Special Needs Trust Form 1041 For Estate

Description

How to fill out Trust Agreement - Family Special Needs?

Regardless of whether it is for commercial reasons or personal issues, everyone must deal with legal matters at some stage in their life. Completing legal documentation requires meticulous care, starting from selecting the appropriate form sample.

For instance, if you select an incorrect version of the Special Needs Trust Form 1041 For Estate, it will be rejected once you submit it. Therefore, it is essential to have a trustworthy source of legal documents like US Legal Forms.

With a vast US Legal Forms catalog available, you will never need to waste time searching for the right template online. Take advantage of the library’s straightforward navigation to find the appropriate template for any situation.

- Locate the template you require by utilizing the search box or catalog browsing.

- Review the form’s description to ensure it aligns with your situation, state, and locality.

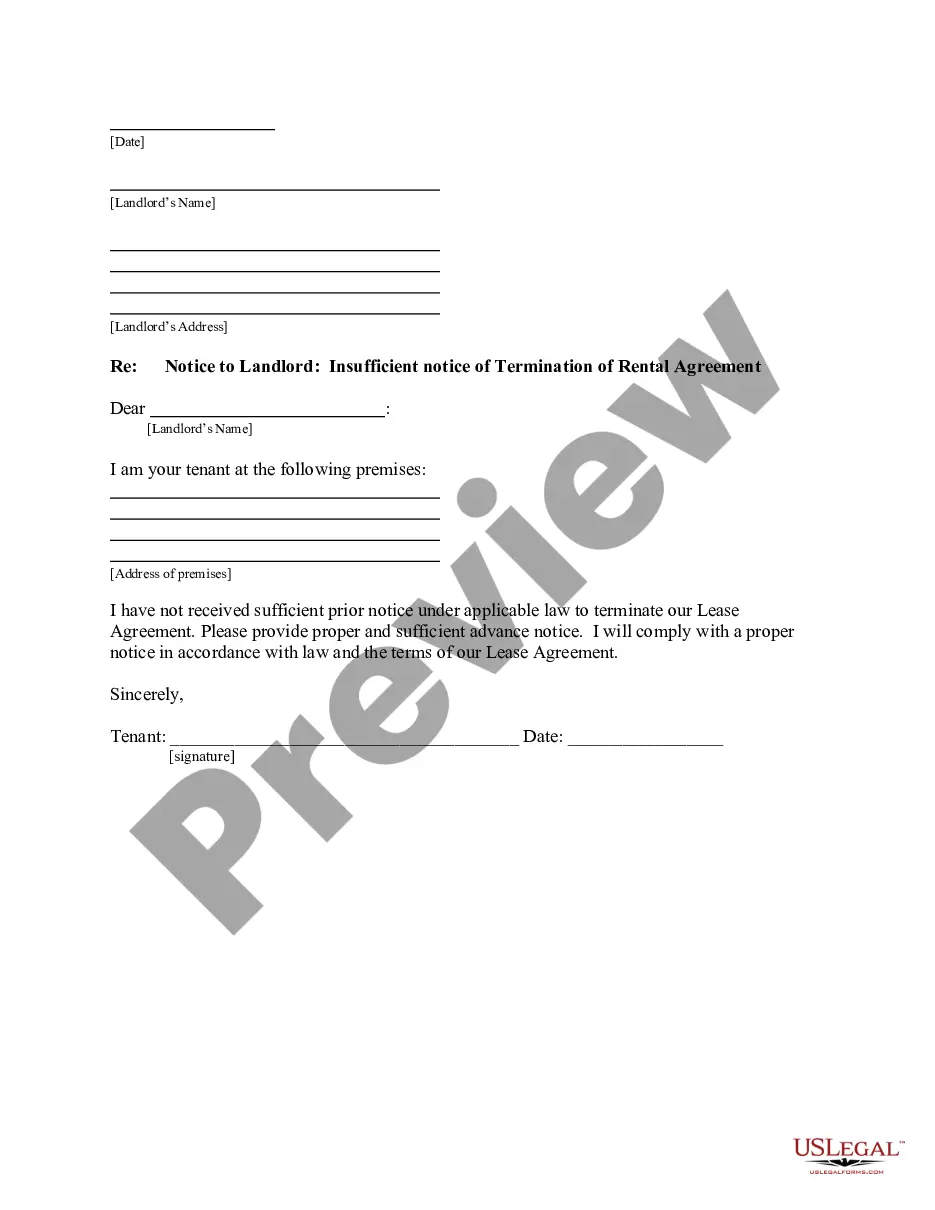

- Click on the form’s preview to examine it.

- If it is not the correct document, return to the search feature to locate the Special Needs Trust Form 1041 For Estate sample you need.

- Download the template if it suits your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- In case you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the account registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the file format you prefer and download the Special Needs Trust Form 1041 For Estate.

- Once it is saved, you can fill out the form with the aid of editing software or print it and complete it manually.

Form popularity

FAQ

If an estate or trust receives a distribution reported on Form 1099-R, it should be reported as Other Income on line 8 of Form 1041. To enter information reported on Form 1099-R in Form 1041, from the Main Menu of the return select: Income. Other Income.

The distribution amount will be reported on Form 1041 Schedule B, Line 10 - Other Amounts paid, credited, or otherwise required to be distributed.

Report income distributions to beneficiaries and to the IRS on Schedule K-1 (Form 1041). For calendar year estates and trusts, file Form 1041 and Schedule(s) K-1 on or before April 15 of the following year.

Trusts and estates report their income and deductions on Form 1041 as well as the income distributed to beneficiaries of the trust or estate.

Some other examples of common trust purchases are a new TV for the Beneficiary's room, a hotel room rental on vacation, a class at a local community college, or non-government funded medical expenses such as massage therapy. Things may get a little bit more confusing when it comes to paying for food and shelter.