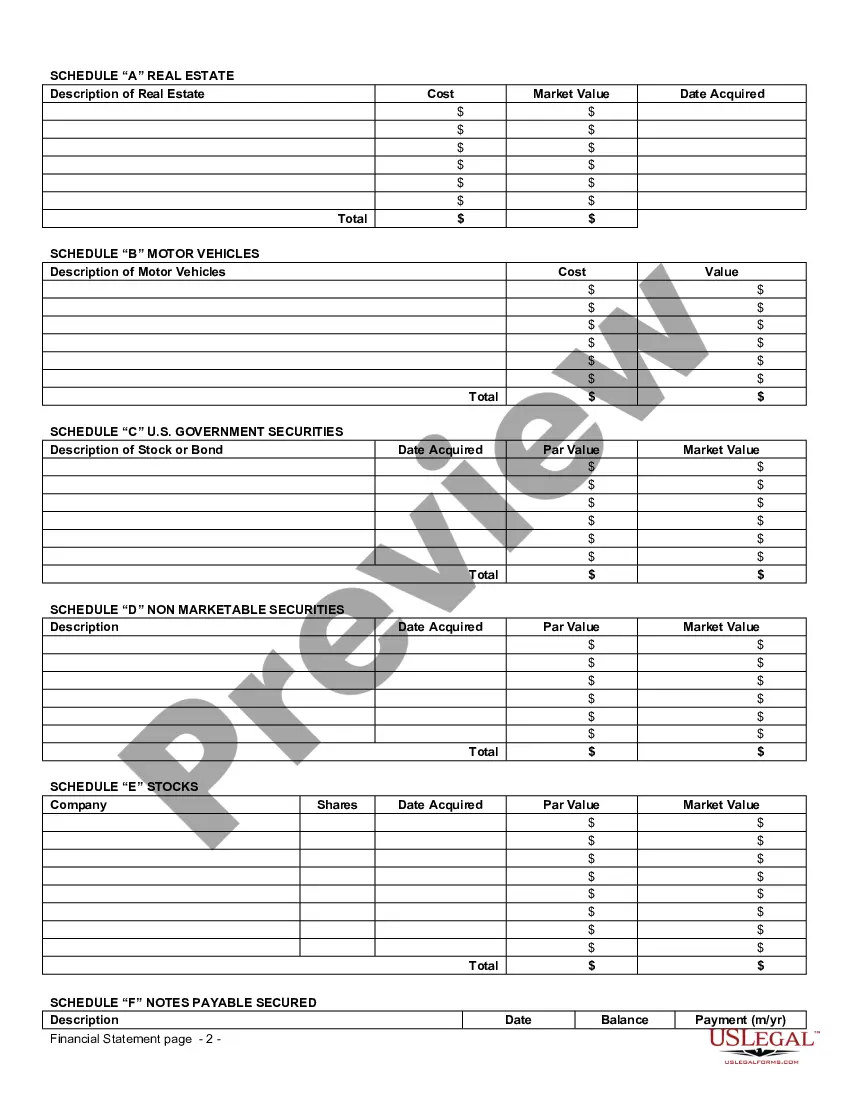

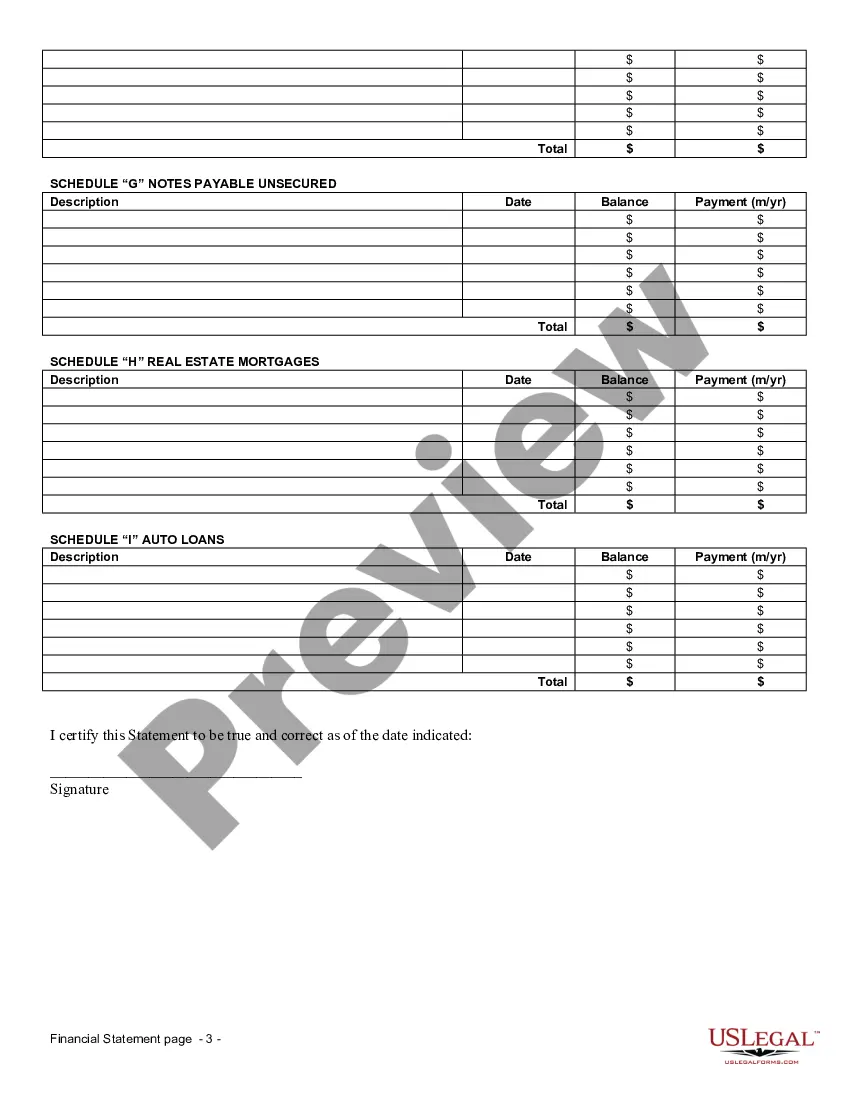

Financial Statement Format For Non Corporate Entities

Description

How to fill out Financial Statement Form - Individual?

Acquiring legal templates that adhere to federal and local regulations is essential, and the web provides a multitude of choices.

However, why waste time searching for the accurately crafted Financial Statement Format For Non Corporate Entities example online when the US Legal Forms online repository already compiles such templates in one location.

US Legal Forms is the premier online legal repository with more than 85,000 fillable templates created by attorneys for various professional and personal situations. They are easy to navigate, with all documents categorized by state and purpose.

Find another sample using the search function at the top of the page if necessary. Select Buy Now once you've located the appropriate form and choose a subscription plan. Create an account or Log In and make a payment via PayPal or credit card. Select the suitable format for your Financial Statement Format For Non Corporate Entities and download it. All templates available through US Legal Forms are reusable. To redownload and complete previously acquired forms, access the My documents tab in your account. Experience the broadest and user-friendly legal document service!

- Our experts keep abreast of legislative updates to ensure your documents remain current and compliant when obtaining a Financial Statement Format For Non Corporate Entities from our site.

- Acquiring a Financial Statement Format For Non Corporate Entities is straightforward and quick for both existing and new users.

- If you already have an account with an active subscription, Log In and store the document sample you require in the appropriate format.

- If you are new to our website, please follow the instructions below.

- Review the template using the Preview feature or through the text outline to ensure it meets your requirements.

Form popularity

FAQ

Yes, the balance sheet format is mandatory for non-corporate entities, including non-profits. This document must accurately reflect the organization's financial position at a specific point in time. Adhering to an appropriate financial statement format for non corporate entities, including the balance sheet, is vital for compliance and effective financial management.

The statement of financial position is mandatory for not-for-profit organizations. This statement outlines the assets, liabilities, and net assets, providing insight into the organization's financial stability. Utilizing the financial statement format for non corporate entities, including this mandatory document, enhances clarity and accountability.

