3rd Party Special Needs Trust Form With Bank Account

Description

How to fill out Trust Agreement - Family Special Needs?

Managing legal documents and tasks can be a lengthy addition to your entire day.

3rd Party Special Needs Trust Form With Bank Account and documents like it typically necessitate that you search for them and comprehend how to fill them out correctly.

For this reason, whether you are addressing financial, legal, or personal issues, having a comprehensive and efficient online repository of forms at your disposal will be very beneficial.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific documents and a variety of tools to help you complete your paperwork swiftly.

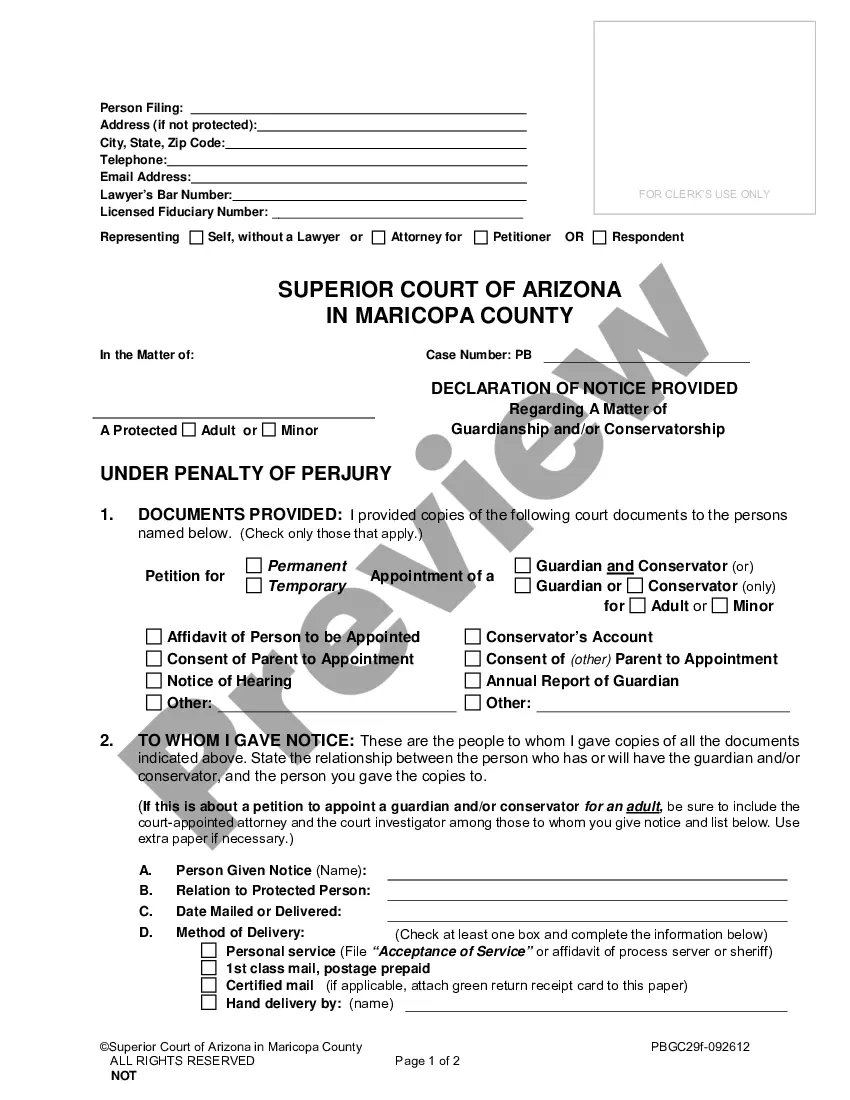

Is this your first time using US Legal Forms? Sign up and create an account in just a few minutes, granting you access to the form library and 3rd Party Special Needs Trust Form With Bank Account. Then, follow the steps outlined below to complete your form: Ensure you have the correct document by utilizing the Preview feature and reviewing the form details. Select Buy Now when you are prepared, and choose the subscription plan that suits your requirements. Click Download then fill out, eSign, and print the document. US Legal Forms has twenty-five years of experience assisting clients manage their legal documents. Acquire the form you need today and simplify any process effortlessly.

- Explore the collection of relevant documents available with just one click.

- US Legal Forms delivers you state- and county-specific documents accessible at any time for downloading.

- Safeguard your document management processes with a high-quality service that allows you to create any form in minutes without extra or hidden charges.

- Simply Log In to your account, locate 3rd Party Special Needs Trust Form With Bank Account and download it immediately in the My documents section.

- You can also reach previously downloaded documents.

Form popularity

FAQ

It cannot be paid to a trust. If you are receiving Social Security by direct deposit, you should leave the account that receives the payments outside of your trust.

A Special Needs Trust (SNT) allows for a disabled person to maintain his or her eligibility for public assistance benefits, despite having assets that would otherwise make the person ineligible for those benefits. There are two types of SNTs: First Party and Third Party funded.

Cons of Special Needs Trusts The trust must be maintained, and yearly management costs can be high. Depending on who manages the fund, there may be a minimum amount required to set up the trust. It may be financially difficult for the settlor to actually establish the trust, depending upon their circumstances.

The trustee works in very close contact with the beneficiary and/or their caregiver to manage the trust and its financial distributions to pay for these things. The main takeaway regarding distribution of SNT funds is this: The beneficiary never sees the money directly, but the money is used to pay for their needs.

The Trustee simply transfers all assets to the beneficiary. Distribution is also fairly easy if the trust document identifies all assets and specific amounts to be paid to each beneficiary. Distributions by percentages are a little more complicated as the Trustee should first establish the estate's fair market value.