Promissory Note Secured For Payment

Description

How to fill out Multistate Promissory Note - Secured?

Properly created official documentation is one of the essential assurances for preventing issues and legal disputes, but obtaining it without assistance from a lawyer may require some time.

Whether you need to swiftly locate a current Promissory Note Secured For Payment or any other templates for employment, family, or business purposes, US Legal Forms is always available to assist.

The process is even simpler for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button beside the selected file. Additionally, you can access the Promissory Note Secured For Payment anytime later, as all documents ever procured on the platform are accessible within the My documents tab of your profile. Save time and money on preparing formal documents. Experience US Legal Forms today!

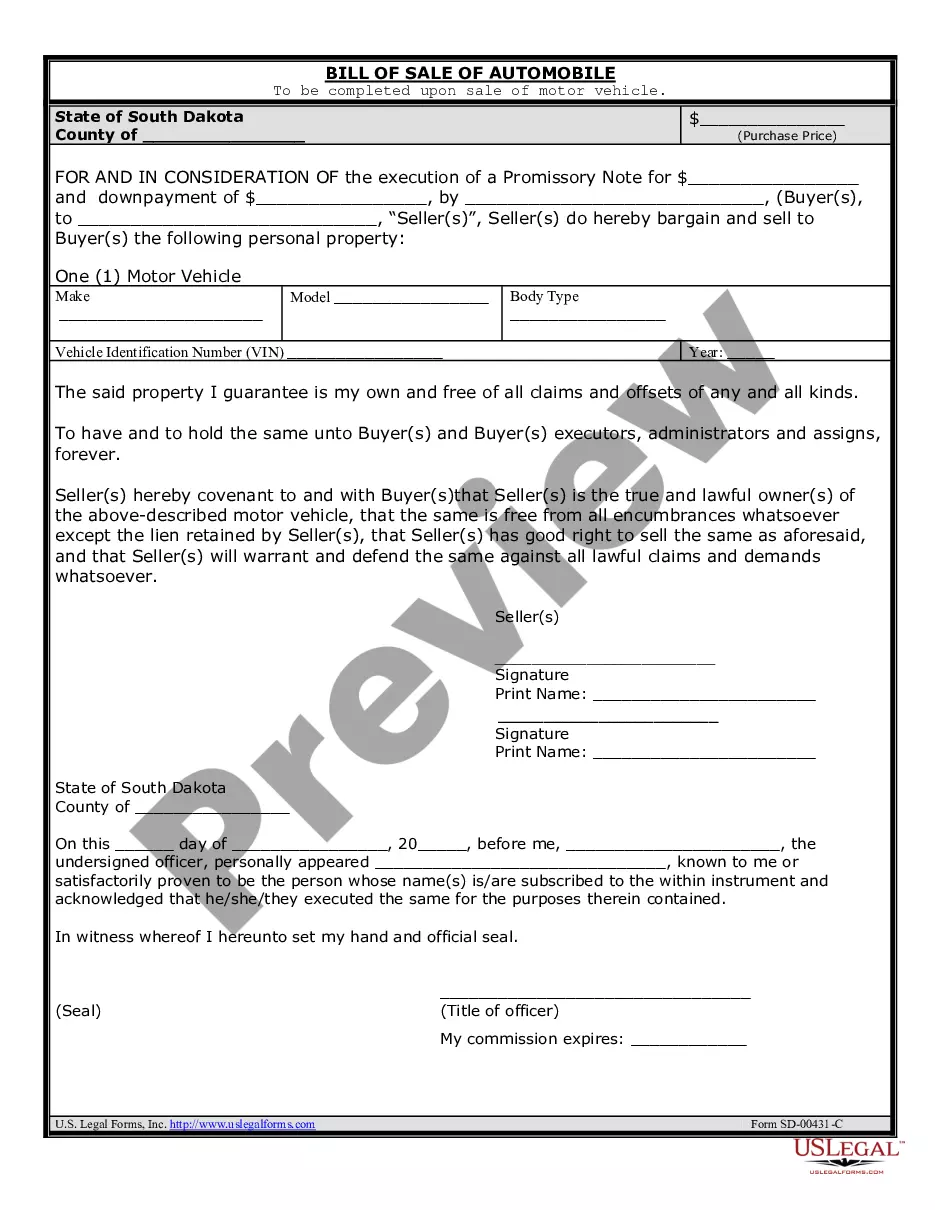

- Verify that the form is appropriate for your situation and locality by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Press Buy Now once you find the correct template.

- Select the pricing plan, sign in to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Promissory Note Secured For Payment.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Two other methods of perfection are available both to outright buyers of promissory notes and to persons who take security interests in them. Those methods are (1) filing of a financing statement (§ 9-312(a)) and (2) taking possession of the note (A§ 9-313(a)).

Secured Promissory NotesA secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

How To Collect On a Promissory NoteStatute of Limitations.Organize All Related Documentation.Contact the Borrower.Hire an Attorney.Have Your Attorney Contact the Borrower.File Suit Against the Borrower.Enforce the Court's Decision.Collection Through a Third Party.More items...?