Seller Financing Vs Contract For Deed

Description

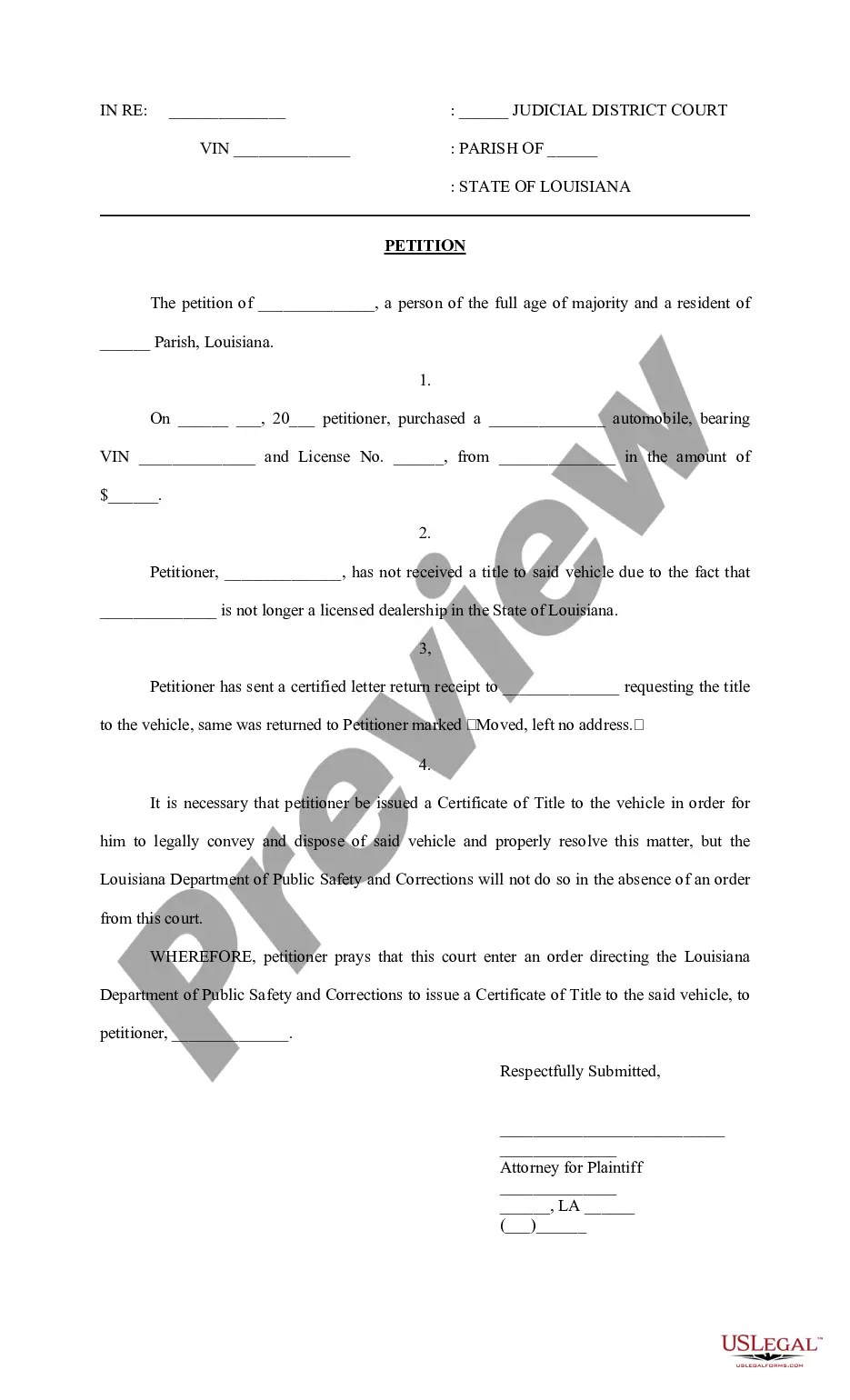

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Seller To Finance Part Of Purchase Price?

Creating legal documents from the ground up can frequently be somewhat daunting. Certain situations may require extensive research and significant financial commitment. If you’re looking for a more straightforward and cost-effective method of drafting Seller Financing Vs Contract For Deed or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can promptly obtain state- and county-specific forms meticulously compiled for you by our legal experts.

Utilize our platform whenever you require dependable and trustworthy services through which you can swiftly find and download the Seller Financing Vs Contract For Deed. If you’re already familiar with our services and have set up an account before, simply Log In to your account, find the form, and download it or re-download it anytime later in the My documents section.

Not registered yet? No problem. Registering takes just a few minutes, and navigating the catalog is easy. However, before diving directly into downloading Seller Financing Vs Contract For Deed, consider these tips.

US Legal Forms enjoys a solid reputation and boasts over 25 years of experience. Join us today and make document completion a simple and efficient process!

- Review the document preview and descriptions to confirm that you are on the correct form.

- Ensure that the form you choose meets the standards of your state and county.

- Select the most appropriate subscription option to acquire the Seller Financing Vs Contract For Deed.

- Download the form. Then fill it out, sign it, and print it.

Form popularity

FAQ

To correctly execute a contract for deed, both parties should clearly outline the terms, including payment schedules and responsibilities for maintenance. It’s essential to ensure that the document complies with local laws to avoid future disputes. Understanding the differences between seller financing vs contract for deed can help you choose the best option for your situation. Consider utilizing USLegalForms to access templates and guidance for drafting your contract accurately.

One downside of seller financing is the potential for higher interest rates compared to traditional loans. Additionally, sellers may have stricter requirements for buyers, which can limit options. By weighing the pros and cons of seller financing vs contract for deed, you can make informed decisions about your real estate transactions.

Although seller financing and contract for deed share similarities, they are not the same. Seller financing allows buyers to receive the property title while making payments, while a contract for deed keeps the title with the seller until the full payment is made. Understanding these nuances is essential when navigating seller financing vs contract for deed.

A contract for deed is often referred to as a land contract or installment sale agreement. This terminology highlights the nature of the agreement, which allows the buyer to make payments over time while the seller retains ownership. Familiarizing yourself with these terms can clarify discussions about seller financing vs contract for deed.

Owner financing involves greater risk for sellers compared to traditional lenders. This means that buyers often have to pay higher interest rates and make higher loan payments over the life of the loan. Owner Financing: Definition, Example, Advantages, and Risks investopedia.com ? terms ? owner-financing investopedia.com ? terms ? owner-financing

Risks of a Contract for Deed Even one late payment can result in much higher penalties and fees, not to mention possible legal action from the seller (including kicking the homebuyer out of the home without recouping any money they have paid while living there).

A contract for deed is a type of seller financing, where the seller agrees to give possession of the property to the buyer immediately. The buyer makes payments directly to the seller, usually monthly, over a period of time agreed upon by both parties and established within the contract. A Guide to Contract for Deed - ? blog ? guide-to-contract-... ? blog ? guide-to-contract-...

Here's a quick look at some of the most common types of seller financing. All-inclusive mortgage. In an all-inclusive mortgage or all-inclusive trust deed (AITD), the seller carries the promissory note and mortgage for the entire balance of the home price, less any down payment. Junior mortgage. Seller Financing: How It Works in Home Sales | Nolo nolo.com ? legal-encyclopedia ? seller-finan... nolo.com ? legal-encyclopedia ? seller-finan...

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate. Contract For Deed ? Advantages and Disadvantages - Maitin Law Firm maitinlaw.com ? 2020/02/21 ? contract-for-... maitinlaw.com ? 2020/02/21 ? contract-for-...