If you are in need of a comprehensive and easily understandable loan agreement format in Tamil, look no further. A simple loan agreement format in Tamil is a legally binding document that outlines the terms and conditions of a loan between two parties. This agreement serves as a proof of transaction and helps protect both the lender and the borrower. The key components of a simple loan agreement format in Tamil include the names and contact information of the parties involved, the loan amount, the interest rate (if applicable), the repayment terms, late payment penalties (if any), and the details of collateral (if provided). It is crucial for both parties to carefully review and understand every provision of the agreement before signing. In Tamil Nadu, there are various types of simple loan agreement formats that cater to different loan scenarios. Some of these formats include: 1. Personal Loan Agreement: This agreement is used for loans between individuals for personal purposes such as education, health, or home repairs. 2. Business Loan Agreement: Specifically designed for enterprises, this agreement captures the terms and conditions of a loan provided for business-related activities, such as capital investments or expansion projects. 3. Microfinance Loan Agreement: Often employed by microfinance institutions, this agreement outlines the terms for small-scale loans to individuals or groups involved in income-generating activities. 4. Vehicle Loan Agreement: This agreement is utilized when lending money for the purchase of a vehicle, including terms like vehicle details, repayment duration, and insurance requirements. 5. Mortgage Loan Agreement: Typically used for real estate transactions, this agreement sets out the terms for a loan secured by a property, specifying repayment terms, interest rates, and the consequences of default. In conclusion, a simple loan agreement format in Tamil is an essential tool for documenting the terms and conditions of a loan. Understanding the different types of loan agreements available in Tamil Nadu ensures that you select the most appropriate format for your specific loan requirements.

Simple Loan Agreement Format In Tamil

Description

How to fill out Simple Loan Agreement Format In Tamil?

Legal document management can be frustrating, even for knowledgeable experts. When you are interested in a Simple Loan Agreement Format In Tamil and do not get the time to devote trying to find the correct and updated version, the operations can be stress filled. A strong online form catalogue could be a gamechanger for everyone who wants to deal with these situations effectively. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and business forms. US Legal Forms handles any requirements you could have, from individual to business paperwork, all in one spot.

- Make use of innovative resources to accomplish and handle your Simple Loan Agreement Format In Tamil

- Access a resource base of articles, guides and handbooks and materials relevant to your situation and requirements

Help save effort and time trying to find the paperwork you need, and utilize US Legal Forms’ advanced search and Review tool to get Simple Loan Agreement Format In Tamil and acquire it. In case you have a membership, log in to the US Legal Forms profile, search for the form, and acquire it. Review your My Forms tab to find out the paperwork you previously saved and to handle your folders as you see fit.

If it is your first time with US Legal Forms, create an account and acquire unlimited usage of all advantages of the library. Here are the steps to take after downloading the form you need:

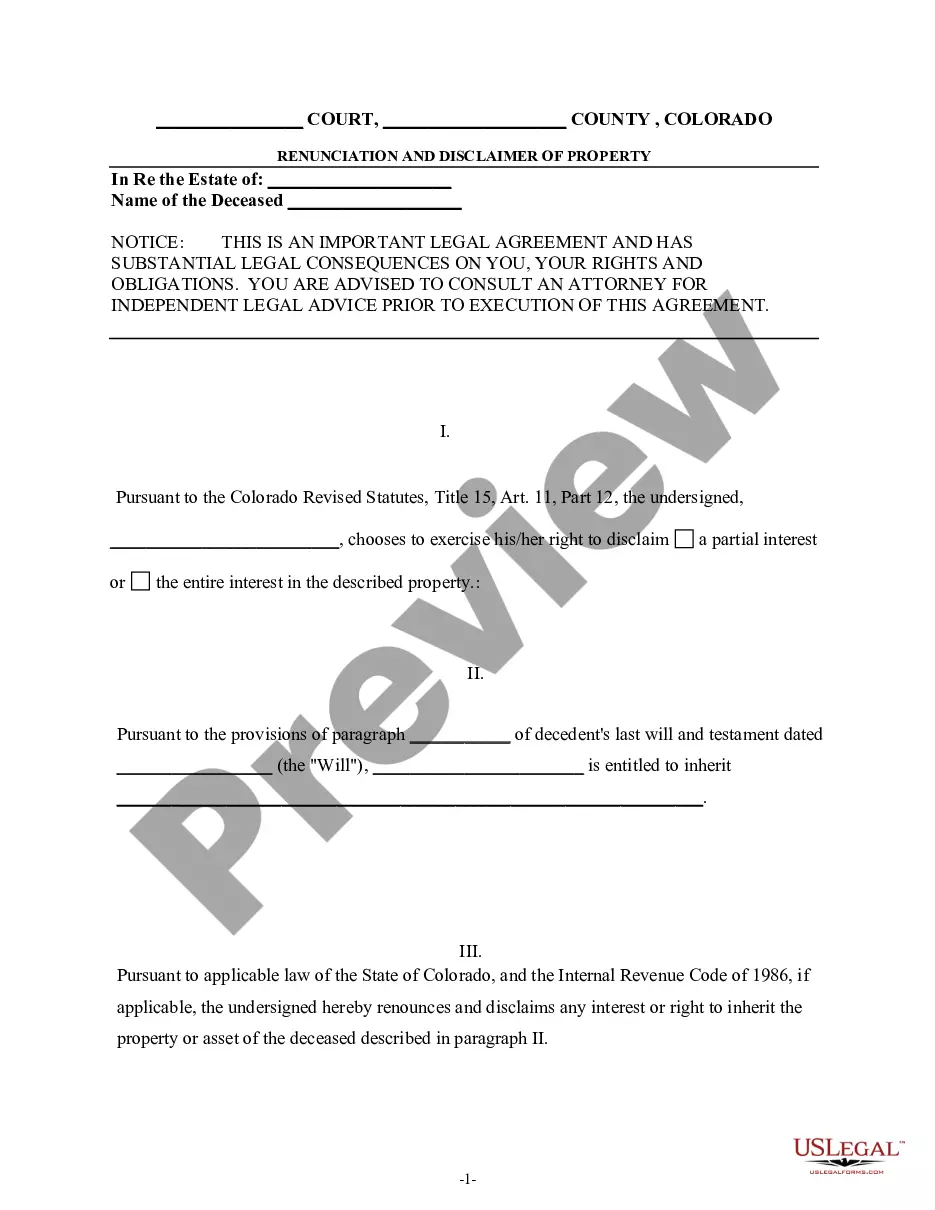

- Confirm this is the correct form by previewing it and looking at its information.

- Ensure that the sample is accepted in your state or county.

- Choose Buy Now when you are ready.

- Select a monthly subscription plan.

- Find the formatting you need, and Download, complete, sign, print out and send your document.

Take advantage of the US Legal Forms online catalogue, supported with 25 years of expertise and reliability. Enhance your day-to-day document management in to a easy and user-friendly process right now.

Form popularity

FAQ

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

However, the do-it-yourself approach is perfectly acceptable and just as legally enforceable. Once you have both agreed on the terms, you may want to have the personal loan contract notarized or ask a third party to act as a witness during the signing.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.