3rd Party Special Needs Trust Form With Irs

Description

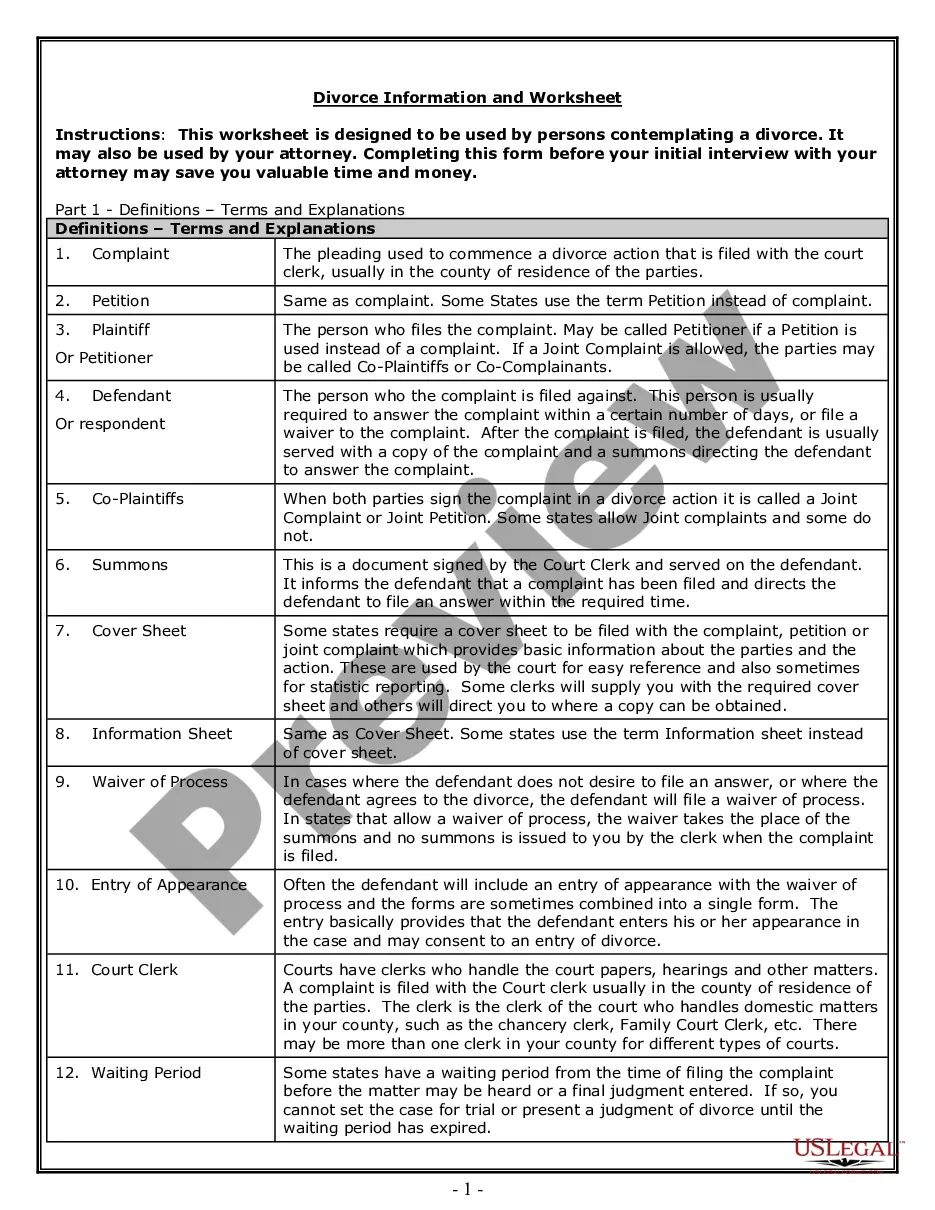

How to fill out Trust Agreement - Family Special Needs?

Managing legal documentation and processes can be a lengthy addition to your day.

Third Party Special Needs Trust Form With IRS and similar documents usually necessitate you to search for them and find your way to fill them out correctly.

As a result, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online repository of forms whenever required will be significantly beneficial.

US Legal Forms is the leading online service for legal templates, providing over 85,000 state-specific documents and various resources to assist you in completing your paperwork effortlessly.

Is this your first time using US Legal Forms? Sign up and create an account in a few minutes, and you will gain access to the form library and Third Party Special Needs Trust Form With IRS. Then, follow the steps below to complete your form: Ensure you have located the correct document using the Review feature and examining the form details. Select Buy Now when ready, and choose the monthly subscription plan that suits your requirements. Click Download, then complete, eSign, and print the form. US Legal Forms has 25 years of experience assisting clients with their legal paperwork. Find the form you need right now and streamline any process without breaking a sweat.

- Explore the collection of pertinent documents accessible to you with a single click.

- US Legal Forms offers you state- and county-specific documents available for download at any time.

- Safeguard your document management processes using a high-quality service that allows you to prepare any form in minutes with no extra or hidden fees.

- Just Log In to your account, locate Third Party Special Needs Trust Form With IRS, and download it immediately from the My documents section.

- You can also retrieve previously downloaded documents.

Form popularity

FAQ

In these circumstances, the Form 1041 is very simple to complete. The trustee will check the box on Form 1041 indicating that the trust is a grantor trust and provide some general information about the trust (name, address, tax identification number, and the date the trust was established).

Tax Information Authorization You can use Form 8821 to allow the IRS to discuss your tax matters with designated third parties and, where necessary, to disclose your confidential tax return information to those designated third parties on matters other than just the processing of your current tax return.

In the case of third party special needs trusts, if the trust is considered a grantor trust, all items of income, deduction and credit are generally taxed to the individual(s) who created and funded the trust (typically parents or other relatives of the individual with a disability).

A Special Needs Trust must have its own Federal Identification Number (also called an Employer Identification Number, EIN, Tax Identification Number, or TIN) to be valid. This unique number means that the Trust is its own entity, and that it does not belong to anyone but itself.

Whether or not you need an EIN for a trust depends on the type of trust. Generally, grantor revocable trusts do not need an EIN. Any income taxes from a revocable trust is reported via the grantor's SSN since the grantor can revoke the trust at any time and regain possession of the property.