Property Transfer Act In Marathi

Description

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

Acquiring legal documents that comply with federal and local laws is crucial, and the web provides numerous alternatives to select from.

However, what's the advantage of spending time searching for the suitable Property Transfer Act In Marathi example online when the US Legal Forms online repository already compiles such documents in one location.

US Legal Forms is the top online legal directory featuring over 85,000 editable documents created by attorneys for any professional and personal situations. They are straightforward to navigate with all files categorized by state and intended use.

Find another template using the search function at the top of the page if necessary. Click Buy Now once you’ve identified the appropriate form and choose a subscription package. Create an account or Log In and process payment through PayPal or a credit card. Choose the best format for your Property Transfer Act In Marathi and download it. All templates you discover via US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- Our experts keep pace with legal updates, ensuring that your form is current and compliant when acquiring a Property Transfer Act In Marathi from our site.

- Obtaining a Property Transfer Act In Marathi is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document template you need in the correct format.

- If you are a newcomer to our site, follow the steps outlined below.

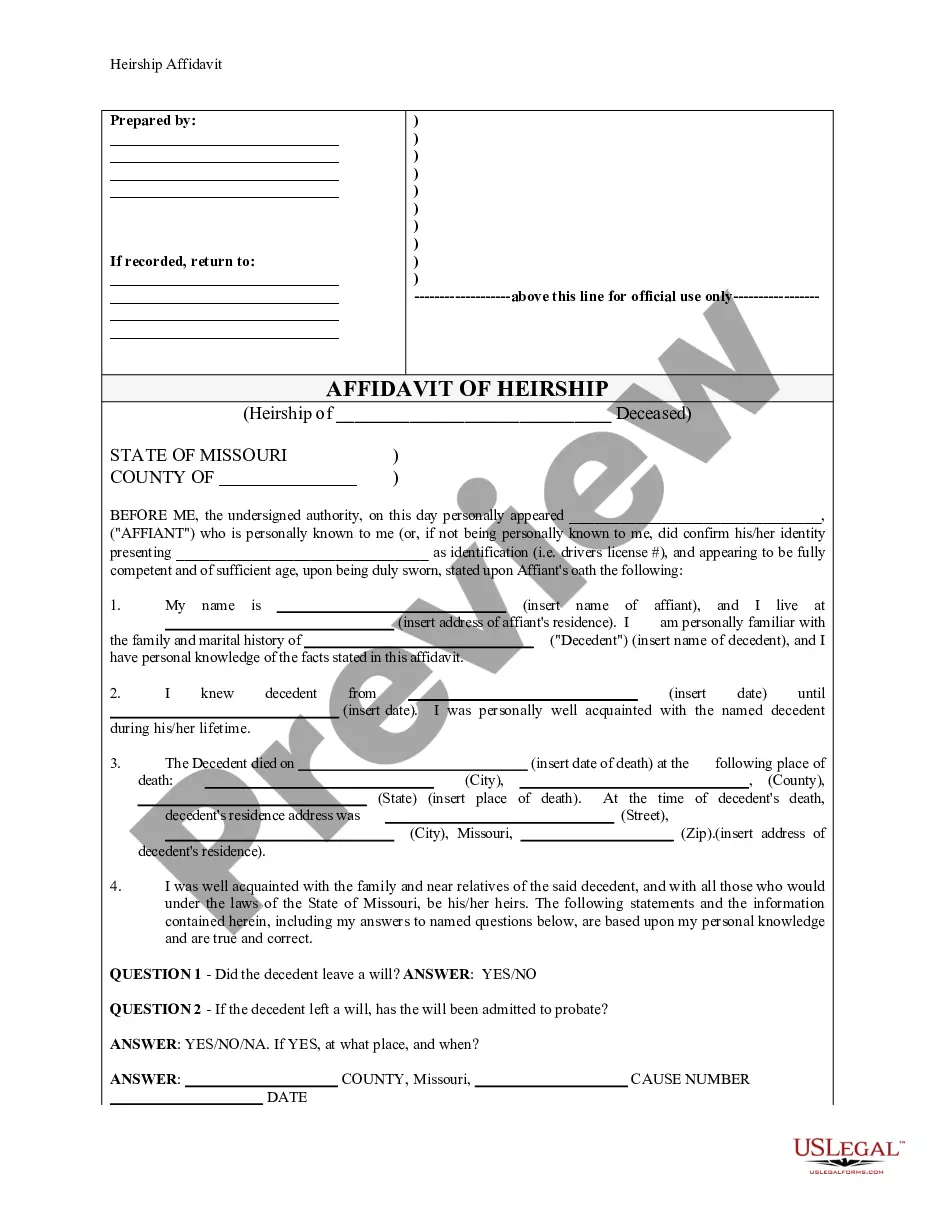

- Review the template using the Preview feature or through the text description to confirm it meets your requirements.

Form popularity

FAQ

Section 33 of the Transfer of Property Act addresses the concept of contingent remainders. It explains how property transfers can be subject to certain conditions being met before the ownership can pass. This section is vital for those involved in estate planning or property investments, and accessing the Property transfer act in marathi can provide valuable context and clarity on these legal stipulations.

The Transfer of Property Act covers various aspects of property rights, including the sale, lease, mortgage, and exchange of property. It provides guidelines on how transfers should occur, the rights of both parties, and the conditions under which transfers may be deemed invalid. For a deeper understanding, the Property transfer act in marathi is an essential resource that simplifies these complex legal concepts.

Section 49 of the Transfer of Property Act deals with the consequences of a property transfer that is not registered. This section emphasizes that any unregistered document can affect the rights of the parties involved but may not be admissible as evidence in court. Understanding this section is crucial for anyone looking to engage in property transactions and the Property transfer act in marathi can help clarify these important details.

The Transfer of Property Act is a key legislation that governs the transfer of property rights in India. This act outlines the legal framework for the transfer of ownership, ensuring clarity and protection for both buyers and sellers. For those seeking information in their native language, the Property transfer act in marathi provides comprehensive insights into these processes.

Maharashtra. In Maharashtra, only a amount of Rs 200 has to be paid as the stamp duty, if a residential or agricultural property is being gifted to the spouse, children, grandchildren or the wife of a son after his demise. This is irrespective of the value of the property.

For the property transfer, you will require applying at your respective district's sub-registrar's office. You must possess the ownership document and the will or the succession certificate. If there is no will, you will be required to produce an affidavit and a no-objection certificate.

However, 2.5 per cent of the property value has to be paid as stamp duty in case the property is being transferred in the name of father, mother, son, sister, daughter-in-law, grandson or daughter as a gift.

Documents Required to transfer property from father to son Will/ testament. Certified copy of death certificate of the father. Succession Certificate. No-obligation certificate from the other successors/heirs along with the affidavit. Lineage list certificate. Relinquishment deed (if required) Gift deed (if required)

Documents Required for property transfer after death of husband Will/ testament. Probate or Letter of Administration. Certified copy of death certificate of the testator. property deed and the identity proof of the person(s) for which the transfer of will is executed. Partition deed executed among the legal heirs.