Certificate Of Completion For Insurance Company

Description

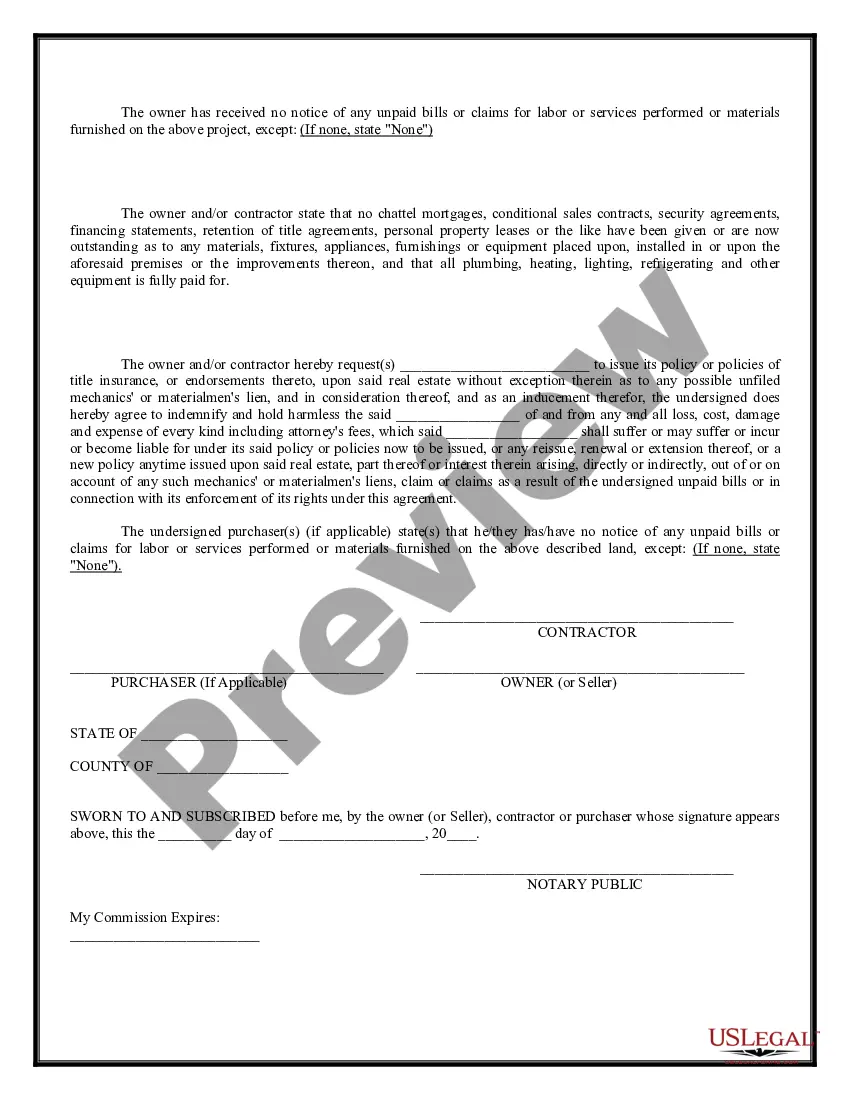

How to fill out Owner's And Contractor Affidavit Of Completion And Payment To Subcontractors?

Handling legal paperwork can be daunting, even for the most seasoned professionals.

When you are looking for a Certificate Of Completion For Insurance Company and lack the time to invest in finding the suitable and current version, the journey can be anxiety-inducing.

US Legal Forms accommodates any requirements you may have, from personal to business paperwork, all in one location.

Utilize advanced tools to complete and manage your Certificate Of Completion For Insurance Company.

Here are the steps to take after locating the form you need: Confirm it is the correct document by previewing it and reviewing its details.

- Tap into a valuable resource center of articles, guides, and manuals that are pertinent to your needs and circumstances.

- Save time and energy searching for the documents you need by using US Legal Forms’ sophisticated search and Review tool to locate Certificate Of Completion For Insurance Company and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Visit the My documents tab to review the documents you've previously downloaded and to organize your folders as you prefer.

- If it's your first experience with US Legal Forms, register for an account and gain unlimited access to all the platform's benefits.

- A comprehensive online form repository could be a game changer for anyone aiming to handle these scenarios effectively.

- US Legal Forms is a leading provider of online legal documents, with over 85,000 state-specific forms available for your convenience.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

To file an insurance claim, start by gathering all necessary documents, including your certificate of completion for insurance company. Then, contact your insurance provider to notify them about the incident. They will guide you through the claims process, ensuring you submit all required forms and provide appropriate details.

Admitting fault: Using apologetic language is enough for the insurance adjuster to assume you're admitting fault and use that against you. Even if you feel you're at fault, wait for the official investigation to prove what actually happened. Don't say things like ?I'm sorry? or ?it was my fault.?

A completion invoice (also known as a Certificate of Completion or Notice of Completion) is a bill the contractor sends the insurance company upon completion of the project so that the carrier will release the depreciation payment.

How to make a claim Step 1: File a police report. ... Step 2: Document any damage. ... Step 3: Review your coverage. ... Step 4: Contact your insurance company. ... Step 5: Prepare for the insurance adjuster. ... Step 6: Review the settlement offer. ... Step 7: Receive the claim payment and repair the damage.

Follow these four simple steps to file a claim: 1.Claim intimation/notification. ... 2.Documents required for claim processing. ... 3.Submission of required documents for claim processing. ... 4.Settlement of claim.

In most instances, an adjuster will inspect the damage to your home and offer you a certain sum of money for repairs, based on the terms and limits of your homeowner's policy. The first check you get from your insurance company is often an advance against the total settlement amount, not the final payment.