Promissory Note Form Sample With Personal Guarantee

Definition and meaning

A promissory note is a legal document that outlines a promise from one party (the borrower) to pay a specific sum of money to another party (the lender) under agreed-upon terms. A 'Promissory Note Form Sample with Personal Guarantee' is a specific type of promissory note that includes a personal guarantee from the borrower, meaning that the borrower agrees to be personally responsible for repaying the loan if the primary borrower defaults. This form is a critical tool for securing loans, as it formalizes the agreement and provides legal recourse in case of non-payment.

How to complete a form

Completing a promissory note form with a personal guarantee involves several steps:

- Gather the necessary information: You will need the names and addresses of both the borrower and the lender, the loan amount, the interest rate, and the terms of repayment.

- Fill in the details: Start filling out the form, ensuring you clearly state the loan amount, payment schedules, and interest rates.

- Include a personal guarantee: The borrower must acknowledge the personal guarantee by signing in the designated area. This confirms their commitment to repay the loan.

- Review for accuracy: Double-check all the information provided to ensure it is correct and complete.

- Sign and date: Both parties should sign and date the document to make it effective.

Finally, it may be advisable to have the document notarized to enhance its legitimacy.

Who should use this form

This form is suitable for individuals or entities who are borrowing money and wish to formalize the loan agreement. It is particularly useful for:

- Individuals seeking personal loans from friends, family, or private lenders.

- Small business owners needing funds for operational or startup costs.

- Those looking for a clear, legally binding agreement to safeguard both the borrower and lender's interests.

This form can help ensure that all parties understand their obligations and provides a clear path for recourse in case of a default.

Key components of the form

A typical promissory note form with a personal guarantee includes the following key components:

- Loan Amount: Specifies the exact amount borrowed.

- Interest Rate: Details the annual interest rate applied to the loan.

- Repayment Terms: Outlines the schedule for repayment, including due dates and payment methods.

- Personal Guarantee: Indicates that the borrower personally agrees to repay the debt.

- Signatures: Requires the signatures of both the borrower and lender to validate the agreement.

Including these components ensures that the form is comprehensive and legally enforceable.

Common mistakes to avoid when using this form

When completing a promissory note form with a personal guarantee, avoid the following common mistakes:

- Failing to include all essential details, such as the loan amount, interest rate, and repayment schedule.

- Not obtaining proper signatures from all parties involved.

- Overlooking the importance of a personal guarantee if required to enhance security for the lender.

- Rushing through the completion of the form without reviewing for accuracy.

- Neglecting to have the form notarized, which could weaken its enforceability.

Avoiding these pitfalls can help ensure that the instrument is valid and binding.

How to fill out Security Agreement For Promissory Note?

Creating legal documents from the ground up can occasionally be daunting.

Specific situations may require extensive research and considerable financial investment.

