Example Of A Special Needs Trust

Description

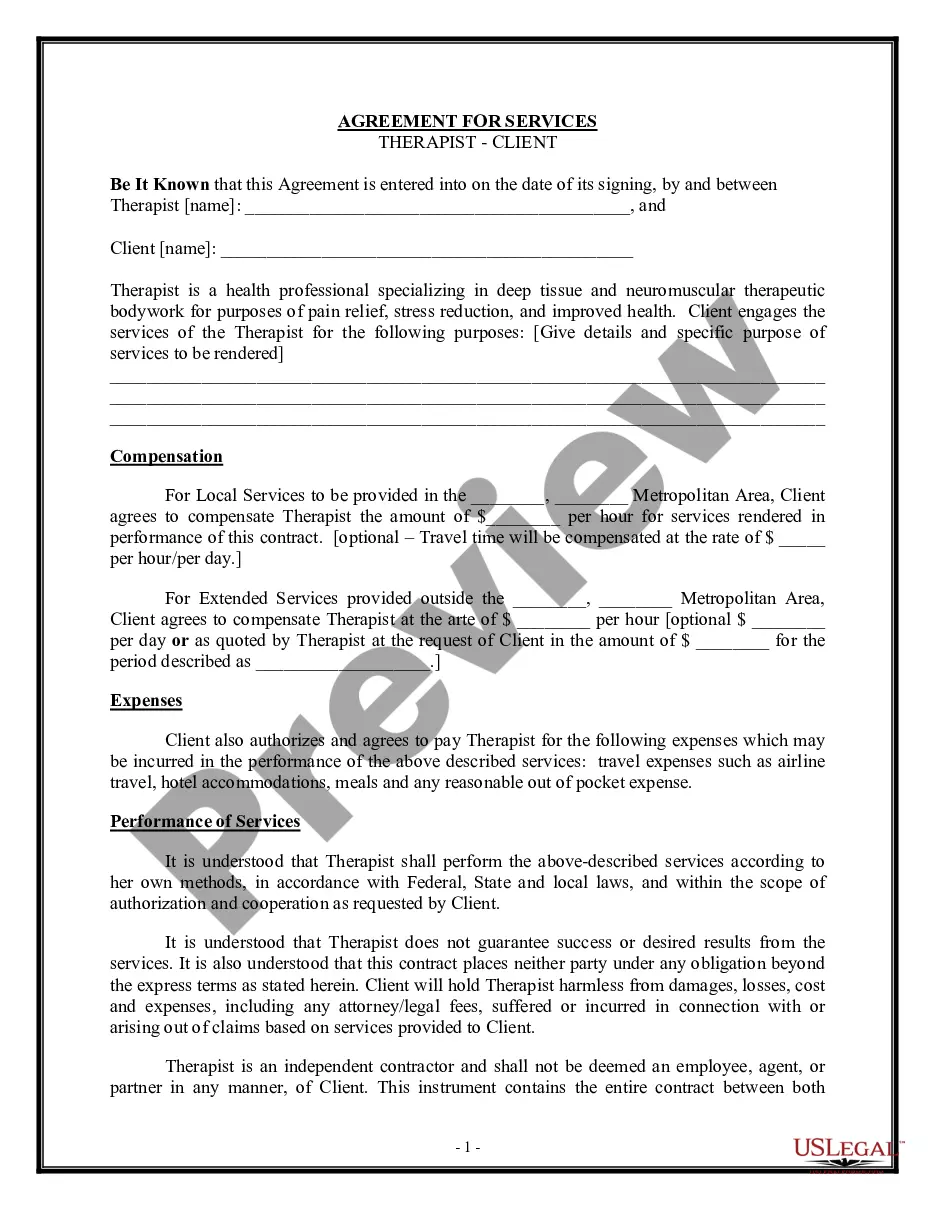

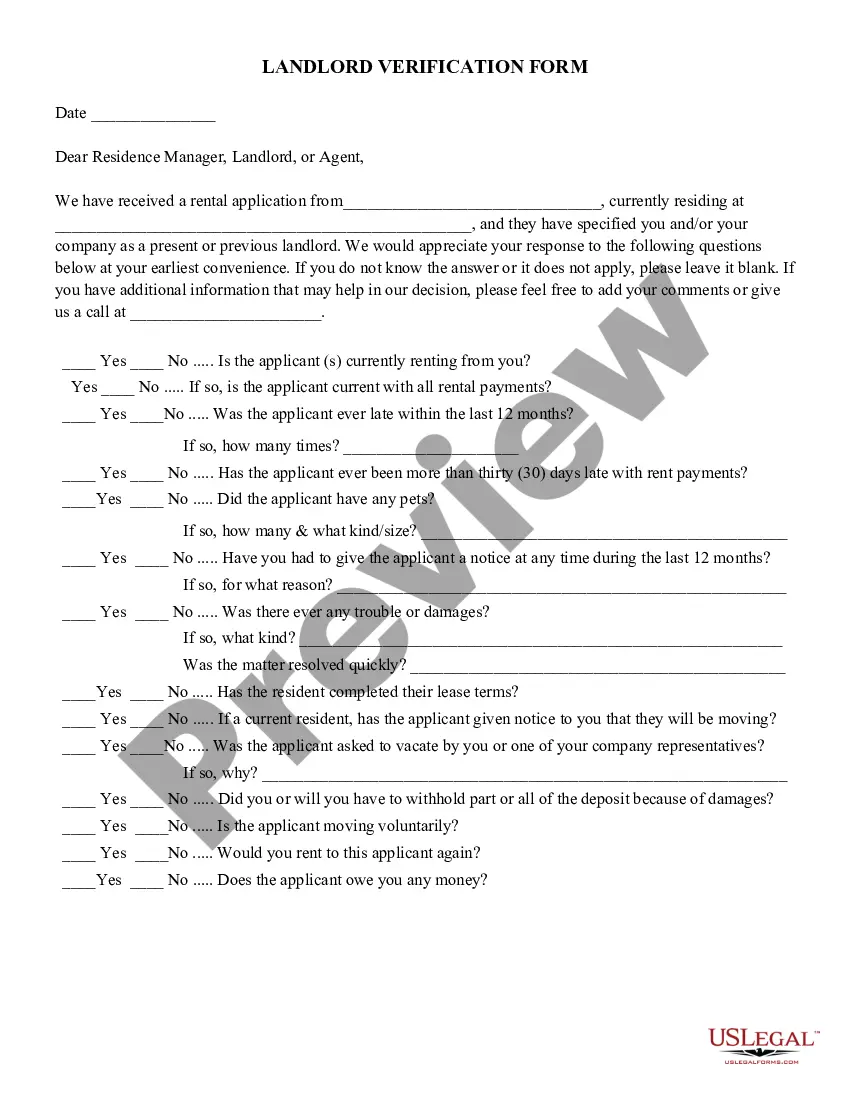

How to fill out Trust Agreement - Family Special Needs?

Legal documentation administration can be overwhelming, even for experienced professionals.

When you are looking for a Sample Of A Special Needs Trust and don’t have the opportunity to spend time searching for the correct and current version, the processes may be stressful.

US Legal Forms accommodates any requests you may have, ranging from personal to business documents, all in one location.

Employ advanced tools to complete and manage your Sample Of A Special Needs Trust.

Here are the steps to take once you have downloaded the form you require: Confirm it is the correct form by previewing it and inspecting its details. Ensure that the sample is valid in your state or county. Select Buy Now when you are ready. Choose a subscription plan. Select the format you need, and Download, complete, eSign, print, and send your documents. Benefit from the US Legal Forms online directory, backed by 25 years of experience and reliability. Transform your routine document management into a streamlined and user-friendly process today.

- Tap into a repository of articles, guidelines, and manuals relevant to your situation and requirements.

- Save time and energy searching for the documents you require, and utilize US Legal Forms' advanced search and Review tool to locate the Sample Of A Special Needs Trust and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, locate the form, and acquire it.

- Check the My documents tab to review the documents you have previously downloaded and to manage your folders as needed.

- If this is your first time using US Legal Forms, create an account to obtain unlimited access to all the platform's features.

- Utilize a comprehensive online form directory that could revolutionize the way individuals manage these matters.

- US Legal Forms stands as a frontrunner in the realm of online legal documentation, providing over 85,000 state-specific legal forms available to you at any time.

