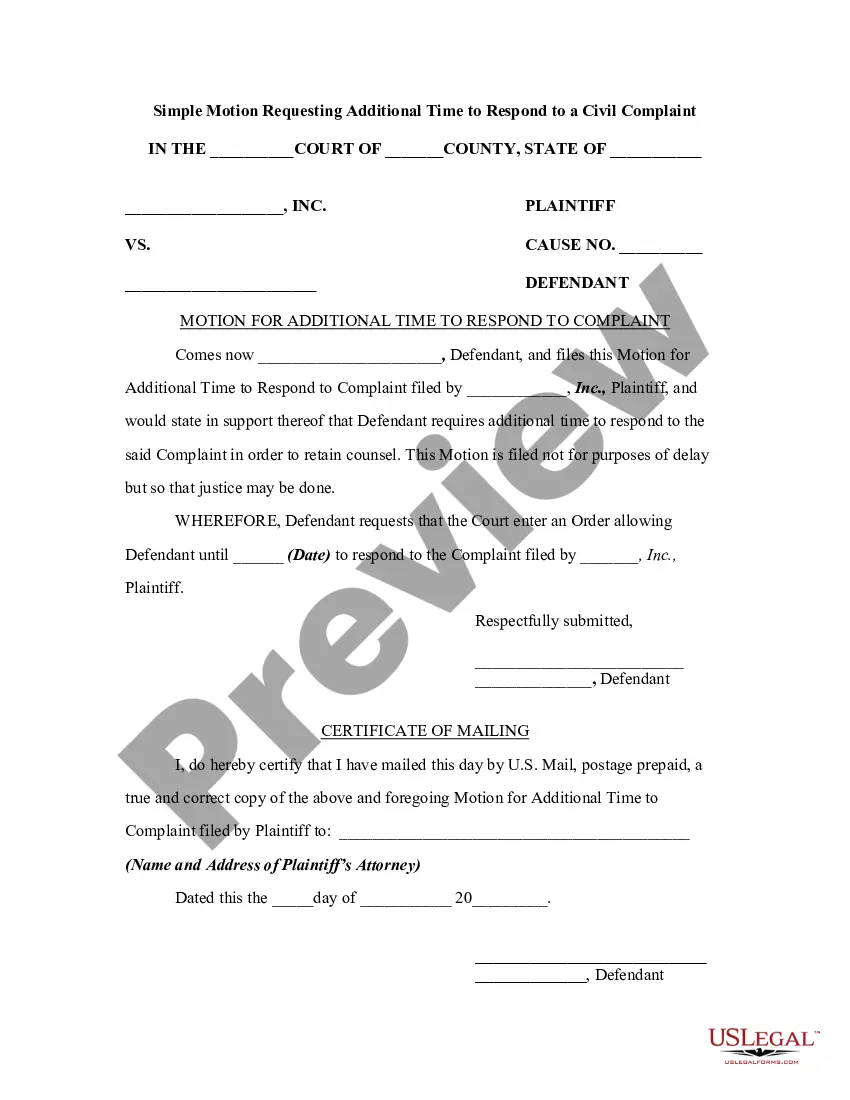

- View the form preview, if available, to confirm that it is indeed the form you need.

- Return to the search and identify the correct template if the Special Needs Trust Form For Florida does not suit your needs.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the pricing option that meets your needs.

- Proceed to register to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Special Needs Trust Form For Florida.

Form popularity

FAQ

The time it takes to set up a special needs trust can vary depending on several factors, such as the complexity of your situation and the promptness of gathering required documents. Generally speaking, with the right preparations, you can complete a special needs trust form for Florida within a few weeks. However, working closely with a legal professional can streamline the process and help you avoid any unnecessary delays.

Creating a special needs trust typically involves drafting a written agreement that specifies the terms of the trust. You will need to complete a special needs trust form for Florida, outlining how the funds will be managed and distributed for the benefit of the individual with special needs. It is recommended to collaborate with a lawyer experienced in special needs planning to ensure that all legal standards are met and that the trust functions smoothly.

Yes, you can write your own trust in Florida; however, it is important to ensure that it complies with state laws. Crafting a special needs trust form for Florida requires understanding the legal requirements and specific language that protects the beneficiary's eligibility for government benefits. While it is possible to create a trust on your own, working with a knowledgeable legal expert can help you avoid costly mistakes.

To set up a special needs trust form for Florida, you will need basic information about the beneficiary, including their personal and financial details. It is also important to gather documentation regarding the assets you plan to place in the trust. Additionally, you may want to consult with a legal professional who specializes in trusts to ensure that all requirements are met and to guide you through the process.

The statute for special needs trusts in Florida is outlined under Florida Statutes, Chapter 733, which covers trusts and estates. This legislation provides the legal framework for establishing special needs trusts while protecting the rights and benefits of individuals with disabilities. Using a special needs trust form for Florida can simplify adhering to these statutes and ensure your trust is set up correctly. Legal advice is always recommended to fully understand the implications.

Typically, you do not need to file a trust with the court in Florida. Trusts are created as private documents that do not require court involvement unless there is a dispute or need for administration. However, outcomes may differ based on specific circumstances, so it's wise to consult with a legal expert. Creating your trust with a special needs trust form for Florida can keep the process straightforward and effective.

While special needs trusts offer many advantages, they do come with some disadvantages. One limitation is that funds in the trust cannot be used for certain expenses, which can affect the beneficiary's eligibility for public benefits. Additionally, legal fees for setting up and maintaining the trust can add up. Using a special needs trust form for Florida can streamline the process and help mitigate some of these costs.

The special needs trust law in Florida allows families to set aside funds for individuals with disabilities without compromising their eligibility for public benefits. This type of trust can support extra care and quality of life. Utilizing a special needs trust form for Florida helps ensure compliance with these laws, providing peace of mind for families. It's crucial to understand these laws fully to maximize benefits.

A trust generally does not need to be filed with the state of Florida. The formation of the trust remains private, which means you are not required to submit it to state authorities. However, certain situations, like tax filings, may require disclosure. Using a special needs trust form for Florida can help you create a solid document without unnecessary public exposure.

No, a trust does not need to be recorded in Florida to be valid. Florida law treats trusts as private agreements that do not require public registration. This provides a level of confidentiality regarding the terms of a trust. For creating a strong trust document, use a special needs trust form for Florida that fits your needs while adhering to state laws.