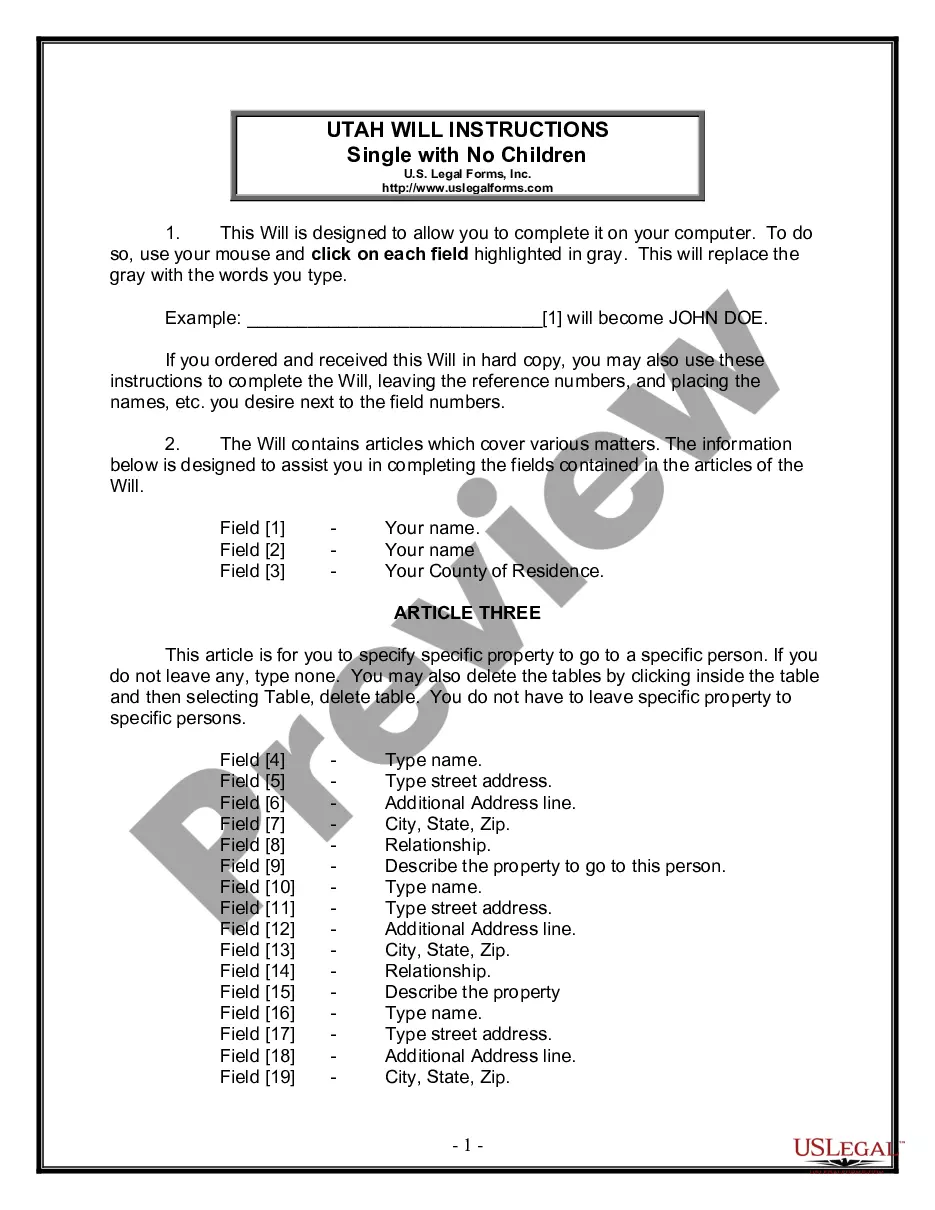

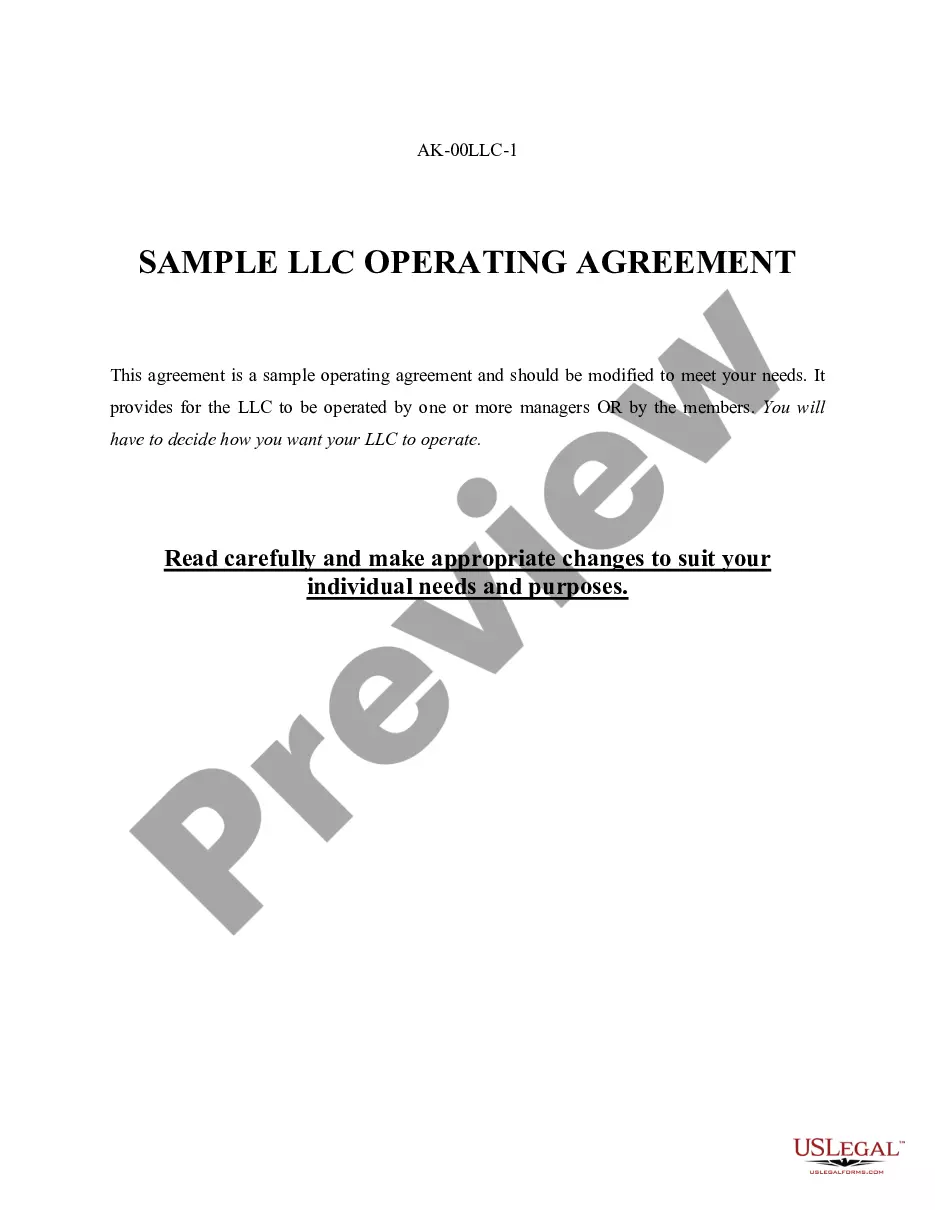

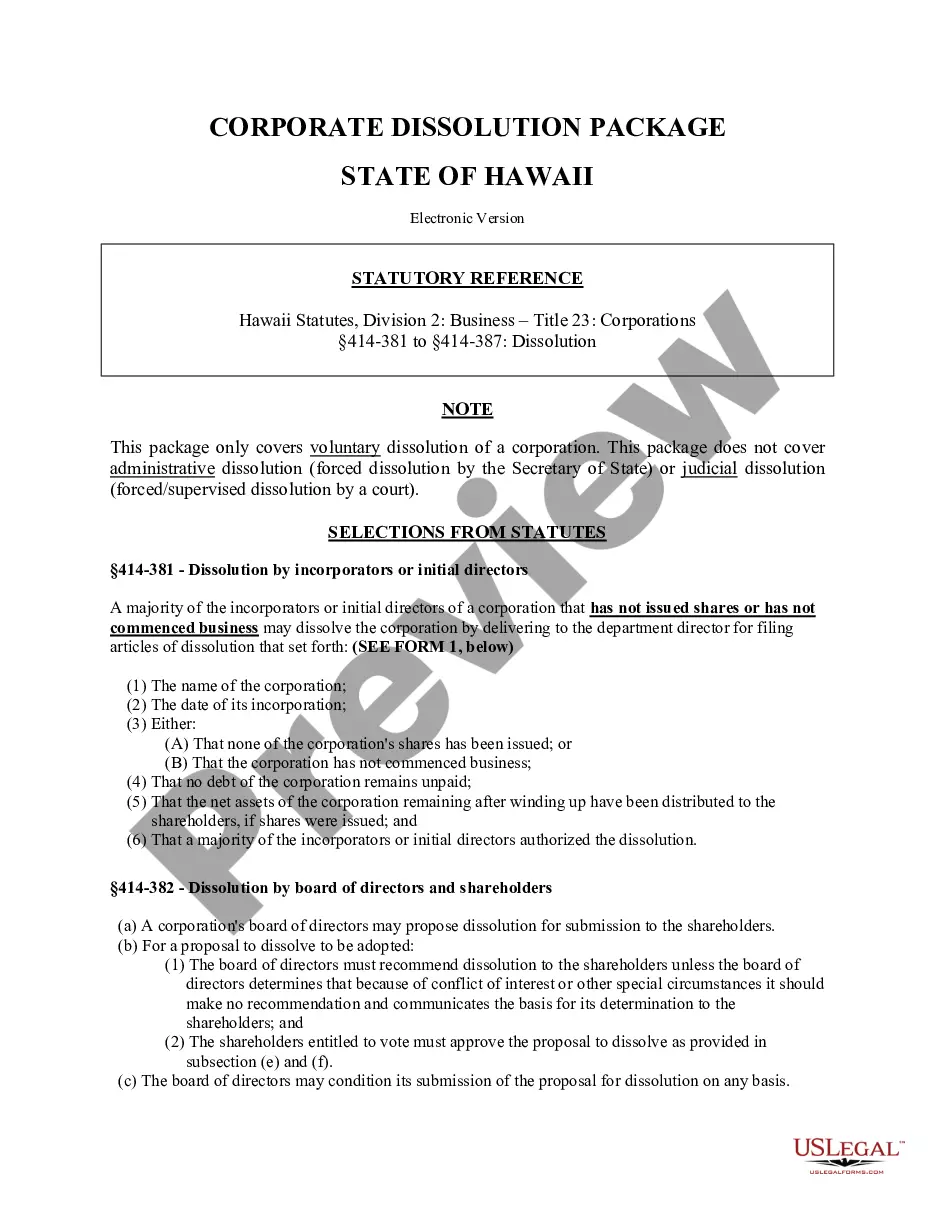

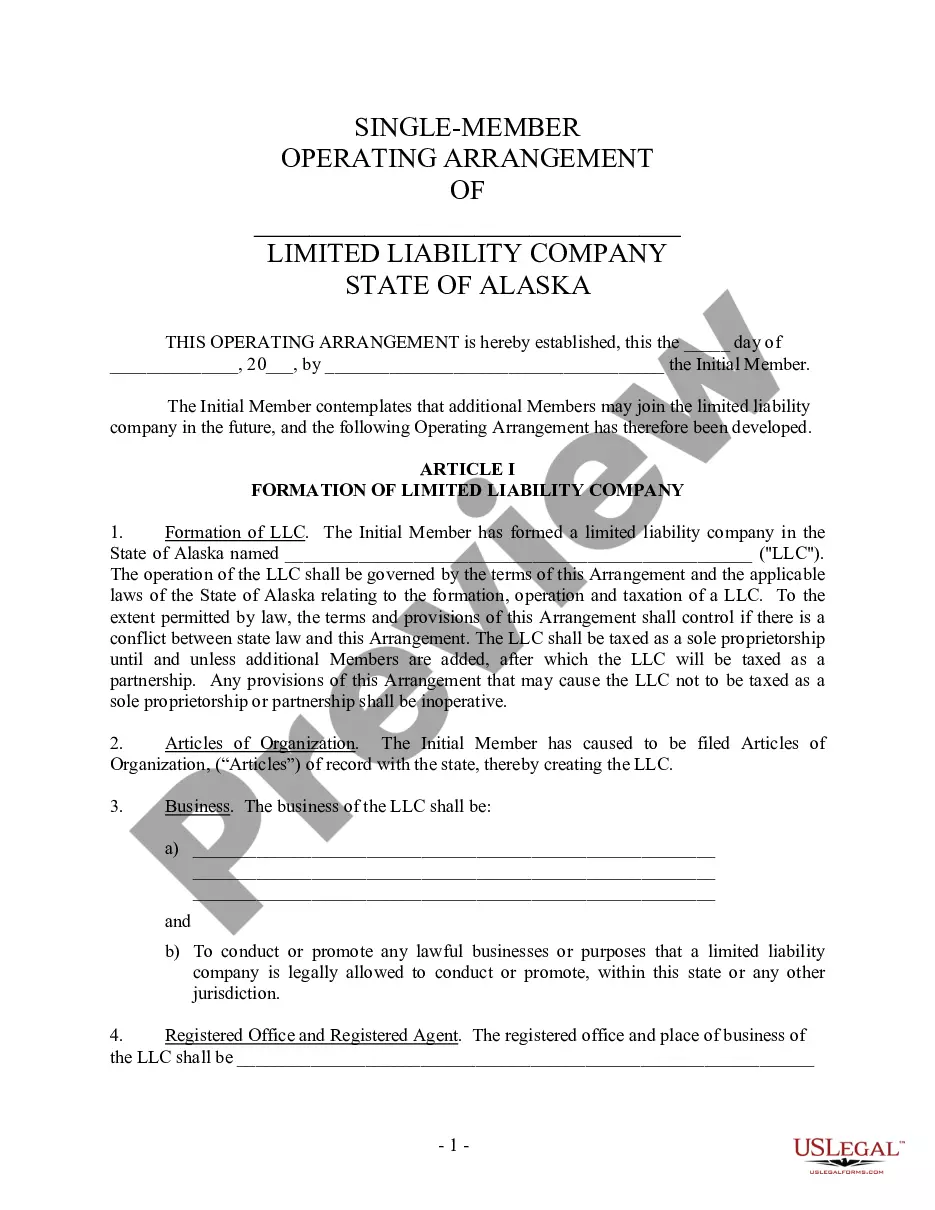

If you seek a more direct and cost-effective method of generating Promissory Note Form Sample With Personal Guarantee or any other documentation without the hassle of complicated processes, US Legal Forms is always available.

Our online repository of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters.

However, before proceeding directly to download the Promissory Note Form Sample With Personal Guarantee, consider these recommendations: Ensure to check the form preview and descriptions to confirm you've found the desired form. Verify that the selected form aligns with the laws and regulations of your state and county. Choose the most suitable subscription option to obtain the Promissory Note Form Sample With