- Access state- or county-specific legal and business forms.

Form popularity

FAQ

A special needs trust is a legal arrangement designed to benefit individuals with disabilities while preserving their eligibility for public assistance programs. For instance, an example of a special needs trust allows a trustee to manage funds for a beneficiary, ensuring they receive necessary care and services without jeopardizing government benefits. This trust can cover expenses that government programs do not, such as education, health care, and personal care. By using USLegalForms, you can easily create a tailored special needs trust that meets your requirements and safeguards your loved one’s future.

In these circumstances, the Form 1041 is very simple to complete. The trustee will check the box on Form 1041 indicating that the trust is a grantor trust and provide some general information about the trust (name, address, tax identification number, and the date the trust was established).

First-Party or Self-Funded Special Needs Trusts Any income earned on the funds invested in the first-party trust is always taxable to the beneficiary in the year it is earned, regardless of when or if it is distributed to the beneficiary.

While all special needs trusts must file annual income tax returns, only larger third-party trusts that earn more than they distribute each year actually pay any taxes. The others pass through their income to the beneficiary with special needs.

A Special Needs Trust must have its own Federal Identification Number (also called an Employer Identification Number, EIN, Tax Identification Number, or TIN) to be valid. This unique number means that the Trust is its own entity, and that it does not belong to anyone but itself.

The trustee works in very close contact with the beneficiary and/or their caregiver to manage the trust and its financial distributions to pay for these things. The main takeaway regarding distribution of SNT funds is this: The beneficiary never sees the money directly, but the money is used to pay for their needs.