Charible Trust

Description

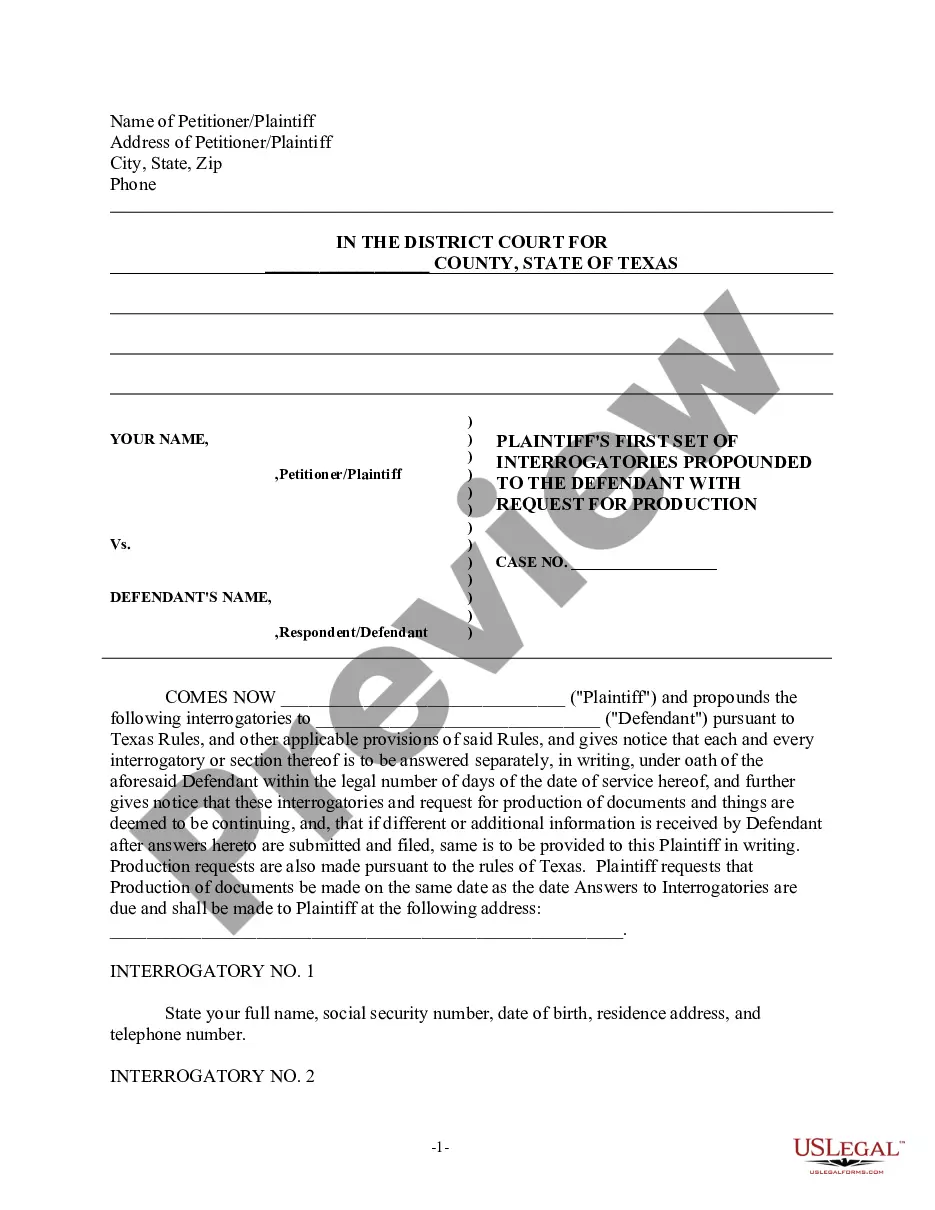

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

- If you're an existing user, log in to your account and select the desired form template. Ensure your subscription remains active, or renew it as necessary.

- Review the form options in Preview mode to confirm you’ve chosen the right charible trust document suited for your locale.

- If the template isn't quite right, use the Search feature to explore other options that fit your requirements better.

- Once you find the appropriate template, click the Buy Now button and select your preferred subscription plan to access the full library.

- Complete the purchase by entering your payment details via credit card or PayPal account.

- Download your chosen form and save it locally. You can also find it later in the My Forms section of your profile.

With US Legal Forms, accessing the right legal documents is made simple and efficient. Each form is designed to meet specific needs while maintaining compliance with state regulations. Enjoy the extensive resources available, and if any assistance is needed, premium experts are available for support.

Take control of your charible trust preparation today with US Legal Forms. Start your journey now!

Form popularity

FAQ

The tax advantages of a charitable trust include potential income tax deductions, reduced estate taxes, and avoidance of capital gains tax on appreciated assets. By donating assets to a charitable trust, you not only support meaningful causes but also enhance your financial situation. Consider exploring tools like USLegalForms for easy access to the necessary documents to establish a charitable trust.

Choosing between a charitable trust and a foundation depends on your specific goals. A charitable trust may provide more immediate tax benefits and handles funds more flexibly, while a foundation offers ongoing funding capabilities for various causes. Evaluate your philanthropic desires and consult with a professional to determine which option serves you best.

A charitable trust is a legal arrangement where one party transfers assets to a trust for charitable purposes. The assets are managed by a trustee and can generate income for the designated charity while benefiting the donor with tax advantages. Essentially, this trust allows you to maintain a connection to your assets while ensuring your philanthropic goals are met.

A charitable trust can avoid capital gains tax by donating appreciated assets directly to the trust. This eliminates the need to sell the asset and incur capital gains tax on the profit. By doing so, you can transfer wealth, support charitable organizations, and benefit from potential tax deductions, all while adhering to the regulations surrounding charitable trusts.

Charitable trusts offer significant tax benefits, including income tax deductions for contributions made to the trust. This means you can lower your taxable income while supporting the charities you care about. Moreover, your estate may benefit from reduced estate taxes, enhancing your overall financial planning when utilizing a charitable trust.

A major advantage of a charitable trust is that it allows individuals to support charitable causes while also providing financial benefits. By setting up a charitable trust, you can contribute assets to a charity and maintain some control over how those assets are used. Additionally, this structure can lead to reduced estate taxes, making it a powerful tool for philanthropic efforts.

The 5% rule refers to the minimum payout required from a charitable remainder trust each year. This rule mandates that a charity must receive at least 5% of the trust's value, which can help keep your charitable intentions intact while generating income for you or your beneficiaries. Understanding this rule is crucial for effective estate planning, and US Legal Forms offers tools to help navigate the complexities of charitable trusts.

A charitable trust is a legal arrangement that allows you to allocate funds for charitable purposes. For instance, consider a trust created to benefit a local scholarship fund for underprivileged students. By establishing this charitable trust, you ensure that the funds assist those in need, while also enjoying potential tax benefits. Utilizing a resource like US Legal Forms can help you set up your charitable trust effectively.

Not all trusts are required to file a tax return. A trust must file if it has taxable income or meets certain other criteria outlined by the IRS. However, if its income falls below a set threshold, it may not need to file. Understanding the intricacies of tax obligations regarding charitable trusts is crucial, and resources at USLegalForms can assist you.

The rules for a charitable trust include ensuring that the trust exclusively benefits charitable purposes. Generally, these trusts must adhere to specific regulations about distribution and operations. They must also comply with federal and state laws regarding tax-exempt status. Establishing a charitable trust can be simplified with the right guidance, like that provided by USLegalForms.