Personal Guarantee. Download the document, complete it, sign it, and print it out. US Legal Forms has a solid reputation and over 25 years of expertise. Join us today and simplify your form completion process!

- With just a few clicks, you can swiftly access state- and county-specific forms meticulously prepared for you by our legal experts.

- Utilize our website anytime you require trustworthy and dependable services through which you can promptly find and download the Promissory Note Form Sample With Personal Guarantee.

- If you are a returning user with a registered account, simply Log In to access your account, locate the form, and download it immediately or re-download it at any time from the My documents section.

- Not signed up yet? No problem. Registering only takes a few minutes, allowing you to explore the library.

Form popularity

FAQ

Chat What are advance directives? ... Living Will. ... Durable Power of Attorney. ... Uniform Anatomical Gift Act. ... Patient SelfDetermination Act. ... Human rights. ... Civil Rights. ... Client Rights.

Types of Advance Directives The living will. Durable power of attorney for health care/Medical power of attorney. POLST (Physician Orders for Life-Sustaining Treatment) Do not resuscitate (DNR) orders. Organ and tissue donation.

How do I write a Living Will in Vermont? Make the document - Provide a few simple details, and we will do the rest. Send and share it - Look over it with your healthcare agent or ask a lawyer. Sign and make it legal - Required or not, witnesses and notarization are a best practice.

It is a secure online database where Vermonters can submit copies of their completed advance directive forms to be accessed by authorized health care facilities and providers.

Traditionally, there are two main kinds of advance directives: the living will and the Durable Power of Attorney for Healthcare. California also allows the use of a POLST (Physician's Orders For Life-Sustaining Treatment).

A specific and common example of an advance directive is a ?do not resuscitate? order (or DNR), which guides care only if your heart stops beating (cardiac arrest) or you are no longer breathing.

The two most common advance directives for health care are the living will and the durable power of attorney for health care. Living will: A living will is a legal document that tells doctors how you want to be treated if you cannot make your own decisions about emergency treatment.

The most common types of advance directives are the living will and the durable power of attorney for health care (sometimes known as the medical power of attorney). There are many advance directive formats.