Yes, your business needs a balance sheet as it is essential for understanding your company's financial health. This document gives a clear view of your assets, liabilities, and equity, which is crucial for informed decision-making. Utilizing the financial statement format for non corporate entities can simplify this process and enhance your company's financial reporting.

Having a balance sheet is generally mandatory for many non corporate entities, especially those seeking funding or grants. It serves as a snapshot of the organization’s financial position and is a vital part of the financial statement format for non corporate entities. A balance sheet helps donors and stakeholders understand the entity's stability and financial health.

profit balance sheet should include assets, liabilities, and net assets. It typically follows a standardized financial statement format for non corporate entities to maintain clarity and organization. This format allows stakeholders to easily assess the financial position of the nonprofit at a specific point in time.

Private companies are generally not required to file financial statements with government agencies, but they often create them for internal use or for lenders and investors. When doing so, it is advisable to follow the financial statement format for non corporate entities to ensure consistency and clarity. This practice can also enhance credibility and support financial analysis.

To prepare a non-profit financial statement, begin by gathering all financial records, including income and expenses. Then, choose the appropriate financial statement format for non corporate entities, such as a statement of activities. Ensure you include all relevant information to give a clear picture of your organization's financial health.

Yes, financial statements for non corporate entities are often mandatory, depending on state regulations and the specific requirements of funding sources. These statements provide transparency and accountability to stakeholders. For many organizations, utilizing the financial statement format for non corporate entities helps maintain compliance with legal guidelines.

Financial statements for non-corporate entities are not universally mandated. The necessity varies based on the entity's size, structure, and specific state regulations. Even though they're not required, adopting a financial statement format for non corporate entities can be advantageous for effective management and stakeholder communication. Platforms like uslegalforms can assist you in creating compliant and comprehensive financial statements tailored to your needs.

Non-reporting entities are generally not required by law to produce financial statements. However, it is beneficial for these entities to create financial statements for internal purposes and to provide clarity for stakeholders. Understanding the financial statement format for non corporate entities can help in presenting a clear picture of the entity’s financial health. Using proper financial statements aids in decision-making and assessing performance.